My CAPE (cyclically adjusted price earnings) ratio reached 27.60 at close of market today, passing 2007 high. http://t.co/XbP0eZ2TA7

— Robert J Shiller (@RobertJShiller) February 13, 2015

USA Number One! is the rallying cry of today’s market pundit – it’s both a reflection of the last three years’ worth of outperformance by US stocks as well as the consensus outlook going forward. It’s predicated on the idea that the US economy is doing better than the rest of the world, therefore, US stocks will also continue to trounce foreign stocks.

Unfortunately, that’s too easy.

For starters, everyone is already aware of the better condition of US economic and corporate fundamentals and, as such, we’re likely closer to full participation for US stocks than for most others.

Second, the data is unambiguous – buying cheaper markets is more important for future performance than buying better economies. Dimson, Marsh and Staunton (London Business School) have conclusively shown that it is not current economic conditions that drive future returns – it is shocks to consensus expectations for those economic conditions. Meaning gains or losses for a country’s stocks are explained by how wrong investors are and how quickly they realize it by either buying or selling. They’ve reconstructed a century’s worth of market data from around the world to arrive at this conclusion – you may want to pay attention.

Strong future growth doesn’t help if everyone foresees it and prices it in. There’s no one who didn’t foresee strong future growth at the turn of the last century, which is why the Nasdaq, for example, sucked forward 15 years’ worth of returns into the 36 months ending March 2000. Everyone knew the internet was going to be huge. We were right, but there wasn’t any upside left in betting on it by the end.

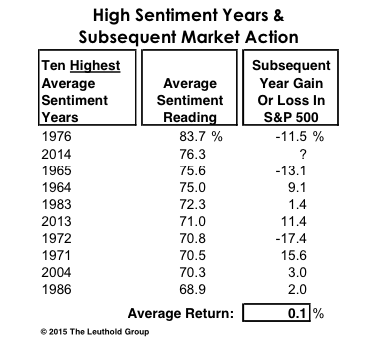

Meb Faber has repeatedly demonstrated the value of owning cheaper markets that are laden with poor expectations and stigma attached. He’s even launched a fund based on this premise. Meb shared a Leuthold Group table the other day depicting shows how overly positive sentiment has typically led to bad performance for a given stock market.

But does sentiment help with stock market returns? Below are the 10 highest and lowest sentiment years and the returns of the stock market the following year. Not surprisingly high sentiment results in low returns of 0.1% per year. Low sentiment results in whopping 17.4% returns per year. What was average sentiment in 2014? 2014 was the second highest value ever at 76.3%.

That sentiment data comes from the Investors Intelligence poll – each year’s reading represents an averaging of every month during that year. I think, based on the data for 2014, it’s safe to say that everyone already agrees the US economy and stock market will do great in 2015. Fortunately for wiser investors, sentiment isn’t very positive at all for major investable markets around the world.

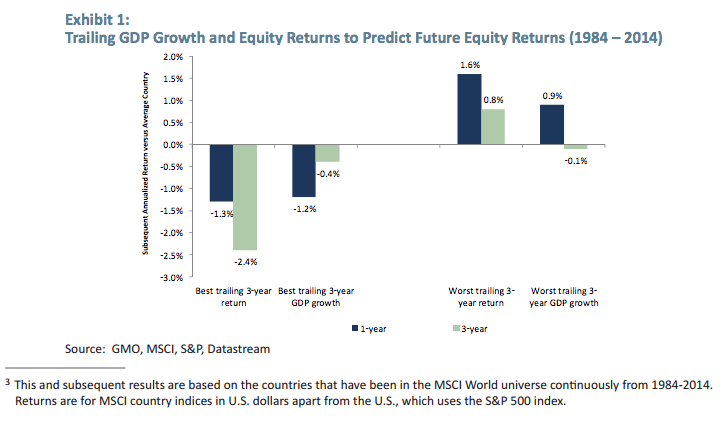

Over at GMO this past week, Ben Inker explains that it’s not the fastest growing or best performing markets that go on to win for investors. It’s the cheapest markets, looking out more than one year.

History tells us that if you are going to be a knee-jerk anything, at least be a knee-jerk contrarian. The 20% of developed stock markets that outperformed most over a three-year period underperformed on average by 1.3% in the following year and by 2.4% annualized over the next three years. The worst 20% of prior performers outperform by 1.6% and 0.8% annualized. The pattern is similar, if weaker, with regard to GDP growth. The fastest GDP growers over the prior three years underperform over the next one and three years by 1.2% and 0.4%, while the worst growers outperform by 0.9% over the next year and marginally underperform by 0.1% over the next three. The performance is summarized in Exhibit 1.

Josh here – The outlook for the United States is superior to the outlook for virtually everywhere else. No shit. We are all aware of this. This is why Bob Shiller’s CAPE ratio alarm is going bananas right now. But this superiority is what’s already expected and therefore currently being discounted into today’s prices.

What isn’t being discounted? That’s the more interesting (profitable) question.

Sources:

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2015/02/13/meanwhile-at-the-best-house-in-a-bad-neighborhood/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2015/02/13/meanwhile-at-the-best-house-in-a-bad-neighborhood/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2015/02/13/meanwhile-at-the-best-house-in-a-bad-neighborhood/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2015/02/13/meanwhile-at-the-best-house-in-a-bad-neighborhood/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2015/02/13/meanwhile-at-the-best-house-in-a-bad-neighborhood/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2015/02/13/meanwhile-at-the-best-house-in-a-bad-neighborhood/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2015/02/13/meanwhile-at-the-best-house-in-a-bad-neighborhood/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2015/02/13/meanwhile-at-the-best-house-in-a-bad-neighborhood/ […]