The Wall Street Journal today:

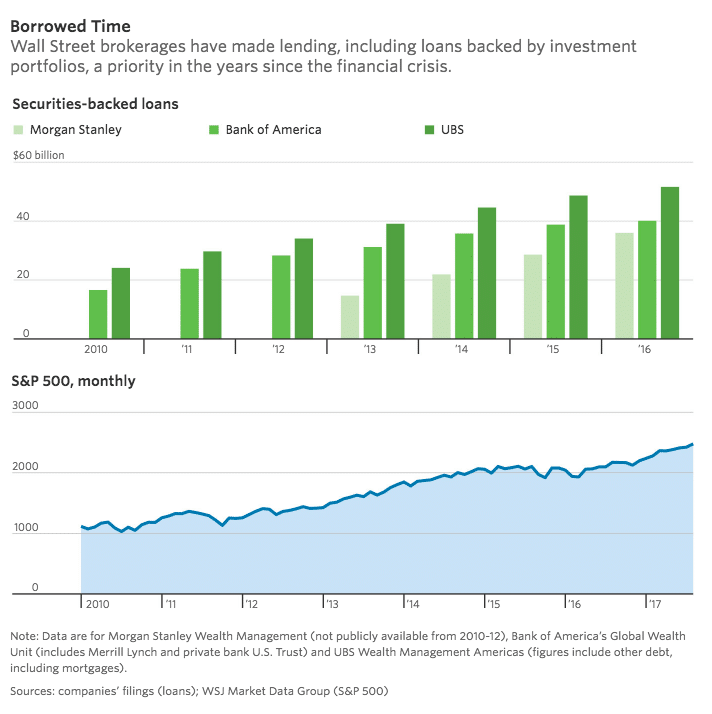

Wall Street brokerages are pushing customers to take out billions of dollars in loans backed by stocks and bonds, a trend that yields lucrative fees for the firms but poses risks for borrowers.

Josh here – It’s a new world. Investors have discovered that costs matter a great deal to their investment returns, second in importance only to their own behavior. If you’re an advisor offering the highest cost, most potentially conflicted wealth management solution in the industry, how do you keep your clients?

Inertia is one answer.

The other answer is to become a debt concierge. Which is the route that many wirehouse wealth managers have taken.

I’m not going to judge this as good or bad.

It’s just a reality. Clients paying for investment management will be stickier at firms where they’ve also borrowed against their portfolio’s stocks and bonds. Furthermore, the advisors are more likely than not to offer this borrowing option when it allows them to hold client relationships tighter and add a second revenue stream on the same assets under management – “I get paid for the portfolio management and I get paid for the money I lend the client against it too.”

Of course this is popular. The rates to the client are competitive and the process is streamlined – these loans aren’t even underwritten because the collateral is literally sitting at the firm already in the form of securities which can liquidated in a second to cover the non-performers.

Securities Based Lending is an old business and has its proper uses. It’s just that there’s never been a good idea on Wall Street that hasn’t been taken to its ludicrous extreme. Registered Investment Advisory firms (RIAs) are now being armed with the ability to make the same kinds of loans, although they cannot be considered a fiduciary if they profit from them. It’s also probably not great advice to encourage clients to take on additional debt just because it’s available. So for those reasons, there is a huge delta between securities based lending at the wirehouses and brokerage firms versus the RIA firms.

The Wall Street Journal has a new story about the trend:

Wall Street Needs You to Borrow Against Your Stock (Wall Street Journal)

I wrote about it years ago for Fortune:

The rise of rich man’s subprime (Fortune)

The bottom line is that if you have a client who has high interest loans outstanding and you can lower their borrowing rate with an SBL, that’s probably a good idea. However, if you’re out there just attaching loans to everyone’s portfolio to lock their accounts in and double your revenue stream, you’re a pig and the next bear market is going to reveal what a terrible advisor you truly are.

Stay woke.

[…] Brown has warned about the newest fad among wirehouses: securities based lending. Brokers are urging their clients to take out loans against their portfolios. It reminds me of […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2017/07/27/financial-advisor-debt-concierge/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2017/07/27/financial-advisor-debt-concierge/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2017/07/27/financial-advisor-debt-concierge/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2017/07/27/financial-advisor-debt-concierge/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2017/07/27/financial-advisor-debt-concierge/ […]

… [Trackback]

[…] Here you can find 21624 additional Info to that Topic: thereformedbroker.com/2017/07/27/financial-advisor-debt-concierge/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2017/07/27/financial-advisor-debt-concierge/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2017/07/27/financial-advisor-debt-concierge/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2017/07/27/financial-advisor-debt-concierge/ […]

… [Trackback]

[…] Here you will find 47909 more Information on that Topic: thereformedbroker.com/2017/07/27/financial-advisor-debt-concierge/ […]