This one’s gonna be a roller coaster of a theoretical post, but when I finish laying it out, you will appreciate the pretzels I’ve bent myself into. The charts herein come from one of the most ridiculously talented technicians I’ve ever met, my friend and colleague J.C. Parets (a name you’ll want to know for 2011).

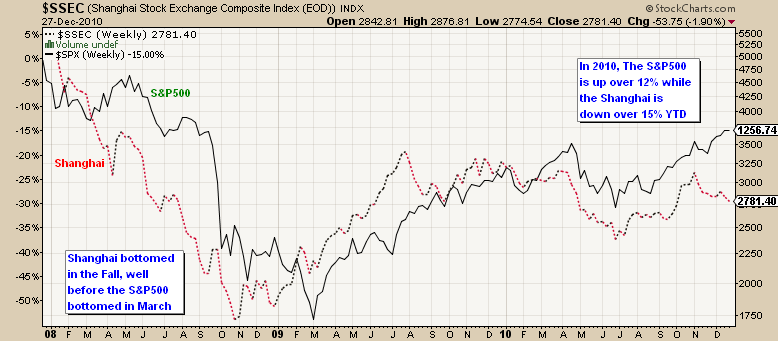

For almost the entirety of this rally in US stocks, we’ve been led forward by the Shanghai Composite. The correlation has been as close as you’re going to get in this mixed-up, crazy world:

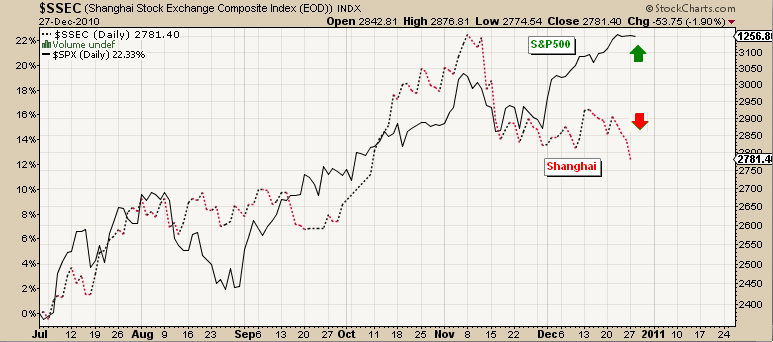

But over the last year, there’s been a divergence so obvious, that only the most out-to-lunch market participants haven’t noticed it. Chinese stocks have hit a wall and turned decidedly south of late, yet US stocks (as represented by the S&P 500) have essentially kept on ticking to new highs! This divergence has been widening even more severely during the the last few weeks and is now at an undeniable extreme:

Where to from here? The conventional wisdom goes something like this:

“One of these has to be wrong – either US stocks correct significantly in-line with the Chinese market or China bounces off this 200-day moving average (on both Shanghai and the FXI) and turns back up.”

The high probability bet is that one of these two outcomes arises, and soon. But you are probably more interested in the low probability (but exciting) potential outcome…here goes:

♣ The US stock market outperformed the so-called layup China trade in 2010

♣ US equity mutual funds have just come off of their 4th straight year of outflows while investors have been pouring record sums into foreign funds

♣ It stands to reason that US stocks may be coming back into favor and will now play catch up in terms of inflows vis a vis emerging markets

♣ If this is the case, we can call this the Repatriation Trade: investors who have gorged themselves on BRIC may now focus on domestic allocations

♣ Under this scenario, a continued run for US stocks minus the leadership from Shanghai may be possible

To be clear, the “easier” bet would be on either a lift for China stocks or a drop for the US market. But what if the Shanghai Divergence is actually signaling the Repatriation Trade? Is there room in this market, valuation-wise, to accommodate a reversing of the flows back in? If we are to believe that the S&P 500 is really going to earn a figure in the mid 90’s this year, the answer you’ll get in most quarters is a resounding “Yes”.

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2010/12/28/the-shanghai-divergence-a-low-probability-bet-on-the-repatriation-trade/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2010/12/28/the-shanghai-divergence-a-low-probability-bet-on-the-repatriation-trade/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2010/12/28/the-shanghai-divergence-a-low-probability-bet-on-the-repatriation-trade/ […]

… [Trackback]

[…] Here you will find 735 additional Information to that Topic: thereformedbroker.com/2010/12/28/the-shanghai-divergence-a-low-probability-bet-on-the-repatriation-trade/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2010/12/28/the-shanghai-divergence-a-low-probability-bet-on-the-repatriation-trade/ […]

… [Trackback]

[…] There you will find 65226 additional Info on that Topic: thereformedbroker.com/2010/12/28/the-shanghai-divergence-a-low-probability-bet-on-the-repatriation-trade/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2010/12/28/the-shanghai-divergence-a-low-probability-bet-on-the-repatriation-trade/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2010/12/28/the-shanghai-divergence-a-low-probability-bet-on-the-repatriation-trade/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2010/12/28/the-shanghai-divergence-a-low-probability-bet-on-the-repatriation-trade/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2010/12/28/the-shanghai-divergence-a-low-probability-bet-on-the-repatriation-trade/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2010/12/28/the-shanghai-divergence-a-low-probability-bet-on-the-repatriation-trade/ […]

… [Trackback]

[…] There you can find 83683 more Info on that Topic: thereformedbroker.com/2010/12/28/the-shanghai-divergence-a-low-probability-bet-on-the-repatriation-trade/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2010/12/28/the-shanghai-divergence-a-low-probability-bet-on-the-repatriation-trade/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2010/12/28/the-shanghai-divergence-a-low-probability-bet-on-the-repatriation-trade/ […]