Nobody wants to say this but I will.

The technology sector has gotten so big, so pervasive and powerful, that the stock market index creators had to break it up. Because the monopolist powers of these corporations off of the stock market and in the real world have not been checked by natural competitive forces or government intervention.

The big names in tech get bigger and bigger every year, their influence extending into all facets of modern life, no industry left untouched by the effects of this.

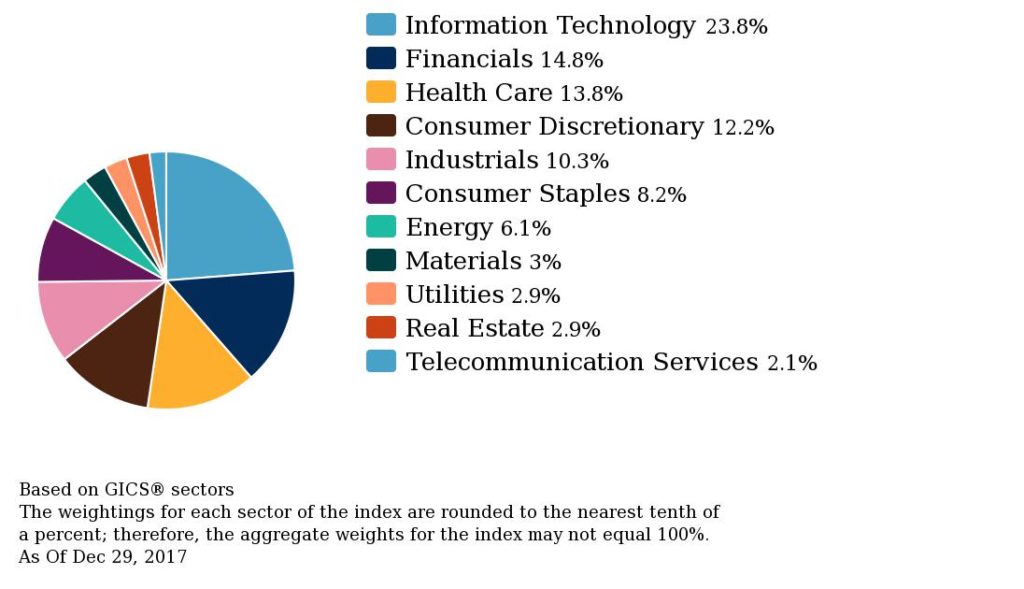

This has been reflected in S&P 500 in terms of market capitalization and the weighting these companies have. They’re almost a quarter of the large cap indices now. And even within the sector, a handful of enormous companies dominate. It’s like how the .01% of rich people have most of the wealth of the 1% in the world. The same thing is being mirrored across the corporate landscape.

This is actually something that the CAPEsters missed about stock market valuation – that we could one day have companies with moats so unassailable that classical valuation theory would cease to matter and comparisons to prior eras would be utterly inapplicable. Imagine telling investors in the 1980’s that someday Apple would be the world’s largest mobile phone seller and that they would earn 95% of the entire industry’s total profitability each year. How do you value that? How do you compare it to an index full of steel producers in the 1970’s ripping each others eyeballs out for every penny per tonne?

And the situation is getting more cartoonish, not less so.

As there appears to be no sign that something is going to happen in the real world to restore any sort of balance to the force, MSCI and S&P Dow Jones Indices (collectively, these two companies comprise the Global Industry Classification Standard or GICS committee) have taken it upon themselves to act. They’re going to spread things out in terms of industry group classification and re-weight the sectors. They’re reclassifying some technology companies as “communications” companies and changing an entire sector’s name from Telecommunications to Communication Services.

Information Technology stocks, as of the latest reading, had become 24% of the S&P 500 by the end of 2017. They were just 15% in 2006 and close to 10% at the end of 2000. Something had to be done, I suppose, before the IT sector became 27%, 30% and so on. The index constructors will say that Communications Services more accurately represents what a social media giant like Facebook actually does, but I think there’s more to it than that. You cannot have one sector be 2% of the index (telecom) and another be 24% and say it’s some sort of representative average of the economy.

And if the economy won’t cooperate with these aims, then the index has to change.

I’m going to give you all the details of the coming changes, straight from the horse’s mouth, but first a few takeaways:

- Sector rotation strategies have always been hilarious to me, but now they’re straight up abstract art projects. Take all your backtests and throw them out.

- There truly is no such thing as pure passive investing, just degrees of passivity. Indices, we ought to remind ourselves, are human constructs. They were not handed down from atop Mount Sinai nor are they naturally occurring phenomena. They’re lists of stocks and amounts cobbled together by a very human committee and, as such, should not be worshipped as the end-all, be-all of investment allocations.

- There are still plenty of quirks in the indexes left over to be scrutinized and poked fun at. For example, why is Walmart a Consumer Staple and Target a Consumer Discretionary – don’t we buy the same stuff from both, pretty much? And we’ll leave aside the more meta questions, such as if every company uses information technology as a core internal part of delivering their service or product, then what makes them not information technology companies? We’ll save that for a 2am dorm room discussion over a smoking bowl of Kalifornia Kush.

