Yo, pay attention because this past week’s reality check could become important.

So far the only data series that are maintaining their strength as the days stretch out into spring are of the jobs and employment variety. The manufacturing stuff and the consumer/retail stuff is good, not great. Q4 earnings were mixed and Q1 earnings, coming any day now, will be announced against the backdrop of $100 oil and $4-plus gasoline for almost the entire reporting period.

The bright spot that was housing appears to be starting to slide again. Which sucks because the housing “improvement” was an enormous part of the bull case. Also, seasonally housing is supposed to be kicking ass right now. But eagle-eyed Joe Weisenthal notes that every single housing market data point this week was punk:

- Monday: Homebuilder sentiment missed, coming in at 28 vs. expectations of 30.

- On Tuesday, housing starts came in just below expectations.

- On Wednesday, mortgage applications for the week fell 7.4%. Also existing home sales came in at an annualized pace of 4.59 million, vs. expectations of 4.61 million.

- On Thursday, the FHFA house price index showed no gain vs. expectations of 0.%. Last month was revised from a 0.7% gain to just 0.1%.

- And then today we got New Homes Sales of just 313K vs. expectations of 325K. Also today, the major homebuilder KB Homes reported a big miss, and the stock is getting crushed.

And housing was the least of it. Stocks hit a post-crisis high on Monday on the news of Apple’s dividend and then dropped pretty much the rest of the week – a very uncharacteristic spate of trading days given how the year has shaped up so far. On the week, only the Nazz recorded a gain, 0.4%. In the meantime, the S&P lost half a percent on the week while the Dow 30 dropped a ball-busting 1.2% according to this wrap-up in the FT. “Hey! Nobody told me these things go down also!”

And those global PMI reports! Just awful, no way to spin ’em, chooch.

First we heard from BHP Billiton, the massive mining concern, about weak mineral demand in China. This was followed by an HSBC Flash PMI reading of 48.1 – the fifth consecutive reading under the all-important 50 level (which indicates contraction as opposed to expansion). It’s important to remember that HSBC’s PMI survey looks mainly at small and mid-sized enterprises. This as opposed to the official PMI numbers from the government which cover larger firms that have bigger global trade involvement and better access to bank capital. Those official stats come out on April 1st and they are usually market-moving, FYI. The bottom line on China is that anything below 48 implies less than 8% growth – which is a death sentence for all the countries who were hoping to sell into that region.

And worse than China was what we heard out of Germany. As Randall Forsyth so perfectly puts it in Barron’s this weekend, Germany had finally diversified away from selling to its weakling neighbors in Europe and moved on to exporting more into China – just in time for China to begin rolling over. The Euro recession is worsening as is China, this is important because of how highly correlated global GDPs are. Also from the Barron’s piece by Forsyth, a killer quote from RBC’s economists:

“Lest we think the U.S. has the ability to avoid any of the negative reverberations from weak growth outside its borders, remember that the rolling five-year correlation of 32 countries’ GDPs have been on the rise and presently stand at over 90%.”

To recap, we’ve lost housing and some of the momentum in the stock market that’s engendered so much optimism. We still have Apple but weakness in materials ($XLB), energy ($XLE) and the industrials ($XLI) has gone from being slightly irksome to being full-on Tara Reid-post-breast-implant-embarrassing. In addition, the China engine that was meant to devour everyone’s goods is sputtering while Germany, the strongest economy in Europe, sinks into recession.

On top of it all, we’re heading into the “sell in may” period of the year – last year they ran and then peaked this market right in the middle of April. They started the “Sell in May” lightening up early, just as the “January Effect” now begins the week before Christmas.

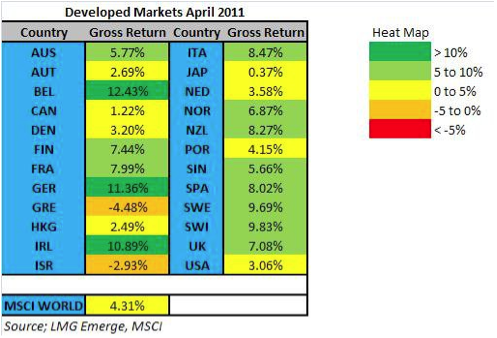

Now of course, April is a rockstar month for stocks generally; from 2001 through 2010, April has witnessed an average S&P 500 appreciation of 2.66%, the single best month of the year. If you go back 40 years and look at 1971 through 2010, you see an average gain of 1.56% for April, making it the second best month in the calendar for stocks. And who could forget last April, when stocks in developed markets, including the US, posted phenomenal numbers? The MSCI World Index of stocks returned a whopping 4.31% in April of 2011.

Check out the below heatmap and try not to burn yourselves on the sizzling hot returns of a year ago:

But that was then and this is now.

Last spring the prospect of a European meltdown was still hazy and we were still getting high on the residue of the winter QE2 session – massive Fed liquidity was still coating our nostrils and coursing through our bloodstream. But “the guy” isn’t necessarily coming back with more this year – unsinkable gasoline prices and political realities probably have the Fed on hold right now, no matter how many jittery text messages we send him.

If you’re running three sheets to the wind right now, you may want to ask yourself what it is you think is about to happen in the near-term. I just went over the bull case as laid out in five major bullet points from JPMorgan and it has gotten more idiotic, not less, hinging as it does on the fact that “there’s nowhere else to put your money”.

If what we’ve just seen since last Monday represents the start of a new trend, it will be hard for the buyers to maintain their excitement.

We’re watching the market internals and technicals closely, casting a wary glance on housing and global PMIs and hanging onto the jobs trend as pretty much the only major positive at the moment.

So there’s your reality check. Do with it what you will.

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2012/03/25/reality-check/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2012/03/25/reality-check/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2012/03/25/reality-check/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2012/03/25/reality-check/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/03/25/reality-check/ […]

… [Trackback]

[…] There you will find 87073 more Information to that Topic: thereformedbroker.com/2012/03/25/reality-check/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2012/03/25/reality-check/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2012/03/25/reality-check/ […]