The majority of discussion about the stock market in the financial media these days is directional. This makes sense in the context of a world in which the indices are all that matter to most people and political uncertainty is widely believed to be the biggest risk factor (as opposed to financial conditions or profit concerns).

And so the discussion returns to – again and again – whether or not the next 5% move in the S&P 500 is up or down. It’s not a question of fundamentals, but of sentiment. Which way will the wind blow?

But the S&P 500 isn’t the only opportunity set in the world of equities. US stocks account for slightly over half of the global stock market, which means that this “next 5%” myopia could lead to missed opportunities.

In the just completed first quarter of 2017, the MSCI All Country World Index ex-USA did close to 9%, versus just under 6% for the S&P 500. Foreign stocks are so despised (or ignored) at this point that it would make perfect sense for them to start a bout of outperformance vs US stocks.

I want to show you some data that my firm’s director of research, Michael Batnick, put together as the first quarter came to a close the other day. I asked him to look at what happens historically after foreign stocks outperform the S&P 500 through the end of the first quarter of a given year. My theory is that the instinct on the part of professional allocators to chase geographic performance might mean that foreign stocks would have a higher tendency to outperform in these periods.

I was way more right about this than I thought I’d be. I always think about markets in terms of human behavior and the incentive systems that drive it, beyond just run of the mill fear and greed. Michael thinks the reason is simpler – once an asset class outperforms in Q1, it’s just like getting a head start in a race, and it’s harder for other asset classes to catch up absent a dramatic reversal at some point during the year.

Either way, we found this to be interesting and worth passing along.

We compared Q1 and full-year performance of the S&P 500 and the MSCI All-Country World ex-USA Index, which I’ll just refer to as “foreign stocks” from here on out. Note that we are using index price net of dividends for this exercise because we’re talking about performance chasing as opposed to returns chasing.

When we look at the past half century, there does appear to be something more meaningful to say about how this sort of thing plays out.

From 1970 through 2016, we found that world stocks ex-USA outperformed the S&P 500 in 22 out of 47 years, or just less than half the time.

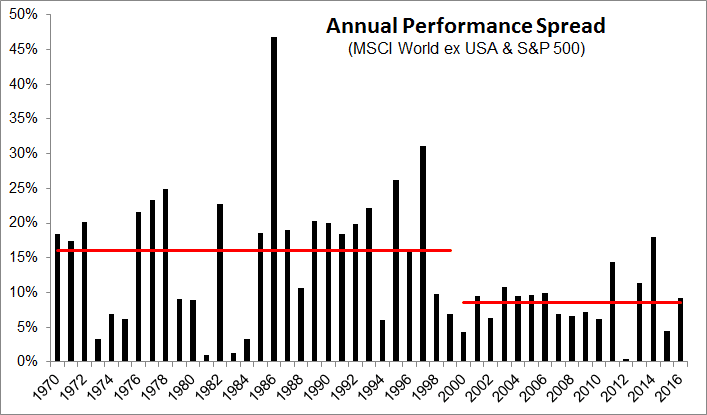

However, the margin of outperformance has been shrinking. Between 1970 and 1999, there was an average spread of 15.01% between the two asset classes. But from 2000 through 2016, that average spread had been cut almost in half to just 8.49%. This means that the benefits of diversification still show up, but they have not been as large as they once had been. This makes sense when you consider that international investing has steadily grown more efficient and easy to implement. Some element of execution risk has subsided, and, along with it, some of the risk premium.

You can see this average annual performance spread in the graphic below:

But the real upshot is that during the 22 years since 1970 in which foreign stocks won in the first quarter, they went on to beat the S&P 500 in 17 of them. In other words, 77% of the time. The average outperformance in those 22 years has been 650 basis points, or 6.5%.

Whether you choose to accept my behavioral explanation – that managers will spend the rest of the year chasing whatever outperformed at the start – or Michael’s mathematical explanation, it’s still a significant finding.

