The greatest trick Wall Street ever pulled was convincing Main Street that Volatility was the same thing as Risk.

— Downtown Josh Brown (@ReformedBroker) May 25, 2014

If your so-called “Absolute Returns” hedge fund crushed it over the last 18 months, I have two pieces of news for you: A) it’s not really an absolute returns vehicle after all and B) it’s going to crush you when the worm turns, regardless of what you’re counting on it to do.

Barron’s has a piece this weekend about why it’s time to revisit the fund of hedge funds approach. Funds of funds, just for context, lost 21% on average during the events of 2008, despite the fact that many of them were billed as absolute returns vehicles. They’re not. In bull markets, they’re expensive beta-chasers by and large. By the time a bull ends and a bear sets in, it is highly likely that only half of the managers in a given FoF have reduced exposure or are prepared. A mix of stocks and treasurys is a much cheaper and more pragmatic answer than a fund of funds in my opinion.

Brokers sell funds of hedge funds to their clients with the idea that they’re reducing risk by incorporating absolute returns strategies. It’s mostly bullshit. What they’re really doing is incorporating sex appeal and celebrity managers into a high net worth investor’s portfolio which leads to stickier relationships and money that doesn’t leave.

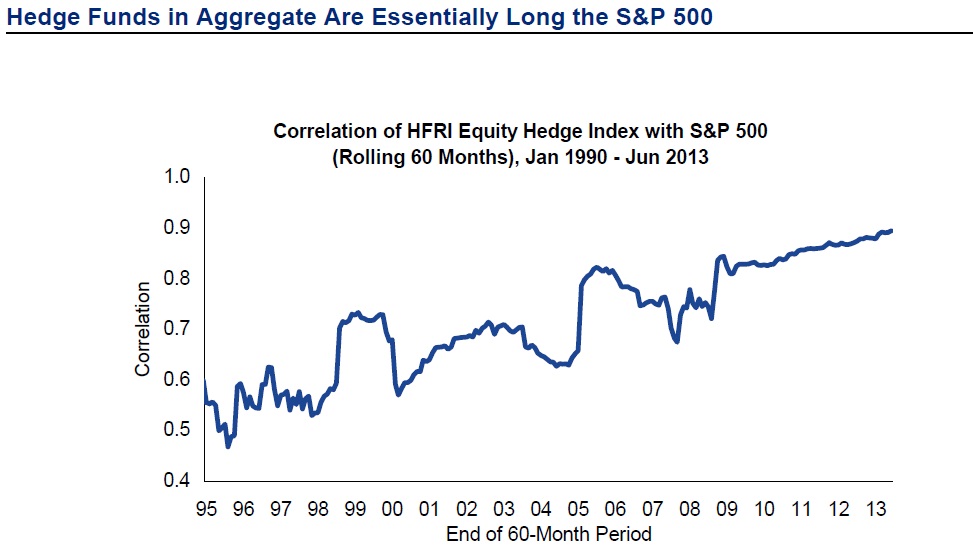

The problem is, whatever “hedging” might be taking place in a fund of funds, it’s probably minor in comparison with stock market chasing. Nobody wants to report a 6% absolute return in a market up 20% plus. And so as bull markets wear on, the correlation between the hedge fund industry returns and the S&P 500 grows when it should really be shrinking. A great chart published by Adam Parker (Morgan Stanley) last summer illustrates this phenomenon:

Clearly you can see the trend here. Correlation with the S&P rises right as it shouldn’t – headed over the cliff. It then falls right after a crash, meaning hedge funds in general are slow to recover, adding insult to injury. Granted, there are winners and losers on an individual basis – but the typical fund of funds is more apt to look like the index given its multi-manager approach.

I am not against the fund of funds approach. I am against the way it’s sold and the promises inherent when a broker presents it.

Investors are first convinced that they cannot bear short-term volatility and that daily swings in their portfolio value somehow constitutes “risk.”

Once you’ve sold someone on the idea that movement in a portfolio is the same thing as risk, there’s no limit to what high margin products you can sell to them to mitigate it. This includes expensive funds that claim to be absolute returns-driven but are really not.

True absolute returns managers are exceedingly rare. Absolute returns pretenders are not rare at all.

.

ñïàñèáî çà èíôó!

.

good info.

[…] Absolute Returns LOL […]

… [Trackback]

[…] There you can find 39616 additional Information to that Topic: thereformedbroker.com/2014/05/25/absolute-returns-lol/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2014/05/25/absolute-returns-lol/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2014/05/25/absolute-returns-lol/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/05/25/absolute-returns-lol/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2014/05/25/absolute-returns-lol/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2014/05/25/absolute-returns-lol/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2014/05/25/absolute-returns-lol/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2014/05/25/absolute-returns-lol/ […]