An astounding fact, courtesy of my friend Nick Colas, chief market strategist at Convergex:

As investors hope for a new high in the S&P 500, consider the following fact: only one industry sector of the index is down over the last 10 years; care to guess which one? It’s not Energy; that group is actually up 23% on a price basis. Nor is it Materials, up 48%. Yes, both those groups have underperformed the 65% price appreciation of the S&P 500, but they are at least up over the decade.

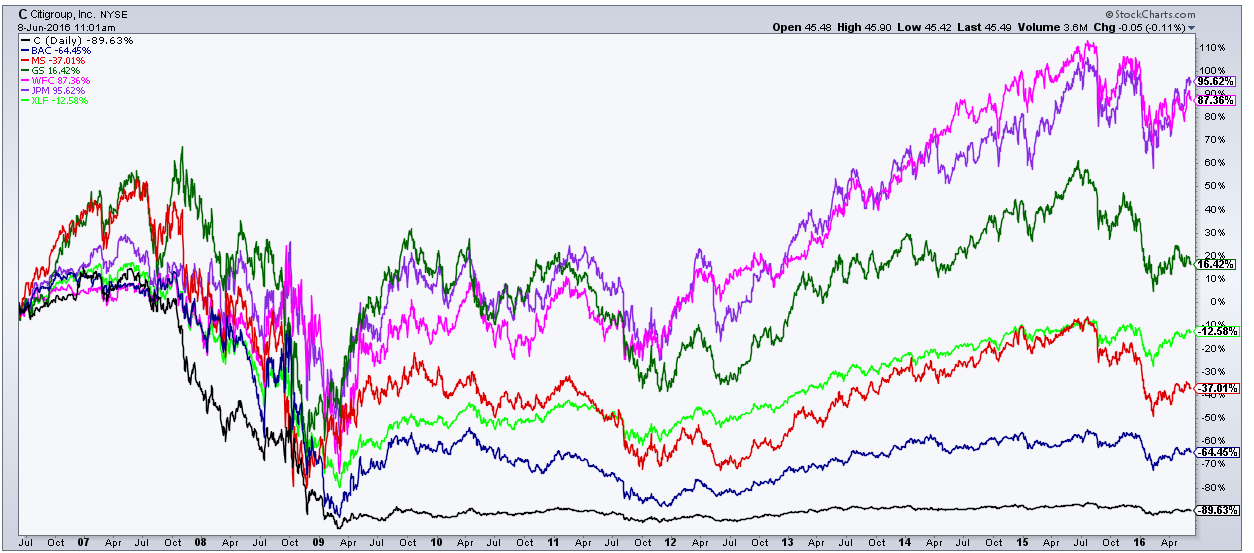

The answer is Financials, as measured by the market cap weighted index of that sector’s stocks in the S&P 500. Over the last 10 years the group is down 29%, and as the TV ad people say ‘But wait, there’s more…” The sector includes REITs, which are up 28% on a price basis (and more with dividends) over the last decade. Since REITs are more than 10% of the “Financials” group over the period, this means traditional banks/brokers/insurance/card companies are down more like 33% over the last 10 years. Again – the only industry group with a 10 year capital loss.

Michael Batnick built the below chart for me, it’s just the big bank holdings within XLF:

Source:

Convergex – June 8th, 2016

[…] Josh Brown: S&P Financials Down 30% Over the Last Decade […]

[…] Only one S&P 500 sector is down for the past decade. (thereformedbroker) […]

[…] Only one S&P 500 sector is down for the previous decade. (thereformedbroker.com) […]

… [Trackback]

[…] Here you can find 22134 additional Info to that Topic: thereformedbroker.com/2016/06/08/sp-financials-down-30-over-the-last-decade/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2016/06/08/sp-financials-down-30-over-the-last-decade/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2016/06/08/sp-financials-down-30-over-the-last-decade/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2016/06/08/sp-financials-down-30-over-the-last-decade/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2016/06/08/sp-financials-down-30-over-the-last-decade/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2016/06/08/sp-financials-down-30-over-the-last-decade/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2016/06/08/sp-financials-down-30-over-the-last-decade/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2016/06/08/sp-financials-down-30-over-the-last-decade/ […]