And now, the caveat…

It’s never that simple. Two of the five outliers have occurred recently. In the post-crisis period, foreign stocks have only outperformed US stocks through the first quarter twice, which should tell you how relentlessly out of favor this asset class has been. The last time it happened, 2015, the S&P 500 went on to take charge and finish the year up 1.38% vs a 5.6% drop for the rest of the world. Prior to that, in 2008, the S&P 500 ended the year negative 37% and the MSCI ACWI ex-USA did worse: negative 44%

Looking at these two examples from 2008 and 2015 is a good reminder about how much randomness there is in any given year.

Finally, I want to remind you that 77% is not 100%. Just because foreign stocks have gone on to outperform US stocks most of the time after a winning first quarter, there are five years since 1970 where they did not.

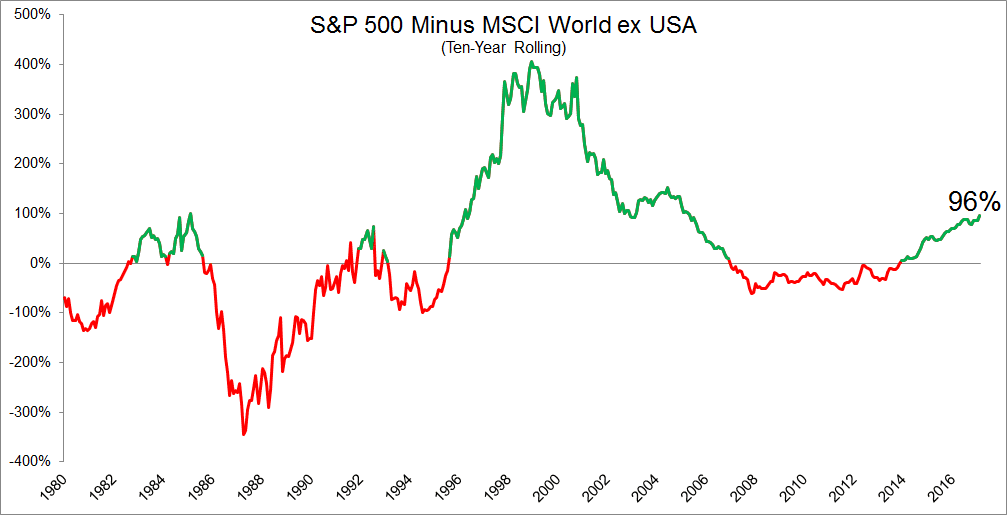

Additionally, we have found that these periods of under- or outperformance for foreign stocks tend to be streaky and are often related to currency trends, which do not obey the calendar. Below, you can see 10-year rolling returns for US vs Foreign.

Where the line is red, the S&P 500 is underperforming the world. Where the line is green, it is outperforming. US stocks have doubled the performance of foreign stocks in recent years, which sounds like a lot – until you realize that we’ve seen much bigger spreads in prior eras. Trends can persist for a much longer time than you may expect.

At our shop, we put a lot of thought toward what kind of international exposure we want for client portfolios, how we want to get it, and what we should be doing on an ongoing basis to optimize it. But one of our core beliefs is that risk is related to reward, and that the rewards of geographic diversification have a habit of showing up at precisely the time that we need them to over the long run.

[…] ‘Those Other Stocks’ – Josh Brown – The Reformed Broker […]

[…] Źródło: http://thereformedbroker.com […]

[…] Forrás […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2017/04/10/those-other-stocks/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2017/04/10/those-other-stocks/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2017/04/10/those-other-stocks/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2017/04/10/those-other-stocks/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2017/04/10/those-other-stocks/ […]

… [Trackback]

[…] Here you will find 94942 more Information to that Topic: thereformedbroker.com/2017/04/10/those-other-stocks/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2017/04/10/those-other-stocks/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2017/04/10/those-other-stocks/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2017/04/10/those-other-stocks/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2017/04/10/those-other-stocks/ […]