The natural gas sector has been hot this week on the heels of several upgrades and bottoming calls on The Street. I’ll take this opportunity to disabuse the investing public of a horrible bit of faux-wisdom about the commodity…

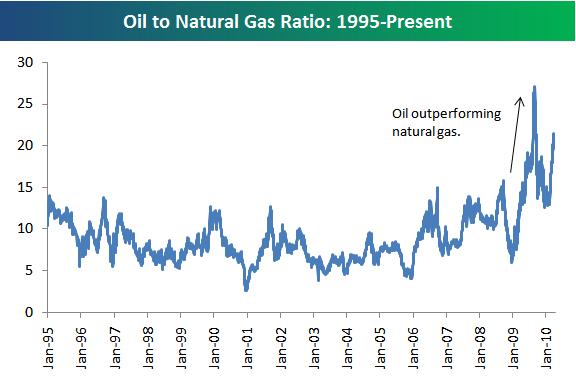

One of the biggest money-losing maxims of the past 5 years is the old “Oil Historically Trades at an 8 to 1 Ratio to Natural Gas” chestnut. I’ve also heard that it’s more like 10 to 1. Whatever.

Time to forget this ratio for good.

‘Cause the word “Historically” is meaningless in the face of our newfound limitless supply of natural gas. My clients who work in the oil and gas patch in Oklahoma and Texas know this ratio to be false in today’s reality. They know that the availability and methods for procurement of natural gas are much improved…

We can drill everywhere for nat gas now – from Pennsylvania to the Rocky Mountains, from the swamps to the shales. Geographically speaking, America is like a hot tub cover sitting atop a steamy jacuzzi of nat gas.

We can drill for it sideways, diagonally, upside-down, in our underwear and from half-court. We can pull it from the well heads as a byproduct of oil drilling or we can frak it from the side of a cliff formation.

There is so much natural gas in this country that we’ve run out of places to store it. A recent estimate from the EIA postulates that we are currently looking at working nat gas storage in excess of 54 days worth of usage. The same study concluded that we may end up testing “the brim”, meaning the maximum amount of storage capacity that we can handle in the lower 48 states. This brim is estimated at 4 trillion cubic feet, but no one is really sure because it has never gotten close before.

This is a great thing from an energy-sourcing standpoint and many of the technological breakthroughs that have made this bountiful supply a reality have come along in the last decade or so. With significantly better equipment comes higher supply, regardless of what used to be the norm.

What does this mean to those looking for a quantitative answer to an old school relative-value question? It means that your historical 8 to 1 ratio has been rendered impotent. Throw your models away. The below chart of Oil-To-Gas from Bespoke demonstrates exactly how volatile this relationship truly is:

“Historically” is a dangerous term, it justifies all kinds of cocksure assumptions. When I hear Wall Street guys talking with certainty about the crude to natty ratio, I chuckle to myself. Historically, it was a good idea to have 8 year old boys working in coal mines. Historically, it was acceptable for food packaging companies to add poisonous trans fats to apple sauce in order to extend shelf life by an extra week or so. Historically, the earth was flat, Tiger was a model citizen and guaranteeing pensions to autoworkers for life was a safe bet as most of ’em would barely live past 60 years old.

Historically.

Enough with the ratio, the earth has turned and things don’t work that way anymore.

Chart Source:

Oil To Natural Gas Ratio (Bespoke)

Related tickers: $UNG $USO

[…] – Will natural gas stay oil’s poor cousin? For and against. […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2010/03/31/oil-to-nat-gas-ratio-many-ships-have-been-broken-on-this-rock/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2010/03/31/oil-to-nat-gas-ratio-many-ships-have-been-broken-on-this-rock/ […]

… [Trackback]

[…] Here you can find 39468 additional Information to that Topic: thereformedbroker.com/2010/03/31/oil-to-nat-gas-ratio-many-ships-have-been-broken-on-this-rock/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2010/03/31/oil-to-nat-gas-ratio-many-ships-have-been-broken-on-this-rock/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2010/03/31/oil-to-nat-gas-ratio-many-ships-have-been-broken-on-this-rock/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2010/03/31/oil-to-nat-gas-ratio-many-ships-have-been-broken-on-this-rock/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2010/03/31/oil-to-nat-gas-ratio-many-ships-have-been-broken-on-this-rock/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2010/03/31/oil-to-nat-gas-ratio-many-ships-have-been-broken-on-this-rock/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2010/03/31/oil-to-nat-gas-ratio-many-ships-have-been-broken-on-this-rock/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2010/03/31/oil-to-nat-gas-ratio-many-ships-have-been-broken-on-this-rock/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2010/03/31/oil-to-nat-gas-ratio-many-ships-have-been-broken-on-this-rock/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2010/03/31/oil-to-nat-gas-ratio-many-ships-have-been-broken-on-this-rock/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2010/03/31/oil-to-nat-gas-ratio-many-ships-have-been-broken-on-this-rock/ […]