There are guys in the media and online selling a show or a service in which they offer dozens of “actionable” trading ideas a month and hundreds of buy or sell calls a quarter. Unless everyone trying to keep up with all that in-and-out bullshit is using a tax-deferred or Cayman corporation account, I have no idea how this is working for the “viewers” or “subs” in real life.

Even if the majority of the calls are good – and how can they be? – the resulting commission costs and short-term cap gains resulting from this type of manic activity make zero sense for the majority of investors.

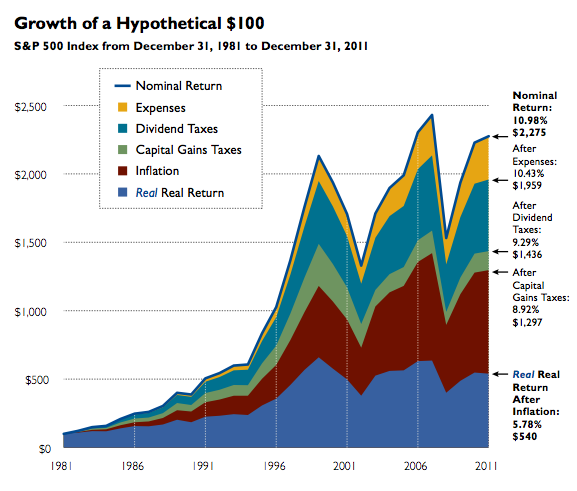

It’s not that trading is bad or good – it’s just that the object for most investors who are not professional, full-time speculators, should be to minimize all friction to the best of their ability. Frictional costs – like trading commissions and taxes – are among the individual investor’s greatest enemies. Warren Buffett said that in the 70’s and little has changed. Massive drawdowns, non-diversification, amateur market-timing, performance-chasing and failing to keep up with inflation are some of the others.

There’s a recent piece of research at Thornberg Investment Management I want you to read this weekend that deals with this issue and shows the true impact of costs on your real investment returns.

Head over below:

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/03/16/what-is-your-real-real-return/ […]

… [Trackback]

[…] There you will find 13351 more Info on that Topic: thereformedbroker.com/2013/03/16/what-is-your-real-real-return/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/03/16/what-is-your-real-real-return/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/03/16/what-is-your-real-real-return/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2013/03/16/what-is-your-real-real-return/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2013/03/16/what-is-your-real-real-return/ […]

… [Trackback]

[…] Here you will find 680 more Info on that Topic: thereformedbroker.com/2013/03/16/what-is-your-real-real-return/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/03/16/what-is-your-real-real-return/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/03/16/what-is-your-real-real-return/ […]

… [Trackback]

[…] There you can find 86669 additional Information to that Topic: thereformedbroker.com/2013/03/16/what-is-your-real-real-return/ […]