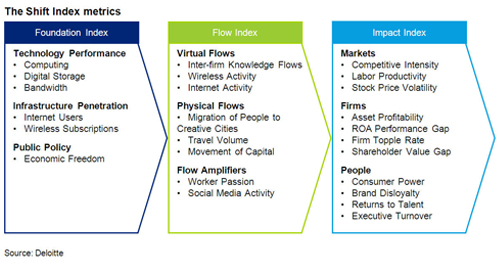

Makeup of the Shift Index

Usually when an article starts off with a roomful of theoretical mathematicians having a whiteboard party, I zone out pretty quickly, but I found this story interesting because it’s conclusions could become very important for stock pickers and active managers all around the world.

From HarvardBusiness.org:

We were trying to get our heads around the long-term transformation we saw happening to the global business environment as a result of digital technology and, to a lesser extent, public policy changes. We later came to call this transformation the Big Shift.

Essentially, the concept behind The Big Shift and the researchers’ attempt to quantify it’s effects goes something like this: Yes we’re in a cyclical downturn, but more importantly, US companies have seen a 75% drop-off in measures like Return On Assets, this despite a huge leap in productivity, since the 1960’s. The creators of the index believe that the boom-bust cycles of the last few decades are masking this more worrisome secular trend.

It’s little surprise to find also that the highest-performing companies are struggling to maintain their ROA rates and are increasingly losing market leadership positions. Taken as a whole, the findings portray a U.S. corporate sector in which long-term forces of change are undercutting normal sources of economic value. “Normal” may in fact be a thing of the past: even after the economy resumes growing, companies’ returns will remain under pressure.

This idea speaks to our global competitive position (or lack thereoff) in all different fields, from online gaming to open-source software. Competition for our companies, based on this study, has basically doubled from 1965 to 2008 and this is one of the major factors sited for the ROA slide.

The situation, however is not hopeless, but it will require a massive shift in the way we do business as the old architecture, reporting relationships and org charts of the industrial era have outlived their usefulness. Yes, another theory based on Creative Destruction.

Companies must move beyond their fixation on getting bigger and more cost-effective to make the institutional innovations necessary to accelerate performance improvement as they add participants to their ecosystems, expanding learning and innovation in collaboration curves and creation spaces. Companies must move, in other words, from scalable efficiency to scalable learning and performance. Only then will they make the most of our new era’s fast-moving digital infrastructure.

OK, that last bit was a little touchy-feely (collaborative curves and creation spaces?) but I think the Big Shift is absolutely a real phenomenon and has way bigger and longer-term ramifications than whatever is currently transpiring in Bailout-Land right now.

Sources:

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2009/06/23/are-you-paying-attention-to-the-big-shift-index/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2009/06/23/are-you-paying-attention-to-the-big-shift-index/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2009/06/23/are-you-paying-attention-to-the-big-shift-index/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2009/06/23/are-you-paying-attention-to-the-big-shift-index/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2009/06/23/are-you-paying-attention-to-the-big-shift-index/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2009/06/23/are-you-paying-attention-to-the-big-shift-index/ […]

… [Trackback]

[…] Here you can find 96132 additional Information to that Topic: thereformedbroker.com/2009/06/23/are-you-paying-attention-to-the-big-shift-index/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2009/06/23/are-you-paying-attention-to-the-big-shift-index/ […]

… [Trackback]

[…] There you will find 48529 additional Information on that Topic: thereformedbroker.com/2009/06/23/are-you-paying-attention-to-the-big-shift-index/ […]

… [Trackback]

[…] There you can find 52397 additional Information on that Topic: thereformedbroker.com/2009/06/23/are-you-paying-attention-to-the-big-shift-index/ […]

buy cialis online best price

USA delivery

buy cialis tadalafil tablets

Health