The following is not research or a stock recommendation and should be used for strictly informational purposes. The opinions contained herein are the author’s only and should not be construed as an official recommendation from any party.

Here’s an interesting story…so this company Lender Processing Services (LPS) probably could’ve been considered one of the most boring software/ technology companies on earth until 2008 happened. Now, LPS finds itself at the epicenter of the coming foreclosure/ refi boom.

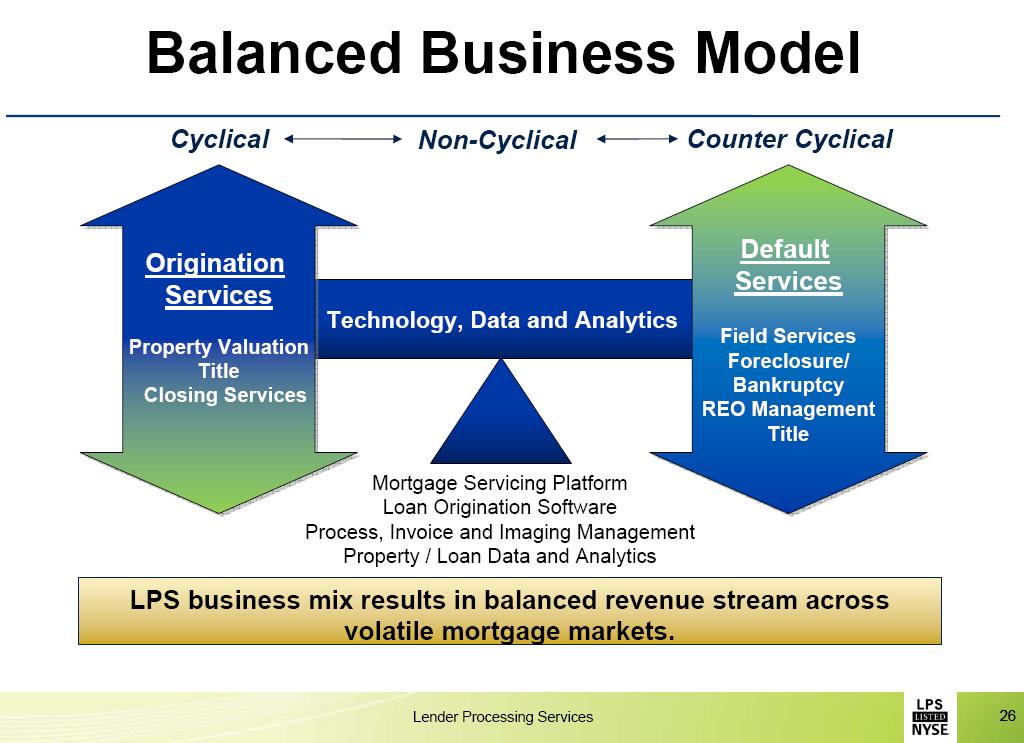

The play here is simple. LPS is in an almost-indispensable part of every technology-related facet of the mortgage business, providing everything from property valuation info to origination and title help to data and analytical services. Their customers are a who’s who of the lending business and in many lines of business, they barely even have a competitor. The most interesting part of the story right now, however, is that about 45% of the company’s revenues come from foreclosure and default events.

In essence, this company is as close to a pure-play you can get to capitalize on the fact that legislation changes, bankruptcy and foreclosure proceedings and refinance activity are all expected to explode in 2009.

LPS has a market cap of almost $3 billion and it does business with virtually everyone involved in the mortgage game. They’ve increased revenues in 2008 to over $1.2 billion. The company does have over a billion bucks in debt, which they intend to reduce by $450 million over the next 2 years. They’ve produced around $270 million in free-cash flow and have over $100 million in cash, so the balance sheet is extremely manageable.

The company is targeting between $2.65 to $2.75 in fully-diluted earnings per share this year and within the last 30 days, the 2010 consensus estimates have already crept up to $2.99 a share. Applying just an average Price-to-Earnings multiple of 16 on these estimates (over the last 50 or so years, the S&P 500 has traded at an average multiple of 16.59), you come up with a $50 stock price on next year’s numbers…the stock currently sells for around 31. It should be noted that this multiple assumes no premium for the fact that LPS is easily growing faster than most other public companies (many of which are forecasting EPS shrinkage!).

As you can see in the image above, which is taken directly from the company’s own investor presentation this spring, the business lines that comprise LPS are fairly well-balanced, in terms of offering solutions that benefit during cyclical, non-cyclical and counter -cyclical environments.

This is a story I intend to follow and learn more about, but frankly, I am very much intrigued by the possibility of benefitting from the massive wave of refinancing and foreclosure activity that we are sure to be hit with throughout 2009.

To do your own homework, I would start with the company’s 28 page presentation from their recent roadshow, found here:

LPS at Stephens Best Ideas Conference, San Francisco

Full Disclosure: I am currently long LPS and intend to continue to trade the security. Please do not construe my commentary above as any kind of solicitation or recommendation. Investors should do their own research and consult my Terms & Conditions page before doing anything based on what they’ve read here.

Good post – I found this while scanning google for foreclosue info – added ya to my G Reader, Keep up the good work. Looking forward to reading more. Mark

Good post – I found this while scanning google for foreclosue info – added ya to my G Reader, Keep up the good work. Looking forward to reading more. Mark

Good post – I found this while scanning google for foreclosue info – added ya to my G Reader, Keep up the good work. Looking forward to reading more. Mark

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2009/03/30/a-foreclosure-play-in-the-stock-market-lps/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2009/03/30/a-foreclosure-play-in-the-stock-market-lps/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2009/03/30/a-foreclosure-play-in-the-stock-market-lps/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2009/03/30/a-foreclosure-play-in-the-stock-market-lps/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2009/03/30/a-foreclosure-play-in-the-stock-market-lps/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2009/03/30/a-foreclosure-play-in-the-stock-market-lps/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2009/03/30/a-foreclosure-play-in-the-stock-market-lps/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2009/03/30/a-foreclosure-play-in-the-stock-market-lps/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2009/03/30/a-foreclosure-play-in-the-stock-market-lps/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2009/03/30/a-foreclosure-play-in-the-stock-market-lps/ […]

ordering cialis online australia

Generic for sale