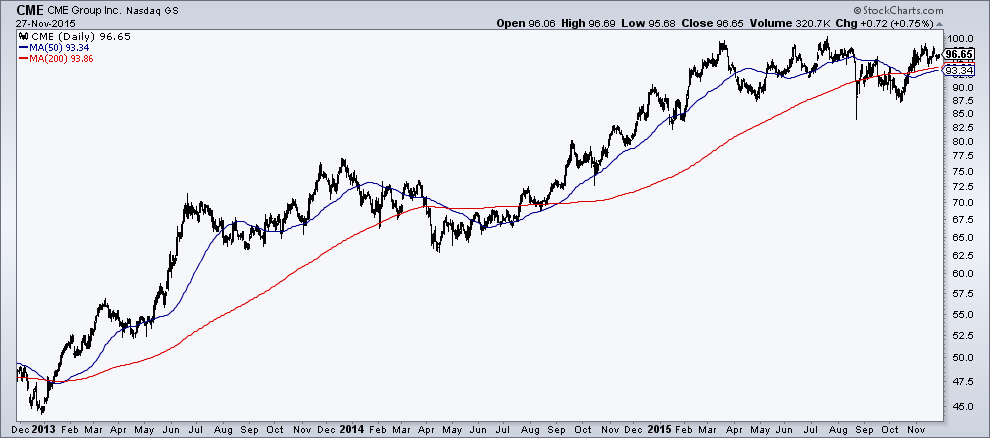

I think this CME chart I made speaks for itself, but I’ll have some comments to add on the fundamental drivers once you’ve digested the technicals.

I rarely write about individual stocks here because I don’t want there to be a misconception about my intent: I never give advice on specific investments on this site. And I am not doing so now. See my Terms and Conditions page for the full skull-n-bones disclaimer. If you cannot process the idea that I am writing an informational post and not individualized advice, this would be a good time to click away. Go ahead, we’ll wait…

Okay, now that it’s just adults, let’s continue.

CME Group, ticker CME, might be the perfect equity proxy for rising rates. Plotted below in black candlesticks, you can see that it trades almost completely in sync with both the 5-year (pink) and 10-year (red) treasury yield indexes.

Now look at the bottom pane. Since August, the rolling 30-day correlation between the 5-year yield index and CME stock has snapped into place and is hovering just below +1, or what you’d call a perfect correlation. There’s a very good reason for this – almost 50% of the volume traded on CME happens in interest rate-related products (futures, swaps, etc). Combine this with an exchange-wide price hike going into effect in January and you can see why CME is on the verge of breaking out:

After almost a year’s worth of consolidation between 90 and 100, the Fed’s first hike this December could be the rocket fuel it needs to finally take out the high end of the range. RSI is 55, so healthy but far from overbought.

For a bit of background, the Chicago Mercantile Exchange went for-profit 15 years ago with the rest of the exchanges and had its IPO in 2002. Five years later, they miraculously gained approval to buy the rival Chicago Board of Trade for $12 billion. Then they acquired the New York Merc and then they bought the Kansas City Board of Trade. If it’s not a monopoly, it’s as damn close to a monopoly as you’re going to find: According to one industry group, “CME has captured 99.97 per cent of US interest rate futures and options volumes.”

CME’s CEO Chairman Terry Duffy, is one of the most powerful, politically connected executives in the financial industry. A January 2008 anti-trust investigation by the Justice Department was successfully batted away. The company has also expanded its trading operations globally – roughly 30% of exchange volumes now come from overseas. And CME is expanding beyond clearing the trades of currencies, commodities and financial products – it’s launched a data and analytics service that is rapidly becoming a key piece of the business. According to Gregory Meyer at the FT, CME’s lockdown on the industry has led to some incredibly profitability:

As Wall Street banks scale back, the world’s biggest exchange group racks up operating margins of 60 per cent. This ranks CME among the three most profitable members of the S&P 500 index, alongside Visa, the card network, and Gilead Sciences with its $1,000-a-day hepatitis pill.

And as the company expands its global footprint and gets into new lines of business, it’s not afraid to shed dead weight. CME Group is in the process of shutting down its open-outcry pits and the physical trading floors that are so anachronistic these days.

The hedge fund Citadel, which is as well-versed in exchange industry dynamics as anyone, has been loading up on the stock. Last quarter, they nearly doubled their position to just over 2 million shares, according to Whale Wisdom’s database.

In an actual rising rate environment (as opposed to the imaginary one that supposedly began sometime in 2013), CME stands to clean up like few other public companies. Interest rate trading volumes were a drag for the company during an otherwise strong 3rd quarter (reported late October). But as we get closer to liftoff, it would be shocking not to see this situation reverse. My guess is that this is what the market is figuring out, hence the explosion in treasury yield correlations and CME shares since late summer.

My takeaways would be the following:

If you’re in the “no liftoff in 2015” camp, then you could surmise that the market is getting it wrong with CME and that, at 26 times trailing twelve-months earnings, The Street is overpaying.

If you’re in agreement with the bond market that liftoff is weeks away, you might consider the essentially exclusive leverage CME has to rising rates via increased hedging / trading activity in rate futures.

If you’re looking to play higher rates without owning a bank or an asset management stock, CME might do the trick. A $32 billion market cap, with 1.5 million shares changing hands per day on average, makes it liquid enough for just about any fund to be involved.

If you’re looking to play higher rates but shorting bonds isn’t your cup of tea (negative carry, ugh), consider that this trade has positive carry in the form of a 2% dividend yield.

If you’re concerned about regulatory or headline risk, CME might not be a great idea. Terry Duffy has often been linked with the Clintons and is frequently a target of anti-competitive complaints – so much so that the the chairman runs the company from a Washington office.

In any event, it’s probably a stock worth having on your screen. Especially if you’re not following the bond market very closely.

… [Trackback]

[…] Here you will find 42431 more Info to that Topic: thereformedbroker.com/2015/11/28/one-stock-thats-begging-for-higher-rates/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2015/11/28/one-stock-thats-begging-for-higher-rates/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2015/11/28/one-stock-thats-begging-for-higher-rates/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2015/11/28/one-stock-thats-begging-for-higher-rates/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2015/11/28/one-stock-thats-begging-for-higher-rates/ […]

… [Trackback]

[…] Here you can find 37714 more Info to that Topic: thereformedbroker.com/2015/11/28/one-stock-thats-begging-for-higher-rates/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2015/11/28/one-stock-thats-begging-for-higher-rates/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2015/11/28/one-stock-thats-begging-for-higher-rates/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2015/11/28/one-stock-thats-begging-for-higher-rates/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2015/11/28/one-stock-thats-begging-for-higher-rates/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2015/11/28/one-stock-thats-begging-for-higher-rates/ […]