Dear Samantha,

I wanted to start by saying thank you so much for your letter and for watching my YouTube show. I’m very impressed by your desire to learn more about investing at such a young age. I wish I had started in junior high school! You are much smarter than I was at age 12.

I don’t have any specific advice for you but I would like to recommend two books for you to read. They are two of the most important books you will ever read because they will teach you two of the most important lessons about business and investing. These are the two books that were the most influential for me as I began my career. I wish I had read them when I was much younger, as you are now.

The first book is called “The Go-Giver” by Bob Burg and John David Mann. This book had a major impact on my life because I began to implement the lessons from it immediately. This is, I believe, the true secret to success and happiness.

The Go-Giver teaches us that by making ourselves useful and available to the needs of others, we can find a greater level of success than we could with a more selfish approach. Fortunes have been built with this philosophy over hundreds of years. A life of service to others can result in a powerful sense of purpose. The more people rely on your help and enjoy being in your company, the more successful you will become – in business and in life.

The second book taught me the most important lesson there is about investing. It’s called “Simple Wealth, Inevitable Wealth” by Nick Murray. In Simple Wealth, you will learn that what most people consider to be risky – buying stocks – is, in fact, the opposite! Buying stocks with the intention of holding them forever is, in fact, the most conservative thing any young person could possibly do.

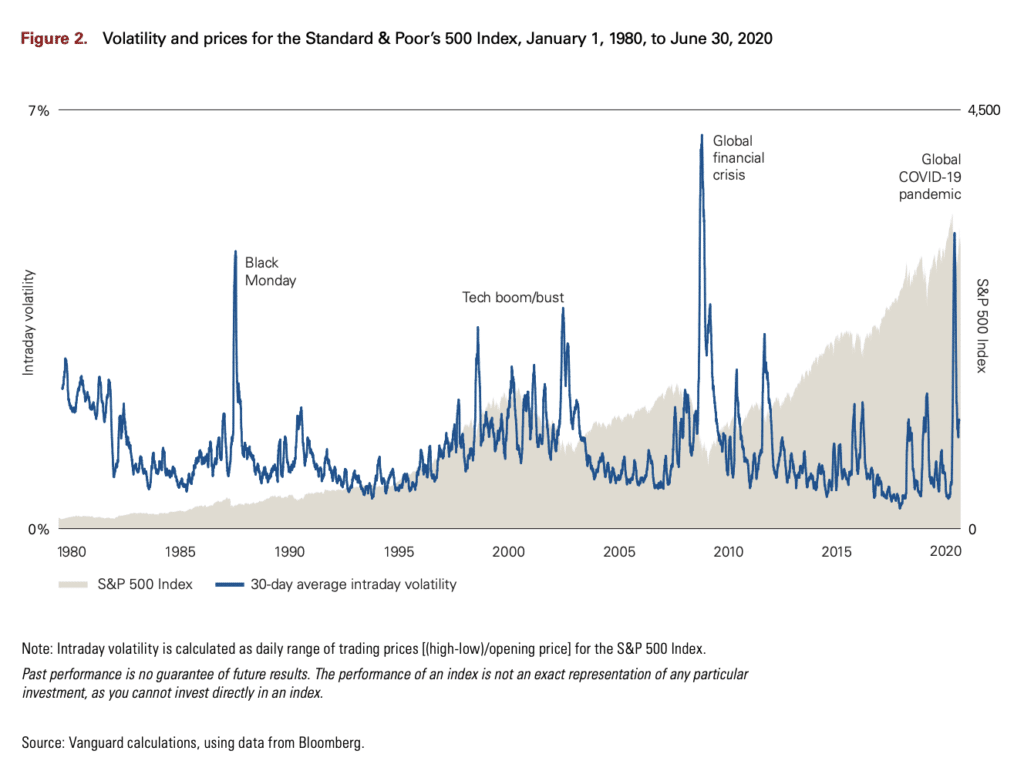

I will prove it to you. Consider this chart below, published by Vanguard. It depicts the biggest risks over the course of my lifetime and the associated volatility – another word for price fluctuation – that hit the stock market every time people got frightened:

As you can see by the blue line, volatility comes and goes, it is never permanent. But as the gray area chart behind it shows, the gains are permanent if you remain invested long enough. Since January 1st, 1980, the S&P 500 stock index is up over 9,000% including reinvested dividends, which is an average annual return of over 11.5% per year. You cannot earn anywhere near that amount by not accepting volatility (or risk) in the short-term and there is no way around this basic fact.

By accepting the potential for losses today, we earn the potential returns of tomorrow. Once you have accepted this fact, you are ahead of most investors – both individuals and professionals – who spend their entire lives searching for an escape or a clever way around this reality. Nick Murray will convince you that this search, given your time horizon of decades, is completely unnecessary.

This is not the way finance has traditionally been taught, but it is the plain, undeniable truth: Anything we try to do in order to avoid risk today means less reward in the future, which is in actuality equivalent to taking more risk, not less.

You can buy The Go-Giver on Amazon and Simple Wealth on nickmurray.com. I hope you get as much out of them as I have. I wish you all the best in school and in your future career, which I know will be a bright one!

Thanks again,

your friend Josh

P.S. Michael Batnick says hi

Ritholtz Wealth Management

You can listen to this post here, via The Goldmine Podcast: