Investing is hard. This is partly because there is no bedrock to stand upon. Historical relationships between valuation and prices are not firm. Nor are the correlations between Thing A and Thing B.

The ground below our feet is constantly shifting and only the open-minded can make the mental leaps from one regime to the next. Those who choose their one or two Most Important Things to follow religiously and base their views upon (CAPE Ratio, Fed Model, Seasonality, Economic Outlook) are going to find themselves consistently run over in The Street.

One of the worst things you can do in this business is take a given correlation and then extrapolate it out to infinity. Correlations – especially between markets and asset classes – are ephemeral. Sometimes they exist and sometimes they don’t. Sometimes perfectly correlated markets become perfectly inversely correlated.

Think about the stocks / crude oil relationship from earlier this year. Now you see it (and it dominates every day’s discussions), now you don’t (…..and it’s gone).

And no one waves a flag when these relationships are about to shift.

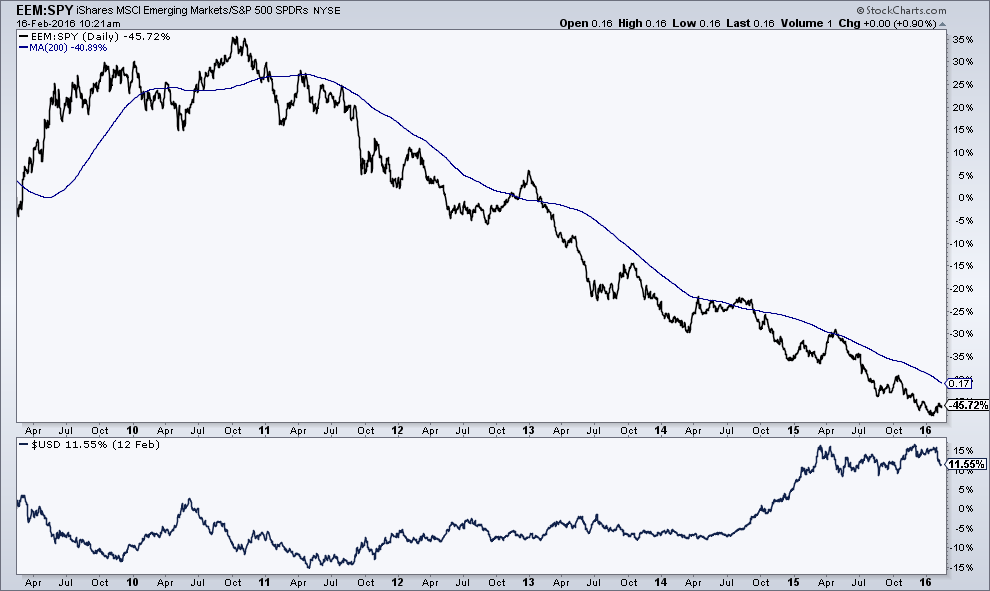

This spring, I posted the below chart – a ratio between emerging market stocks and the S&P 500 vs the US dollar index. You can see how powerful the inverse relationship had been – strong dollar meant weak EM relative to US large caps:

Right after I wrote that, as if on cue, the dollar peaked and then sold off, and EM stocks went crazy to the upside. The relationship held and traders were rewarded for recognizing its power.

Now that’s a trend that seems pretty indefatigable, right?

Except here’s the problem – as too many people become aware of it or start to place their bets on it, the relationship between one thing and the other begins to price all of this “certainty” in. This “common knowledge” then serves to change the relationship or even completely invert it until the prior correlations become unrecognizable.

My friend Jon Krinsky at MKM Partners takes a look at the emerging markets rally – now up almost 20% from the May lows – and says that it could have legs regardless of what happens with the US dollar. In other words, the inverse relationship may not necessarily hold as steadily as it has all these years.

Here’s Jon:

The MSCI Emerging Market Index (MXEF) is still working through an inverse head and shoulders pattern, which carries a measured move toward 1050 (~15% upside).

What If the Fed Hikes Rates and the Dollar Rallies? While Emerging Markets have a higher inverse correlation than U.S. equities to the Dollar, we think E.M. can still rally for three reasons.

1. DXY rally has priced in potential hikes, similar to the October-December period last year.

2. EM and DXY can be positively correlated, as they have both rallied since May.

3. Much of DXY strength has come from EUR and GBP weakness. The MSCI currency index is actually up 4.3% since May.

So that’s the technical take on why the EM / dollar thing may not matter as much any more. Here’s the fundamental take: Emerging market governments already know they have the risk of a dollar shortage. Surely you can’t think that traders are the only people who understand the nature of his relationship. Everyone is aware that Latin American economies, for example, are highly dependent on commodities, whose prices are hurt by a rising dollar. Everyone understands that Asian developing economies rely on access to dollar flows to manage their debt and fund their government programs.

To think that these realities are not already priced in, and then some, is to think that you are somehow in possession of knowledge that the $12 trillion currency reserve market has somehow glossed over. A correlation chart can tell us what has happened and what is happening now. All good information. Unfortunately, it does not (can not) tell us how market realities will change in the future, if at all.

The more interesting way of thinking about things is that the market already has one set of expectations built in for this relationship that may not hold forever, or may manifest itself in a different way.

Correlations don’t last forever, and there’s no one setting the timer. One of the biggest mistakes we can make as investors is to assume otherwise.

Sources:

Reiterating The Bull Case For Emerging Markets

MKM Partners – October 23rd 2016

EM vs US Dollar is the biggest story of the spring (TRB)

[…] ‘One of the Worst Things You Can Do in This Business’ – Josh Brown – The Ref… […]

[…] The trouble with obsessing over correlations is that they don’t stay (TRB) […]

[…] The monetary markets have gotten ever extra environment friendly at upending earlier market relationships. Today, analysts depend on charts indicating the correlation between two or extra monetary variables to make some kind of market pronouncement. Unfortunately, correlations change. Josh Brown writes: […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2016/10/24/one-of-the-worst-things-you-can-do-in-this-business/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2016/10/24/one-of-the-worst-things-you-can-do-in-this-business/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2016/10/24/one-of-the-worst-things-you-can-do-in-this-business/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2016/10/24/one-of-the-worst-things-you-can-do-in-this-business/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2016/10/24/one-of-the-worst-things-you-can-do-in-this-business/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2016/10/24/one-of-the-worst-things-you-can-do-in-this-business/ […]

… [Trackback]

[…] There you can find 35157 additional Info on that Topic: thereformedbroker.com/2016/10/24/one-of-the-worst-things-you-can-do-in-this-business/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2016/10/24/one-of-the-worst-things-you-can-do-in-this-business/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2016/10/24/one-of-the-worst-things-you-can-do-in-this-business/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2016/10/24/one-of-the-worst-things-you-can-do-in-this-business/ […]

… [Trackback]

[…] There you will find 19179 additional Info to that Topic: thereformedbroker.com/2016/10/24/one-of-the-worst-things-you-can-do-in-this-business/ […]

[…] The financial markets are becoming ever more efficient at upending previous market relationships. Today, analysts rely on charts indicating the correlation between two or more financial variables to make some sort of market pronouncement. Unfortunately, correlations change. Josh Brown writes: […]