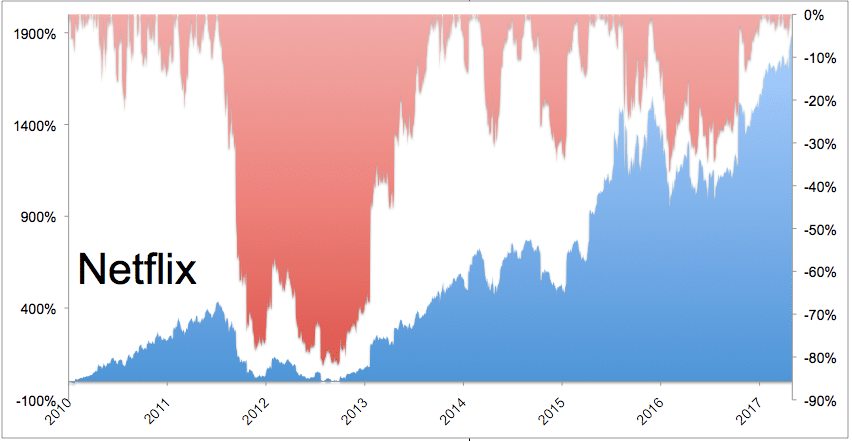

Netflix is crashing today after last night’s news that subscriber adds were not as many as Wall Street had been expecting. Netflix rarely misses this number, but it has happened before. The stock is prone to massive rallies and selloffs, given revolutionary nature of what they’ve built and the inherent uncertainty involved with building an expensive, sprawling distribution network around the world while simultaneously funding all the content that will populate it.

As Michael showed a few months ago, for every monster winner in the stock market, its beneficiaries have had to endure fairly large drawdowns on the way to those eye-popping gains. It’s rare you can get the former without living through the latter because risk and reward are linked (see ‘My friend is beating me‘).

One thing I wanted to mention is that more is not better. Netflix is spending billions and billions of dollars to create new content. The majority of it literally sucks, totally unwatchable or completely boring. This is because you can’t just mass produce art and there is a finite limit of talent in every industry, a finite limit of good ideas. If you make fifty TV shows or you make one hundred TV shows, you’re probably only going to get five good ones in either case, if you’re lucky.

Then there’s the finite amount of attention people have to sit down and actually watch it. This hasn’t been Netflix’s problem as much as it’s been the problem of the traditional broadcast networks, who rely on viewership and ad revenues. Netflix, in contrast, just has to convince you to subscribe for the first time and then keep you from canceling.

Business models that rely on inertia are better than transactional models (tune in tonight! tune in tomorrow morning!) and this is why subscription-based business models are valued more highly on Wall Street (see the software sector (Salesforce, Adobe) vs the hardware sector (Intel, Cisco) for an example, or Costco vs Target for another example). It’s not an accident that Apple exploded higher recently when it became apparent that the services business embedded within the iCloud / App Store ecosystem would smooth out the time between new phone launches.

Back to Netflix. The company is going to need better shows. HBO is going to go on a rampage under its new management over the next year or so. Disney’s streaming service is on its way in 2019 and they recognize the company’s future is on the line. Amazon will eventually get its content to click, and the audience is already there in the form of a hundred million Prime households. Just producing volume may not be good enough.

But can you scale great writing, directing and acting? Can you manufacture brilliant video content at will? I don’t know. Even Marvel stumbles. Even Lucasfilm stumbles. Pixar f***s up occasionally. It’s not that easy, it’s not just a matter of throwing more money at the problem because everyone is now throwing money around.

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2018/07/17/more-isnt-better/ […]

… [Trackback]

[…] Here you can find 67487 additional Info on that Topic: thereformedbroker.com/2018/07/17/more-isnt-better/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2018/07/17/more-isnt-better/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2018/07/17/more-isnt-better/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2018/07/17/more-isnt-better/ […]

… [Trackback]

[…] Here you can find 83622 additional Info on that Topic: thereformedbroker.com/2018/07/17/more-isnt-better/ […]