The New York Times is out with an investing column that posits the following: You should be 100% stocks in your portfolio because, given enough time, they should outperform everything else you can possibly own in an investment account.

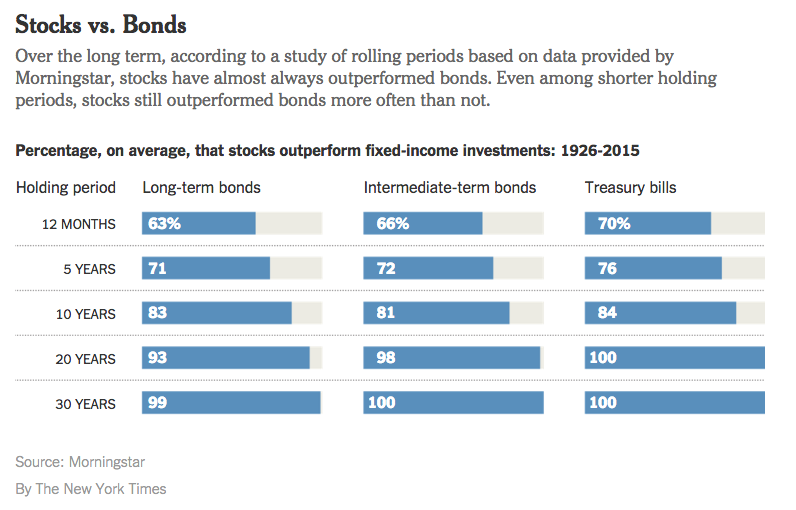

And here is the data that “proves” it – as long as you’re willing to bet that the future will look precisely like the past:

I’m troubled by this idea, although I do agree that there are select cases where this could make sense. The author is David A. Levine, a former chief economist at Sanford C. Bernstein & Company. And, to his credit, he does pay lip service to the idea that very few human beings can actually live with the volatility that a 100% equity portfolio will induce.

As we say at our shop, long-term returns are the only returns that matter, but the long-term is not where investors live their lives.

There are some cases where a 100% stock allocation makes sense. Here are five of them:

* The investor is under 35 years old, starting from a small base, and is automatically dollar-cost averaging every month.

* The investor is in a coma of an indeterminate length

* The investor has been diagnosed with a terminal disease and is going to be passing on the assets to the next generation soon.

* The investor’s portfolio is very small in comparison with their other assets, assets that are not fully correlated with stocks.

* The investor is going to be living on a desert island for two decades without access to TVs, radios, the internet or Barron’s.

Under any of the above circumstances, the idea of a 100% allocation to stocks is doable. The portfolio will probably perform miracles for the investor’s net worth so long as they don’t (or can’t) touch it for 20 years.

But I would postulate that it is unnecessary, for one thing, and may even be suboptimal given the ease and low cost with which real estate and bonds can be held and a periodic rebalance can be executed.

We’ve seen eleven bear markets during which stocks declined by over 35% in the eleven decades since Charlie Dow created his index in 1896. That works out to roughly one every ten years, although they don’t occur on a regular schedule. The majority of investors cannot live through two or three of those and have their money be fully exposed without making a major mistake or two.

Having worked directly and indirectly with investors from all walks of life and every region of the country over the last 18 years, I can promise you that almost no one can endure – emotionally speaking – the volatility and drawdowns that an all-equity portfolio brings to the table.

The good news is, investors don’t have to. The power of compounding is every bit as potent in a well-managed, diversified portfolio as it is in a kamikaze portfolio.

Source:

How Much of Your Nest Egg to Put Into Stocks? All of It (New York Times)

[…] Why you shouldn’t. (thereformedbroker) […]

[…] As Josh Brown reports on The Reformed Broker: […]

[…] As Josh Brown reports on The Reformed Broker: […]

[…] Brown, a writer and investment adviser I admire, made the case earlier this year for diversification with bonds, on the strength of the idea that few people can stomach the wild […]

[…] Brown, a writer and investment adviser I admire, made the case earlier this year for diversification with bonds, on the strength of the idea that few people can stomach the wild […]

[…] Brown, a writer and investment adviser I admire, made the case earlier this year for diversification with bonds, on the strength of the idea that few people can stomach the wild […]

[…] As Josh Brown reports on The Reformed Broker: […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2016/02/13/should-you-be-100-long-stocks/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2016/02/13/should-you-be-100-long-stocks/ […]

… [Trackback]

[…] There you can find 14792 additional Information to that Topic: thereformedbroker.com/2016/02/13/should-you-be-100-long-stocks/ […]

… [Trackback]

[…] Here you will find 19404 more Info on that Topic: thereformedbroker.com/2016/02/13/should-you-be-100-long-stocks/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2016/02/13/should-you-be-100-long-stocks/ […]

… [Trackback]

[…] Here you can find 69508 more Info on that Topic: thereformedbroker.com/2016/02/13/should-you-be-100-long-stocks/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2016/02/13/should-you-be-100-long-stocks/ […]