Here’s a term we haven’t heard in awhile. It’s begun to resurface. Here’s HSBC’s global technical analysis note this morning:

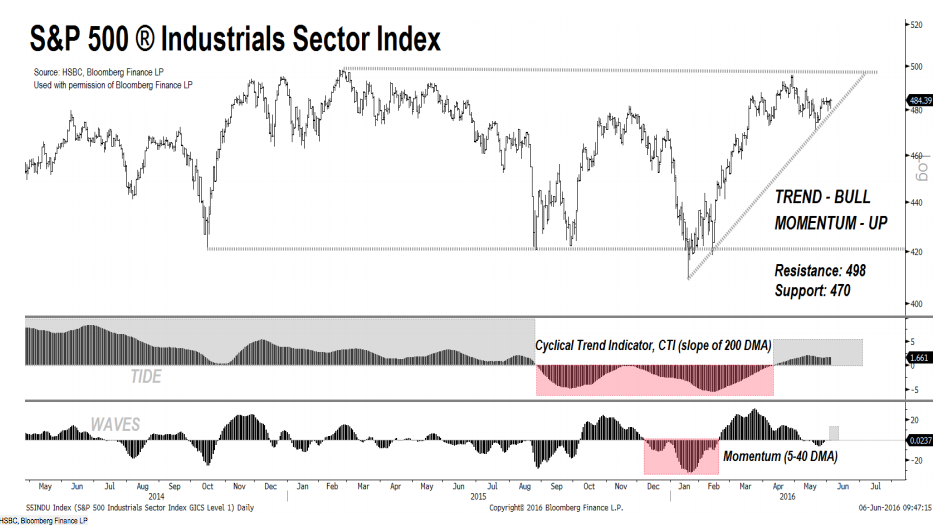

The S&P 500 ® Industrials sector has given a bull signal with momentum turning higher on the back of a positive Cyclical Trend Indicator. Added to the upside breakout in the FANGs highlighted in our publication of 2 June, this is further evidence that a melt up in US stocks is becoming an increasing probability.

Josh here – this is the set-up:

Last week’s BLS report puts the Fed back in its hole until later this summer lifetime.

The S&P 500 opened this morning less than 1.5% from the all-time highs.

The S&P 500 Total Return index, which reinvests dividends, has already made a new record this month.

The only major US equity index with a year-to-date loss is the QQQ’s, but with Apple off the mat and the FANGs breaking out, it may not be that way for long.

Both the small cap value and midcap value are approaching year-to-date gains of 10%.

The S&P 500 itself is now up almost 4% year-to-date. This is that moment where the underinvested professional begins to worry about career risk. Hedge funds are being closed down at a record pace and the flight of capital from actively managed stock mutual funds has reached breathtaking proportions.

Everyone is (or feels) underinvested if a melt-up begins to take hold, which fuels the fire. $67 billion has come out of stock mutual funds and ETFs, on a net basis, since January 1st. This is not a “cash on the sidelines” argument, it’s a “holy shit, we’re gonna get fired” argument. If you work on The Street (or in Boston), you know how palpable this anxiety is and what types of behavior it will drive people to rationalize.

In October of 2013, I did a post called “Rocket Fuel” outlining the reasons to expect a strong finish. It wasn’t an easy thought to keep in my head at the time, the market had already run up so far, so fast that year.

In the interest of full disclosure, you should not think that we are doing anything different with our strategic or tactical models as a result of the market’s approach to the old record highs. We manage rules-based strategies and none of the inputs incorporate my feelings or gut instincts (thank god).

Related:

The single biggest driver of asset prices is

— Downtown Josh Brown (@ReformedBroker) June 6, 2016

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2016/06/06/melt-up-2/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2016/06/06/melt-up-2/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2016/06/06/melt-up-2/ […]

… [Trackback]

[…] There you can find 98577 additional Info to that Topic: thereformedbroker.com/2016/06/06/melt-up-2/ […]

… [Trackback]

[…] Here you can find 67973 additional Information to that Topic: thereformedbroker.com/2016/06/06/melt-up-2/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2016/06/06/melt-up-2/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2016/06/06/melt-up-2/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2016/06/06/melt-up-2/ […]

… [Trackback]

[…] There you can find 32894 more Information on that Topic: thereformedbroker.com/2016/06/06/melt-up-2/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2016/06/06/melt-up-2/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2016/06/06/melt-up-2/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2016/06/06/melt-up-2/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2016/06/06/melt-up-2/ […]