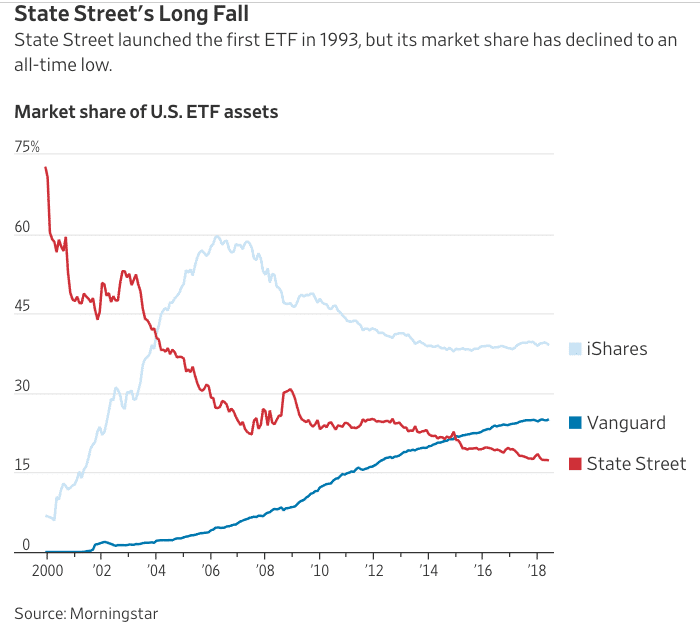

Friday’s Wall Street Journal did a big story about how the inventor of the ETF product, State Street’s SPDRs unit, has seen its market share fall as Vanguard and BlackRock’s iShares have gobbled their way up to the top.

State Street launched the first ETF 25 years ago and dominated the market for a decade. Today, its slice of U.S. ETF assets is just 17.3%—down from 49% 15 years ago. More worrying for its future, State Street captured just 5.9% of the $343 billion that poured into ETFs in the past year. By contrast, Vanguard Group and BlackRock Inc.’s iShares took in a combined 67%. Even Charles Schwab Corp., a relative newcomer with just 22 ETFs, had a fatter haul.

The article goes into how this happened, and it basically boils down to State Street not being bold enough early on with new offerings or being aggressive enough about slashing fees on the products. The bank didn’t really see the big picture and, besides, paying S&P big money to license its indices as well as the SPDRs trademark made it nearly impossible to compete on cost.

I’m a fan of State Street Global Advisors and the SPDRs products and I think they have a big opportunity to win back some share. I’ll lay out the broad strokes of what I would do.

The RIA community’s favor is the single most important determinant of flows. Institutions and self-directed retail investors use ETFs, but investment advisors are absolutely in love with them. Big picture, whether or not your products make it into the model portfolios recommended by RIAs is the whole ball game. State Street understands this, which is why last year it rolled out a brand new suite of ultra low-cost index ETFs, and cut a commission-free trading deal with major brokerage custodian platform TD Ameritrade Institutional. The phone call I got the morning of the rollout was “It’s official, we are ready to compete for every slice of your core portfolio now.”

Smart move. Advisors are obsessed with delivering a low expense ratio core portfolio because it makes their overall management fee to the end-client more palatable. This is a major part of the story about this era’s mass defection from traditional ’40 Act mutual funds and more expensive active management. CNBC.com said last fall that “The latest survey of advisors conducted by the Financial Planning Association found that 88 percent of those surveyed now use ETFs, compared to 40 percent in 2006.

Advisor flows are an enormous chunk of total flows to these products. According to ThinkAdvisor last November, “Advisors and investors allocated $469 billion to exchange-traded funds in the 12 months ended Sept. 30, a 19% increase over the previous year…Eighty percent of the net new assets came from retail channels driven by advisors.”

Fortunately for State Street and Jim Ross, the legendary Chairman of its global SPDR business, they have a powerful card they haven’t played yet. SPDRs is unique among the top ETF providers in that they are the only player not currently competing with their own best customers. Vanguard, BlackRock, Fidelity and Schwab are all aggressively marketing their own robo-advice platforms – these are businesses that are meant to directly compete with the RIA clients who currently recommend their ETFs.

This weekend’s Barron’s cover story is about the state of the robo-advice business. “Today, Vanguard has $112 billion in assets in its automated product. Charles Schwab is No. 2 with $33 billion.” These two are running away with the game right now because they already have massive scale. Schwab’s got a trillion bucks in self-directed assets on its platform from regular household investors. They’re offering robo-advice to that cohort at 28 basis points and converting retail investors into robo-advised investors. This while human RIAs on its custodian platforms are also using the same ETFs.

Vanguard’s offering starts at a $50,000 minimum account size but has already become massive in less than three years. It’s basically a digitization of their call center, but they’ve positioned it as a complete advice solution, including access to human CFPs on demand. BlackRock’s offering, called Futureadvisor (a company they bought) is tiny in comparison, but has similar potential if they ever turn the jets on. Fidelity is also trying to build its robo solution while simultaneously launching ETFs to appeal to human RIAs on its custody platform.

Vanguard, Schwab and BlackRock have a tremendous amount of mindshare in the human advisor community. They’ve got excellent ETF products and advisors love to use them. But they now go head to head with them on the advice side. State Street can chip away at that by pointing out this simple fact.

State Street’s SPDRs unit should be pitching itself to registered investment advisors as the last ally they have left in the ETF industry, now that all of its competitors are competing with their own best customers. The last ETF company they can trust. Go negative. Tell the story. Here’s the message they should go out with: “Build your practices and portfolios with our ETFs as building blocks and know that we will never compete with you for clients. We’re on your side.”

If Sherwin-Williams launched a discount house painting service, it’s pretty obvious to me that professional painters would be more likely to gravitate toward the products of Benjamin Moore or some other provider so long as prices and quality were comparable. This is why Sherwin-Williams is not spending a hundred million dollars advertising a painting service of their own. If food service giant Sysco began opening their own restaurants next door to the restaurants they supply, those restaurant owners would likely begin to look for other suppliers.

I’m not sure why the investment advice industry should be any different. I would bet that it’s not.

Business is business.

[…] Friday’s Wall Street Journal did a big story about how the inventor of the ETF product, State Street’s SPDRs unit, has seen its market share fall as Vanguard and BlackRock’s iShares have gobbled their way up to the top. State Street launched the first ETF 25 years ago and dominated the market for a decade. Today, its slice of U.S. ETF assets is just 17.3%—down from 49% 15 years ago. More worrying for … Source: http://thereformedbroker.com/2018/07/29/state-streets-opportunity/ […]

[…] So does Josh […]

[…] State Street’s Opportunity – Friday’s Wall Street. […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2018/07/29/state-streets-opportunity/ […]

… [Trackback]

[…] Here you can find 44132 more Info on that Topic: thereformedbroker.com/2018/07/29/state-streets-opportunity/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2018/07/29/state-streets-opportunity/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2018/07/29/state-streets-opportunity/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2018/07/29/state-streets-opportunity/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2018/07/29/state-streets-opportunity/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2018/07/29/state-streets-opportunity/ […]