Okay, the official press release from the Cabal:

***

S&P Dow Jones Indices And MSCI Announce Select List Of Companies Changing Due To Revisions To The GICS® Structure In 2018

S&P Dow Jones Indices

Jan 11, 2018, 17:56 ET

NEW YORK, Jan. 11, 2018 /PRNewswire/ — S&P Dow Jones Indices, a leading provider of financial market indices, and MSCI Inc., a leading provider of research-based indexes and analytics, announced today a select list of companies expected to be impacted as a result of the Global Industry Classification Standard (GICS®) structure revisions in September 2018 in GICS Direct. The full list of companies announced today can be found at www.spdji.com or www.msci.com. Note that the new company classifications are subject to change before implementation due to ongoing reviews, including for corporate events.

S&P Dow Jones Indices and MSCI have decided to provide the full list of all securities affected by these changes to GICS Direct clients on July 2, 2018, rather than August 1, 2018 as previously announced. Updates to the list will be provided on August 1, 2018 and September 3, 2018.

In November 2017, S&P Dow Jones Indices and MSCI announced changes to the GICS structure to be implemented after the close of business (ET) on Friday, September 28, 2018 in GICS Direct.

Summary of key changes:

Communication Services Sector

The Telecommunication Services Sector will be broadened and renamed Communication Services to include companies that facilitate communication and offer related content and information through various media.

The renamed Sector will include the existing telecommunication companies as well as companies selected from the Consumer Discretionary Sector currently classified under the Media Industry Group, such as Comcast Corp and Naspers Ltd. It will also include select companies from the Internet & Direct Marketing Retail Sub-Industry such as Netflix Inc. and TripAdvisor Inc. along with certain companies currently classified in the Information Technology Sector, including Alphabet Inc. and Facebook Inc.

Internet & Direct Marketing Retail Sub-Industry under the Consumer Discretionary Sector

The Internet & Direct Marketing Retail Sub-Industry will be updated to include all online marketplaces for consumer products and services. The Sub-Industry will include e-commerce companies regardless of whether they hold inventory, and include Alibaba Group and eBay Inc.

Information Technology Sector

Companies currently classified in the Internet Software & Services Sub-Industry such as data centers, cloud networking, storage infrastructure, and web hosting services will be moved to a new Sub-Industry called Internet Services & Infrastructure under the IT Services Industry. This Sub-Industry will include companies such as Verisign Inc. and Shopify Inc.

In addition, cloud-based software companies currently classified as Internet Software & Services such as Logmein Inc. and Nutanix Inc. will be reclassified as Application Software.

As a result, the existing Internet Software & Services Industry and Sub-Industry will be discontinued.

For more details regarding the upcoming structure changes, please visit www.spdji.com or www.msci.com.

The new GICS structure will consist of 11 Sectors, 24 Industry Groups, 69 Industries and 158 Sub-Industries.

ABOUT S&P DOW JONES INDICES

S&P Dow Jones Indices is the largest global resource for essential index-based concepts, data and research, and home to iconic financial market indicators, such as the S&P 500® and the Dow Jones Industrial Average®. More assets are invested in products based on our indices than products based on indices from any other provider in the world. Since Charles Dow invented the first index in 1884, S&P DJI has become home to over 1,000,000 indices across the spectrum of asset classes that have helped define the way investors measure and trade the markets.

S&P Dow Jones Indices is a division of S&P Global (NYSE: SPGI), which provides essential intelligence for individuals, companies, and governments to make decisions with confidence. For more information, visit www.spdji.com.

For more information:

S&P Dow Jones Indices:

Index_services@spglobal.com

Media Inquiries:

spdji_communications@spglobal.com

About MSCI

For more than 40 years, MSCI’s research-based indexes and analytics have helped the world’s leading investors build and manage better portfolios. Clients rely on our offerings for deeper insights into the drivers of performance and risk in their portfolios, broad asset class coverage and innovative research.

Our line of products and services includes indexes, analytical models, data, real estate benchmarks and ESG research.

MSCI serves 99 of the top 100 largest asset managers, according to the most recent P&I ranking.

For more information, visit us at www.msci.com.

Media Inquiries

Sam Wang +1 212 804 5244

MSCI Global Client Service

EMEA Client Service + 44 20 7618.2222

Americas Client Service 1 888 588 4567 (toll free)

Asia Pacific Client Service + 852 2844 9333

NOTICE AND DISCLAIMER

This document has been prepared by MSCI and S&P Dow Jones Indices LLC and its affiliates (“S&P Dow Jones Indices”) solely for informational purposes. All of the information contained herein, including without limitation all text, data, graphs, charts (collectively, the “Information”) is the property of MSCI, S&P Dow Jones Indices, or their respective affiliates. The Information may not be reproduced or redisseminated in whole or in part without prior written permission from MSCI and S&P Dow Jones Indices.

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2018/01/15/breaking-up-tech-indexes-doing-what-the-economy-wont/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2018/01/15/breaking-up-tech-indexes-doing-what-the-economy-wont/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2018/01/15/breaking-up-tech-indexes-doing-what-the-economy-wont/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2018/01/15/breaking-up-tech-indexes-doing-what-the-economy-wont/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2018/01/15/breaking-up-tech-indexes-doing-what-the-economy-wont/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2018/01/15/breaking-up-tech-indexes-doing-what-the-economy-wont/ […]

… [Trackback]

[…] There you can find 4126 additional Information on that Topic: thereformedbroker.com/2018/01/15/breaking-up-tech-indexes-doing-what-the-economy-wont/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2018/01/15/breaking-up-tech-indexes-doing-what-the-economy-wont/ […]