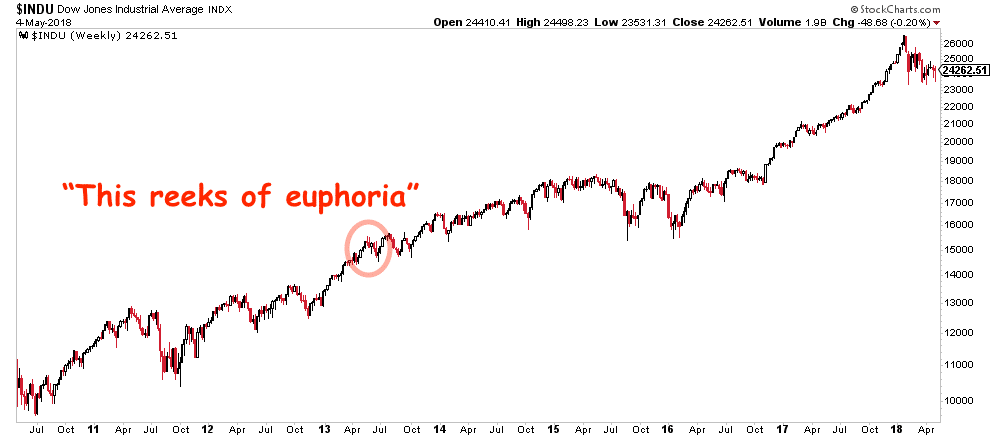

Five years ago today the Dow Jones Industrial Average closed above 15,000 for the first time ever. We were up 15% on the year at that point. Lots of people were talking about euphoria thanks to the fresh new record highs in the S&P 500 and Dow Jones. The Nasdaq was still below the old dot com era highs, but making steady advances.

And the within a month we’d be enjoying the June Taper Tantrum, which was also said to have been “the top” or the beginning of the end. It was only the end of the beginning, it turns out.

The secular bull call turned out to have been the right one. It was hard to make, because people had forgotten that the default direction of stock prices is higher, not lower, over long periods of time.

Here’s what I had to say about Dow 15,000, five years ago today…

***

“Putting Dow 15,000 in Perspective”

Posted by

Oh please, like I would ever write something like that.

If anything, too much perspective has been driving people out of their minds. Everyone has their perspective, whether you’ve asked for it or not. What you probably need is less perspective, or should I say more perspective from people whose perspective has been helpful.

Or maybe none at all for now. Let’s take a break from all the unqualified, inexperienced, triflingly myopic and hopelessly biased “perspective” for the night.

Why does anyone need the record high close in the Dow Jones Industrial Average “put into perspective”, anyway?

Why do we need another “commentator” with no trading experience or skin in the game or ass on the line to tell us whether or not “the Dow matters” or doesn’t matter?

Why do we need another “take” on the reality before our eyes?

Why would we want to read yet another treatise about how the Dow is not reflective of the whole market?

Or how the Dow isn’t reflective of the economy?

Or how the Dow isn’t reflective of the experiences of job seekers or Boomers or MBAs or working women or Wal-Mart greeters or whatever the fuck they want to juxtapose it with to make investors feel apprehensive or guilty or both?

How many inanimate objects can we re-price the Dow in to convince others that everything still sucks?

Should we remind people how much less gold the Dow can buy them than it could have for their grandparents in the 1940’s? That’s important for some reason, right?

Should we put ourselves through the tortured calculations that show how, on an inflation-adjusted basis, the market is actually down and not up? (Maybe not, because if the Dow, which has doubled, is still down vs inflation – then what do you think hoarded cash is worth? LOL.)

How many times must we read the debate about whether stocks are expensive or cheap, overbought or underestimated?

How much of that should we be exposed to and for how many months straight?

It is enough already, just stop it.

Some people need to reflect back on what they’ve been doing for the last 8,000 points. Others need to reconsider whom they’ve been listening to and what they’ve been reading all this time. Have their influencers gotten things mostly right or mostly wrong? Have they been focused on the bigger issues or missing the forest due to over-examination of each tree?

Nobody gets everything right, but small errors in judgment and minor course corrections are preferable to a complete and total inability to wake up. I know that hindsight makes everything seem obvious and this market has been anything but simple the entire way up. So let’s recap…

What got the Dow to 15,000 were the following facts, regardless of how they make you feel or whether or not this was “fair”:

* Mega-caps are in better shape cash-wise than ever and have been able to shrink their floats, thus boosting earnings per share and confidence, which boosts sentiment which boosts valuation multiples.

* Mega-caps have also been able to find growth around the world and to adjust to strengths and weaknesses geographically.

* Mega-caps have become an alternative to cash and fixed income that has made more and more sense the longer we’ve been able to go without a blow-up. They can pay out big dividends in addition to their float-shrinking activities which furthers their competitiveness for capital versus the bond market.

* Mega-caps have spent a few years being loathed even as they’ve gone up in price. This is because the majority has assumed that low economic growth would automatically translate to low stock returns. This has created space for multiple expansion since corporate profit and revenue growth dried up in late 2011.

* Mega-caps rising in value have been key to the Fed’s intentions since March of 2009.

* The Dow is a price-weighted index of mega-caps, primarily driven by a handful of $100+ stocks with huge cash hoards, high and rising dividends, an unlimited ability to refinance at almost no cost and a global presence which has meant flexibility and stability. And these mega-cap stocks in this price-weighted index have demonstrated the ability of capitalist corporate managers to exploit new conditions in order to enrich themselves and their shareholders.

That’s it. Nothing left to talk about.

If you’ve been listening to people who’ve not grasped this concept for the last few thousand points, ask yourself what you plan to do about it? What new choices will you make about the things you’ll pay attention to in the future?

Can you trust them to get the next phase right? You’d best be thinking about that now, because this phase won’t last forever either.

There’s your “Dow 15,000 in Perspective”.

Here’s Will Smith in 2007:

There’s a redemptive power that making a choice has rather than feeling like you’re an effect to all the things that are happening.

Make a choice.

Just decide what it’s gonna be, who you’re gonna be, how you are going to do it.

Just decide.

And from that point, the universe will get out of your way.

***

Josh here, back to present day – Little did I know that by 2018 we’d be looking at Dow 25,000. Little did anyone know. It’s important you not waste much time reading people who are adamant that a rallying market is automatically suspect or that new highs are, for some reason, bearish or worthy of kneejerk skepticism.

Those people are investment illiterate and hazardous to your wealth. New record highs are neither definitionally bullish nor bearish, but they are far more common than the too-smart-for-their-own-good crowd seems to understand.

Read Also:

“Putting Dow 15,000 in Perspective” (TRB)

Bad Advice Can Be Expensive (A Wealth Of Common Sense)

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2018/05/07/five-years-of-secular-bullishness/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2018/05/07/five-years-of-secular-bullishness/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2018/05/07/five-years-of-secular-bullishness/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2018/05/07/five-years-of-secular-bullishness/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2018/05/07/five-years-of-secular-bullishness/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2018/05/07/five-years-of-secular-bullishness/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2018/05/07/five-years-of-secular-bullishness/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2018/05/07/five-years-of-secular-bullishness/ […]