![sickpumpkin[1]](http://thereformedbroker.com/wp-content/uploads/2009/10/sickpumpkin1.jpg)

If you’ve never before heard the below famous quote by Mark Twain, consider its almost supernatural prescience along with its sardonicism:

“October: This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August and February.”

Twain said that a hundred years ago or so – far before it was actually true. Had he chosen to begin with October randomly? Or had T.H. White’s Merlin and Archimedes zoomed backward past his epoch and whispered in his ear?

Either way, October is famous for being a wild month for stocks, some of the most historic crashes in history have taken place upon its playing field. Jeff Hirsch at Stock Trader’s Almanac has the data (emphasis mine):

October has a dreadful history of market crashes such as in 1929, 1987, the 554-point drop on October 27, 1997, back-to-back massacres in 1978 and 1979, Friday the 13th in 1989 and the 733-point drop on October 15, 2008. During the week ending October 10, 2008, Dow lost 1,874.19 points (18.2%), the worst weekly decline in our database going back to 1901, in point and percentage terms.

But as much as we’d like to fret, we must also keep in mind that October has had the magical ability to serve as inflection point in times of market stress. Not that it applies this year, with our 20% S&P gain headed into the month, but in the 37 years between 1928 and 2011 in which the S&P ran into October negative on the year, they’ve turned around in all but 8 instances. Yes, October deserves it’s reputation for being crashtastic – but it has also earned a rep as a time for turnarounds, too.

Here’s the Almanac again: “But October has also been a turnaround month—a ‘bear killer’. Twelve post-WWII bear markets have ended in October: 1946, 1957, 1960, 1962, 1966, 1974, 1987, 1990, 1998, 2001, 2002 and 2011.”

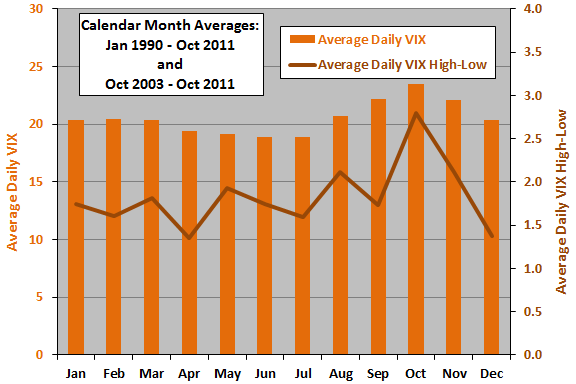

We don’t know, of course, whether or not the market will end this October higher or lower, but we do know it to be the most volatile month of the year. CXO Advisory looked at seasonal patterns of volatility and put together this great chart encompassing the 1990-2011 period to demonstrate the spasmodic nature of the October Vix:

And if October is normally volatile, this month should be no different, especially given the fiscal fight that’s already underway. Despite the fact that history has shown the impact of these types of government flare-ups to be muted (chart here), this does not stop people from reacting.

Crash month, bear killer, last 30-day period before the “best six months” (Nov-April), month of volatility and of inflection points – call it what you will.

For shorter-term traders, October should offer some phenomenal opportunities to trade the vol they’ve been denied for so long. For investors, the key is to not mistake volatility for risk – a classic mistake made over and over again, an emotionally-driven cognitive blind-spot that is routinely exploited by the purveyors of expensive products on Wall Street.

Wild market action does not require wild investor re-action, in fact it is just the opposite that will most likely see us through.

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/09/29/october-into-the-wild/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/09/29/october-into-the-wild/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/09/29/october-into-the-wild/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/09/29/october-into-the-wild/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2013/09/29/october-into-the-wild/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/09/29/october-into-the-wild/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2013/09/29/october-into-the-wild/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2013/09/29/october-into-the-wild/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2013/09/29/october-into-the-wild/ […]

… [Trackback]

[…] There you can find 98357 additional Info on that Topic: thereformedbroker.com/2013/09/29/october-into-the-wild/ […]