I’ve just read a cutesy article about how college professors around the country are incorporating The Great Recession into their curriculum. We’re not just talking about finance classes, they’re using the bailout to help teach “post-colonialism” and “Marxist Theory”, you know, all the important stuff that helps you support a family in the real world.

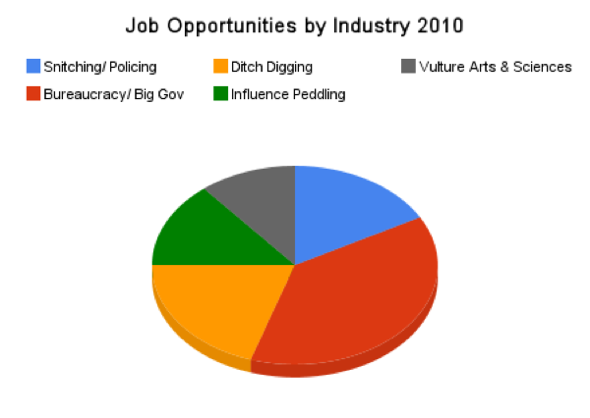

Anyway, allow me to offer a bit of advice to the Class of 2010. If you are graduating from college with your $150,000 education next spring and wondering where all the jobs will be, below is my list. It is probably more accurate than my sarcasm may allude to…

Snitching/ Policing

The world of regulation and oversight is now headed into its Renaissance, following the eight year orgy of rulebook chainsaw-ing and the Bush-led Laissez Faire Kleptocracy. These will be the Salad Days for those in charge of monitoring, examining and prosecuting fraud as every request for funding will be approved and virtually every perp will be considered guilty until proven guilty.

The jobs that fall into this category consist of Compliance, Examination, Auditing, Regulation and White Collar Investigation/ Prosecution.

Bureaucracy

If there’s one certainty of the Obamanomics Era, it’s that paper-pushing will be the most highly sought-after skill set in America. One cannot triple the size of government and move whole chunks of the economy into the public sector without significantly staffing up at the State, Local and Federal level. As the US banking and health care sectors become de facto government-run, the need for bureaucratic drones will skyrocket. This new workforce will be well-paid as tax dollars will be footing the tab and picking up the cost of every perk and benefit under the sun.

All of this government and civil employment means a great deal of short-sleeve button down shirts will be purchased as well.

Ditch Digging

Obama’s entire stimulus plan hinges on the funding of “shovel-ready” projects. These include the modernization of our aging infrastructure, thus providing the young graduates ample opportunity to experience road gang life. There will also be several vanity/ porkalicious projects like the bullet train from Disneyland to Las Vegas (because after a week at the theme park, the average father of 3 needs a few nights in a casino to be completely certain that every last penny has been spent).

The jobs involved with these projects will be heavily unionized, as the entire stimulus plan is simply a giant election IOU to organized labor anyway.

Influence Peddling

Political horsetrading is back with a vengeance now as the Democratic House, Senate and White House remake America into the Land of a Thousand Bills. Everyone’s pet project is getting equal time these days as trillion dollar allocations are approved left and right. The lobbyists are working overtime to make sure that the interests of their heavily-entrenched corporate clients are well-represented in each vote on the floor.

Thomas Jefferson would probably want to blow his brains out, but for the student interested in a slot at a Political Action Committee or K Street bribery lab, the environment has never been more lucrative.

Vulture Arts and Sciences

There is a always a bull market somewhere, and I will tell you where one of the biggest bull markets in history is raging as we speak…in the Bankruptcy Industry. Looking for a job with great growth prospects? Try these: Foreclosures, Restructuring, Bankruptcy Law, Asset Repossession, Business Liquidators, Divorce Law and Debt Recovery.

Any company that benefits from the failure of others is literally up to their eyeballs in business right now, so your resumé will be welcomed.

***

To those of you who will be graduating next spring, use these five industries as your starting point for locating job opportunities. The upside for those engaged in bankruptcy, union labor, regulation, lobbying and big government will be nothing short of staggering.

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2009/12/13/dear-class-of-2010-here-are-your-job-options/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2009/12/13/dear-class-of-2010-here-are-your-job-options/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2009/12/13/dear-class-of-2010-here-are-your-job-options/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2009/12/13/dear-class-of-2010-here-are-your-job-options/ […]

… [Trackback]

[…] Here you will find 23473 additional Information to that Topic: thereformedbroker.com/2009/12/13/dear-class-of-2010-here-are-your-job-options/ […]

… [Trackback]

[…] Here you will find 90919 more Information to that Topic: thereformedbroker.com/2009/12/13/dear-class-of-2010-here-are-your-job-options/ […]