If you’re a bear on the global growth story, it probably feels like all of your wishes are coming true this summer.

Except for one big problem – the US economy refuses to confirm your narrative, despite the precipitous drop in commodity prices and the capital flight from EM nations.

Domestically, employment is good and housing is great – neither of these things has a transmission mechanism directly from the far east. What happens in Shanghai, so far, is staying in Shanghai for most Americans. If you’ve got a tightening labor market, rising wages and increasing values for homes (the biggest asset for the middle class), you have a lot of what you need to keep the US economy in expansion mode. (Read more on this here: Are you capable of holding two opposing thoughts in your head? )

A glance at the last few weeks in the stock market, however, would make you think the story was very different. Volatility is making “1% days” on the S&P 500 the new normal and the benchmark index now sits below a downward-sloping 200-day moving average for the first time since 2011.

Bank of America’s global economics team makes the case that investors are being unduly influenced by headlines coming out of China.

The stock market and the economy

When the markets are as volatile as in recent weeks, they tend to “blot out the sun.” Perma-bears come out of hibernation and their stories sound a lot more plausible. Investors start doing reverse engineering—if the markets are this bad, there must be something fundamentally wrong with the economy? Investors also start worrying that the stock market drop will be self-fulfilling, undercutting confidence and growth.

Meanwhile the actual data looks weak in Asia, but healthy in the US. Unfortunately, the markets seem fixated on the Asia news. For example, the S&P 500 fell 3% on Tuesday when Korean exports tumbled, the Chinese PMI data were slightly weaker than expected and US data was strong. Ultimately the US macro data are much more important to the US stock market than data from Asia, but that is not how the market is trading.

Josh here – The good news, according to BAML, is that positive economic reports eventually restore sanity to the market, as they did in 1987 when the fundamental data continued to come in strong despite the huge drop in stock prices that was almost purely technical in nature. Further, the feedback loop from correcting stock markets to the real economy (the reverse wealth effect) acts on a long lag – meaning, it’s months before economic data begins to reflect stock market weakness, if it ever does at all.

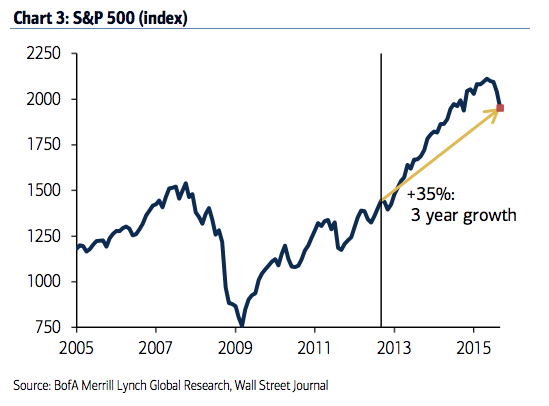

Besides, on a three-year basis, stock investors are still basking in the glow of a 35% return:

The bears are betting that China is contagious for more than just the emerging markets and that a currency crisis will hit right as US stock valuations are sliding down the other side of a historic peak. The counter from the bulls is that virtually no US households have exposure to China and the consumer, whose activity makes up 70% of GDP, is just now coming out of the doldrums. Lower energy prices, higher compensation / confidence and a boom in household formation among millennials would justify stock market PE multiples and be more than enough to offset the declining economies of the EM countries.

It’s hard to deny the fact that the sun is shining brightly in the US. Also hard to ignore how much gloom seems to hang over, oh I don’t know, everywhere else.

Source:

Global growth: Grinding its gears

Bank of America Merrill Lynch – September 4th 2015

RT @BrattleStCap: Good read from @ReformedBroker “China is blotting out the sun” http://t.co/NKtedlXcut http://t.co/bBpdiD8sUK

China is “blotting out the sun” by @ReformedBroker http://t.co/NobXpa77hv

RT @ReformedBroker: China is “blotting out the sun” http://t.co/FQ1AXFRz4E

RT @ReformedBroker: China is “blotting out the sun” http://t.co/92yp4Sj1kc

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2015/09/06/china-is-blotting-out-the-sun/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2015/09/06/china-is-blotting-out-the-sun/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2015/09/06/china-is-blotting-out-the-sun/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2015/09/06/china-is-blotting-out-the-sun/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2015/09/06/china-is-blotting-out-the-sun/ […]

… [Trackback]

[…] There you will find 45658 additional Information to that Topic: thereformedbroker.com/2015/09/06/china-is-blotting-out-the-sun/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2015/09/06/china-is-blotting-out-the-sun/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2015/09/06/china-is-blotting-out-the-sun/ […]

… [Trackback]

[…] There you can find 14460 additional Info on that Topic: thereformedbroker.com/2015/09/06/china-is-blotting-out-the-sun/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2015/09/06/china-is-blotting-out-the-sun/ […]