According to Rex Tillerson, CEO of Exxon Mobil, oil should really only be worth 60-70 bucks a barrel right now – Market Beat’s Mark Gongloff notes that this would mean its current price is somewhere around 40% overvalued.

The name of Tillerson’s game is ending the oil company subsidy debate as soon as possible. He’s at the Senate Finance Committee hearing on the subject as we speak. Tillerson’s gambit is to put “speculation” on trial rather than allow the conversation to focus on “greedy oil execs”.

In truth, big producers like Exxon are not necessarily in favor of skyrocketing oil prices. They are typically hedged anyway thus that upside capture simply isn’t there. They are then faced with climbing acquisition and exploration costs as everybody on the equipment and services side raises prices.

The integrateds have done very well for themselves thus far in 2011 – first quarter profits for the big five majors totaled around $34 billion. The last thing they want is too much of a spotlight on this, and nothing focuses that spotlight like $100 oil prices or 4 bucks a gallon at the pump.

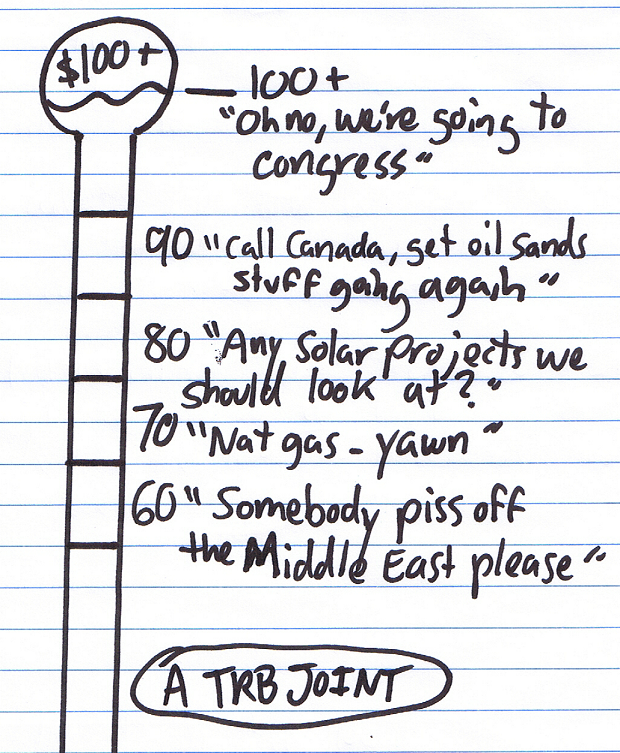

Here’s a look at the way big oil executives view the price of crude and what it means for them:

buy cheap cialis uk

USA delivery