At my shop we spend more of our time thinking about how we can succeed through behavior rather than through trying to find the next hot stock or fund manager.

We’re always fascinated by those who choose the other, less rational route and we typically find that they do so because their job depends on it or they’re not familiar with what the data says.

Jeff Fisher had a rather devastating post at the Motley Fool this week in which he cites Davis Advisors on the Behavior Gap.

For the uninitiated, there is a gap between what investment markets return versus what individual investors end up coming home with and that gap can easily be explained by the investors’ highly predictable behavior. Investors have a remarkably consistent tendency to buy funds at peaks, sell out at lows, trade too often, sell winners, double down on losers and pay exorbitant trading and management costs, most unaware of the repeated damage they do to themselves. I’d call it an anomaly – but it’s so permanent and unfixable, through every era, that to refer to it as a exception would be wishful thinking.

You already know that most mutual funds and active managers underperform – but did you know that their investors somehow manage to even underperform the underperformers!?!

They do. Here’s Fisher:

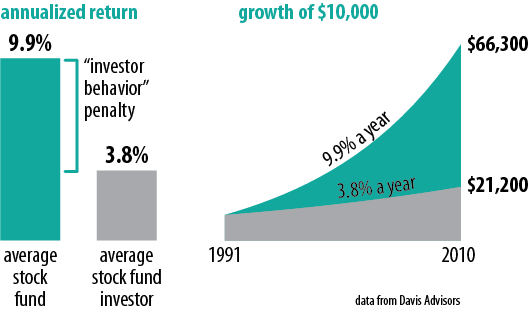

According to an investing study from Davis Advisors, the average stock-holding mutual fund returned 9.9% annualized from 1991 to 2010, but the average fund owner earned only 3.8% on average per year.

Not pretty. And it hurts even more if we put this performance into dollars. By trading in and out of funds, the average fund owner increased a $10,000 investment to just $21,200 over nearly two decades — while the average fund turned that $10,000 into $66,300. Now imagine the continuing effects of compound returns on both of those amounts and the growing difference between them over a lifetime. Feel the pain. Remember it next time you’re tempted to make a trade. Davis also finds that the less trading a fund itself does, the better the fund’s results tend to be. What’s true for individuals is true for funds, too.

The funny part is that bull markets actually exacerbate this tendency to do silly shit, for both pros and amateurs. Because greed is the driver of most of these mistakes and overconfidence takes over after a few quarters of big portfolio gains.

Keep that graphic in mind the next time you find your finger on the trigger.

Source:

[…] the two rules above and you will do better than the majority of investors. Do not concern yourself with Morningstar ratings or historical returns. These are not good […]

[…] and buys during bull markets. This is completely backward – and it’s the primary reason why individual investors tend to do so poorly in the stock […]

[…] en actieve fondsbeheerders het minder goed doen dan de markt, maar wist u dat de individuele beleggers in deze fondsen nog minder presteren dan deze […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/05/22/most-investors-underperform-their-already-underperforming-funds/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/05/22/most-investors-underperform-their-already-underperforming-funds/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/05/22/most-investors-underperform-their-already-underperforming-funds/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2013/05/22/most-investors-underperform-their-already-underperforming-funds/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/05/22/most-investors-underperform-their-already-underperforming-funds/ […]

… [Trackback]

[…] Here you will find 11202 more Info on that Topic: thereformedbroker.com/2013/05/22/most-investors-underperform-their-already-underperforming-funds/ […]

… [Trackback]

[…] There you can find 58361 more Information to that Topic: thereformedbroker.com/2013/05/22/most-investors-underperform-their-already-underperforming-funds/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2013/05/22/most-investors-underperform-their-already-underperforming-funds/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/05/22/most-investors-underperform-their-already-underperforming-funds/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/05/22/most-investors-underperform-their-already-underperforming-funds/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2013/05/22/most-investors-underperform-their-already-underperforming-funds/ […]

[…] and buys during bull markets. This is completely backward – and it’s the primary reason why individual investors tend to do so poorly in the stock […]