An interesting speculation on the part of UBS’s economists about oil this morning. The firm asks which areas of investment will be winners and losers should the price of oil rebound to $80 by the end of this year. They guess that there’s a 25% chance of this occurring based on past price swings…

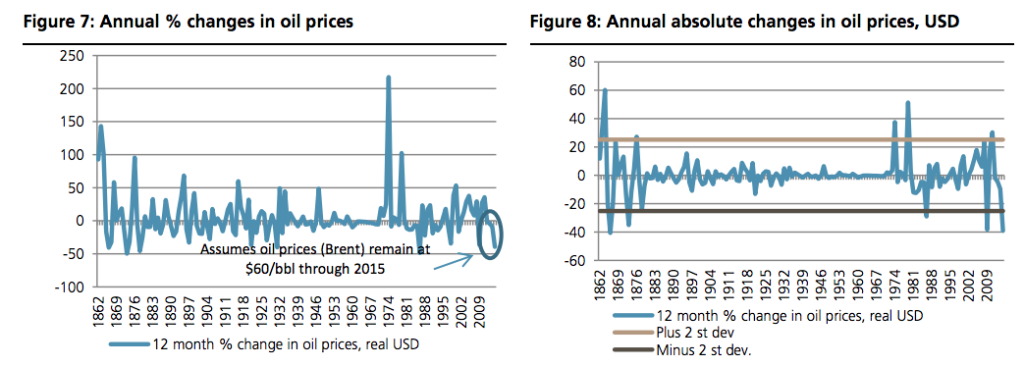

The chart below reinforces that message showing 12-month percentage point changes in oil prices. If oil prices were to remain close to current levels over the remainder of 2015, it would be unusual. There have only been 8 occasions in the last 150 years, for example, when the cumulative 2-year change in oil prices has been more than 50%, which is what it would be if oil prices remained close to $60/bbl from here. Putting that another way, there is at present a 25% chance that oil prices climb to $80 or higher by the end of 2015 based on the pure statistical properties of oil price swings in the past as well as relative to what is discounted in the forward curve.

The firm posits that should this kind of mean reversion occur for oil prices, the net effect on US equities would actually be a positive, as earnings estimates would immediately rebound and fears about high yield bond contagion would go away. Consumers would see a halving of the savings they’ve gotten from falling gasoline prices, but this would not be enough to dampen the benefits to the stock market.

The firm posits that should this kind of mean reversion occur for oil prices, the net effect on US equities would actually be a positive, as earnings estimates would immediately rebound and fears about high yield bond contagion would go away. Consumers would see a halving of the savings they’ve gotten from falling gasoline prices, but this would not be enough to dampen the benefits to the stock market.

Source:

What if oil price now climbs to $80/bbl?

UBS Macro Strategy Key Issue – March 12th 2015

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2015/03/12/what-if-oil-runs-back-to-80-this-year/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2015/03/12/what-if-oil-runs-back-to-80-this-year/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2015/03/12/what-if-oil-runs-back-to-80-this-year/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2015/03/12/what-if-oil-runs-back-to-80-this-year/ […]

where can i buy cialis without a prescription

USA delivery