Nobody explained to the President and his sons this very basic fact about the stock market, otherwise they wouldn’t have spent so much time crowing about it: Accelerating economic growth presents a new challenge to equities.

Here we were, nicely encapsulated in a multi-year stasis where rates (and borrowing costs) remained incredibly low, corporate profit margins remained elevated and the competition for capital between stocks and bonds was no real competition at all.

With the recent phenomenon of faster prints on the economic data, coupled with a more obvious case for why interest rates ought to be higher, stocks have given back some of their parabolic move from the last 15 months. Which is perfectly normal. Having a year in which the max drawdown from peak to trough is 3%, like 2017, is abnormal. More on this from my friend Phil Huber at bps and pieces.

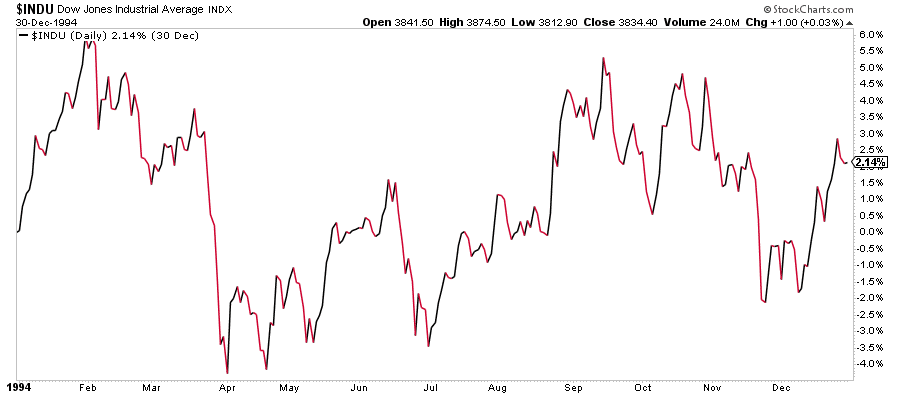

In 1994, there was a rate shock when Alan Greenspan recognized that the Fed was too easy given the boost in economic growth coming out of the 1990-1991 recession (Desert Storm, S&L Crisis, etc). Greenspan addressed this with a 25 basis point hike in February 1994 and then continued to push overnight rates up by a combined 225 basis points over the course of the year. Yields on the 30-Treasury jumped 175 basis points to 7.75% in the first 9 months – which helped destroy the finances of Orange County, CA, push Mexico into a financial crisis and wreak havoc across Wall Street. It became known as the Bond Market Massacre, and the stock market wasn’t immune, with a huge correction occurring that spring.

Here’s what it looked like, for the Dow Jones Industrial Average (in percentage terms from the start of that year):

The lessons:

* The Massacre in the bond market spilled over into the stock market as participants adjusted to the growing pains that come along with a faster economy than they had been expecting.

* Good economic news does not equal more stock gains.

* Every asset class is in a competition with every other asset class for investment dollars. When the dynamics in one asset class change (you can now earn 1.5% in a money market account, as opposed to zero), investors in the other asset classes will make changes to their portfolios. This is happening now, as REITs, Utilities and other high-yielding sectors of the equity markets see investor interest walk out the door – there are now less risky ways to earn income thanks to higher nominal interest rates on Treasurys.

* The recovery for stocks as investors grew accustomed to the new environment of faster growth / higher rates did not take long. Within a year of Greenspan’s February hike, the Dow had bottomed. Enormous stock market gains from 1995 through 1999 were on their way, though no one could have known at the time.

* All things being equal, an accelerating economy with increased wages and rising business spend is a positive for America, especially when coupled with a mirror image scenario happening in countries all over the world. But that doesn’t mean every day is a picnic for the stock market.

* We’ve grown accustomed to slow growth, low rates, high multiples. Now the game is changing. Expect growing pains and you won’t be anxious or disappointed. Ain’t this what they been waitin’ for? You ready?

Soundtrack:

Links:

- Stock Selloff Deepens; Dollar Steady as Gold Gains: Markets Wrap (Bloomberg)

- What’s to Blame for the Global Stocks Pullback? Not Earnings (MoneyBeat)

- Amid stock market selloff, U.S. profit forecasts rise (Reuters)

- As Stock-Market Rout Spreads, Investors Fear Markets Falling in Lockstep (Wall Street Journal)

- This is the Normal Part (bps and pieces)

- It’s Over (Irrelevant Investor)

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2018/02/05/growing-pains/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2018/02/05/growing-pains/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2018/02/05/growing-pains/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2018/02/05/growing-pains/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2018/02/05/growing-pains/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2018/02/05/growing-pains/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2018/02/05/growing-pains/ […]