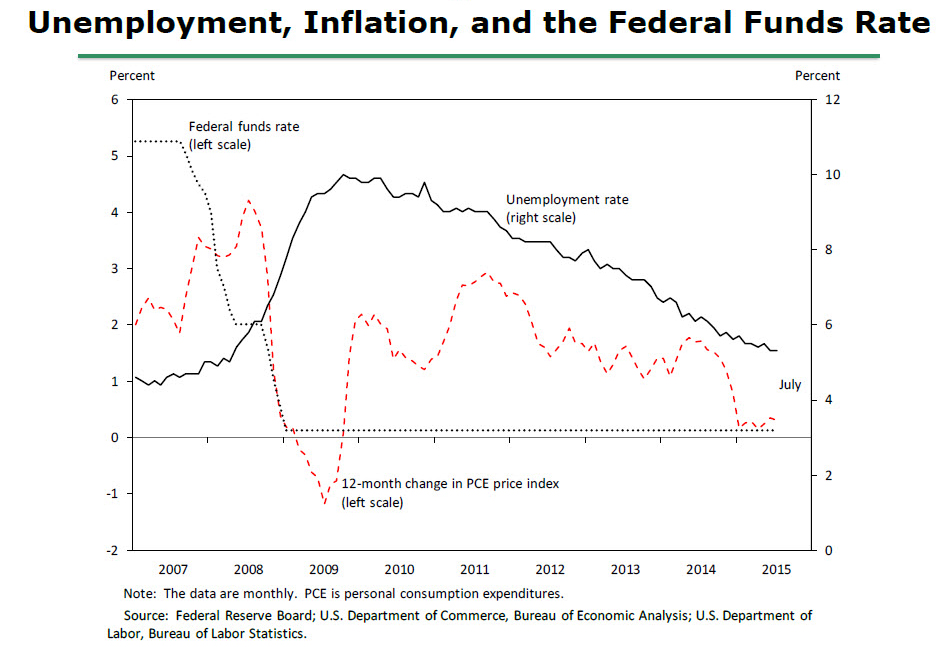

Janet Yellen’s speech about inflation last night was accompanied by a slide show and I found the below chart to be the key takeaway that explains virtually everything going on with rates right now.

The Fed doesn’t understand why prices in the economy aren’t following the tightness of the labor market. Below is unemployment in the post-crisis period versus inflation, which, bizarrely, have been correlated as opposed to divergent:

Here’s Yellen on how the Fed sees this conundrum:

As I noted earlier, after weighing the costs associated with various rates of inflation, the FOMC decided that 2 percent inflation is an appropriate operational definition of its longer-run price objective.14 In the wake of the 2008 financial crisis, however, achieving both this objective and full employment (the other leg of the Federal Reserve’s dual mandate) has been difficult, as shown in figure 4 [above].

Initially, the unemployment rate (the solid black line) soared and inflation (the dashed red line) fell sharply. Moreover, after the recession officially ended in 2009, the subsequent recovery was significantly slowed by a variety of persistent headwinds, including households with underwater mortgages and high debt burdens, reduced access to credit for many potential borrowers, constrained spending by state and local governments, and weakened foreign growth prospects.

I’m not an economist, but in my own mind, I think there are a few main reasons for this that Yellen hints at or doesn’t mention at all:

- Deflation is being exported from around the world as global economies slow (or contract), and other central banks cut rates or engage in QE. There have been over 600 global rate cuts since Lehman. Globalization means the US economy is not immune to pressures from overseas.

- Demographics – record low labor force participation and the aging population add up to a recovery with less zing in it. People spend less as they age and especially when they retire. The millennials, of which there are 73 million, aren’t following prior generations on the same path of ownership and consumption. Many have delayed the start of their own household formation until later in their 30’s. We’ve been in a gap of sorts between one generation fading and the next one rising to fill their spot.

- Technology is deflationary. Everything is cheap or free. Operations that once took ten skilled workers now require just one, armed with software.

- Young people prize experiences over material goods. A lot about the way we measure prices and costs in the economy needs to change. Our economic data points were largely invented during the 1960’s.

- The big one – we’re still in a hangover from last decade’s debt and credit binge. Prominent economists have shown that these debt crises take a long time to recover from and the usual vigor just isn’t there.

- There’s an overall lack of confidence that things will get better. Epic income inequality has destroyed psychology and this has a lingering effect on investment and consumerism. A rising stock market and record high prices for Manhattan / SF condos doesn’t fix this.

Not sure what could come along to change this dynamic overnight. Fiscal policy is working at odds with what the Fed has tried to do on its own. Demography is inexorable. The technological breakthroughs of the modern era are accruing benefits for investors and convenience for users, but doing very little for labor (if not harming it outright).

This paradox has been the Fed’s hardest button to button.

[…] comment on Janet Yellen’s speech last night: The Hardest Button to Button (The Reformed […]

[…] Why there might be a cap on inflation in the future. (thereformedbroker) […]

… [Trackback]

[…] There you will find 13644 additional Information on that Topic: thereformedbroker.com/2015/09/25/the-hardest-button-to-button/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2015/09/25/the-hardest-button-to-button/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2015/09/25/the-hardest-button-to-button/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2015/09/25/the-hardest-button-to-button/ […]

… [Trackback]

[…] There you can find 66901 additional Information to that Topic: thereformedbroker.com/2015/09/25/the-hardest-button-to-button/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2015/09/25/the-hardest-button-to-button/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2015/09/25/the-hardest-button-to-button/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2015/09/25/the-hardest-button-to-button/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2015/09/25/the-hardest-button-to-button/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2015/09/25/the-hardest-button-to-button/ […]

… [Trackback]

[…] There you can find 94018 more Info to that Topic: thereformedbroker.com/2015/09/25/the-hardest-button-to-button/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2015/09/25/the-hardest-button-to-button/ […]