In a new research piece from Goldman Sachs Global Markets Institute, the question is asked about whether or not stock performance should be rethought when it comes to boards of directors gauging company management. In a world where virtually every inbound dollar to the stock market is going into rules-based or passively managed products, what exactly does stock price signify? How much of a stock’s movement is predicated on underlying fundamentals and how much is simply based on whether or not investors are allocating to a specific index or factor?

I don’t think there are any general answers to these questions that can cover the full array of why a stock gets bought or sold in any given period. This is like trying to count and categorize every raindrop that falls in a storm.

But in the report, GS has some excellent charts detailing the rise of rules-based investing that give you some context for what’s been going on. Here are a few of them…

Passive is now a huge chunk of the overall investable assets in the US stock market:

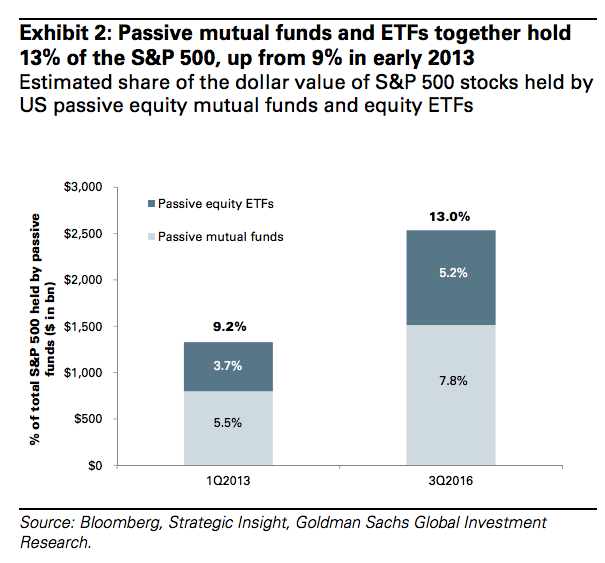

13% of the S&P is now held by primarily passive index funds / ETFs:

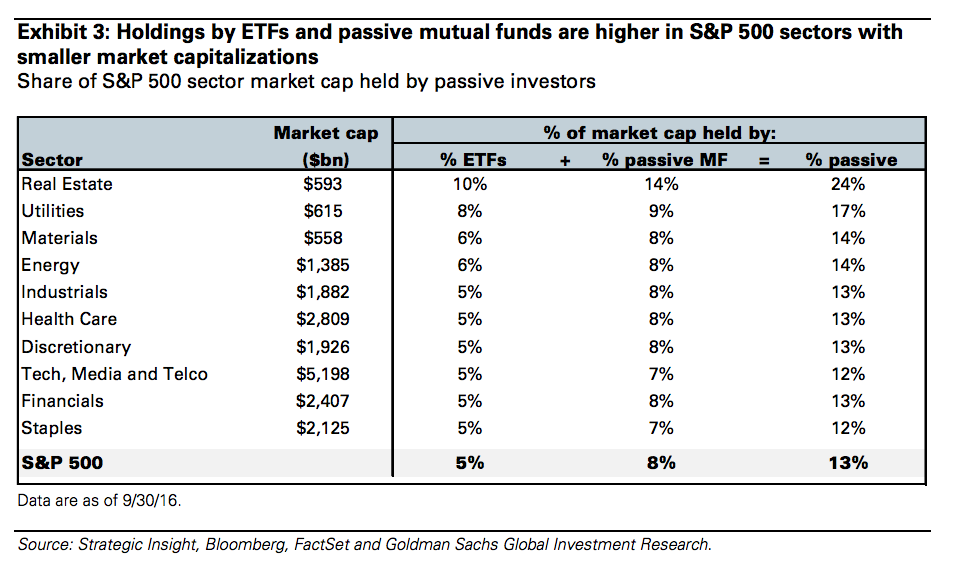

Some sectors are more ETF’d than others:

Source:

Directors ’ dilemma: responding to the rise of passive investing

Goldman Sachs Global Markets Institute – January 2017

[…] The passive share of AUM has doubled in the past ten years. (thereformedbroker) […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2017/01/10/chart-o-the-day-rise-of-rules-based-investing/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2017/01/10/chart-o-the-day-rise-of-rules-based-investing/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2017/01/10/chart-o-the-day-rise-of-rules-based-investing/ […]

… [Trackback]

[…] Here you will find 54302 additional Info to that Topic: thereformedbroker.com/2017/01/10/chart-o-the-day-rise-of-rules-based-investing/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2017/01/10/chart-o-the-day-rise-of-rules-based-investing/ […]

… [Trackback]

[…] There you can find 4303 additional Info to that Topic: thereformedbroker.com/2017/01/10/chart-o-the-day-rise-of-rules-based-investing/ […]

… [Trackback]

[…] Here you can find 74949 additional Information on that Topic: thereformedbroker.com/2017/01/10/chart-o-the-day-rise-of-rules-based-investing/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2017/01/10/chart-o-the-day-rise-of-rules-based-investing/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2017/01/10/chart-o-the-day-rise-of-rules-based-investing/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2017/01/10/chart-o-the-day-rise-of-rules-based-investing/ […]

… [Trackback]

[…] Here you can find 99045 additional Info to that Topic: thereformedbroker.com/2017/01/10/chart-o-the-day-rise-of-rules-based-investing/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2017/01/10/chart-o-the-day-rise-of-rules-based-investing/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2017/01/10/chart-o-the-day-rise-of-rules-based-investing/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2017/01/10/chart-o-the-day-rise-of-rules-based-investing/ […]