Oil price declines are now wending their way through the real economy, for better and for worse. In Texas, a capital of the shale boom, the effects are decidedly negative.

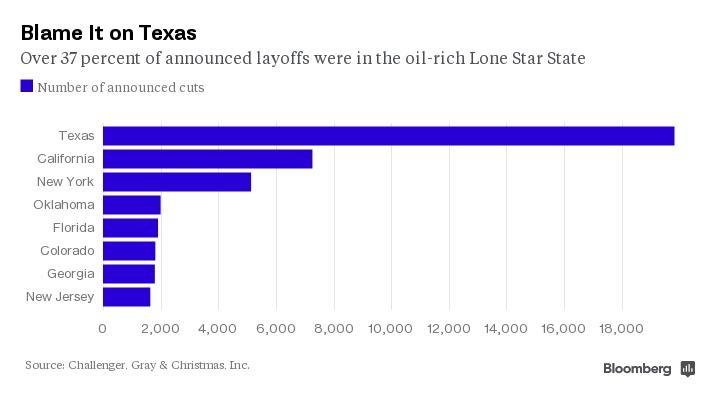

Bloomberg News is reporting that “20,193, or 38 percent, of the 53,041 announced job cuts in January were in the energy industry,” according to data from Challenger, Gray, Christmas.

Additionally…

More than 37 percent of the announcements in January originated from the nation’s No. 1 oil-producing state — Texas. Mine Yucel, head of research at the Federal Reserve Bank of Dallas, said last month that 140,000 Texas jobs directly and indirectly tied to energy will be lost this year if oil stays near $50 a barrel.

The Labor Department says that there are 523,000 Americans working in the oil and gas business, with 198,000 of those directly involved in extraction and the rest in supporting jobs. Obviously, Texas residents make up a large portion of this total, with both white collar and blue collar workers directly or indirectly involved. I would argue that the impact of energy profits and losses is felt by workers and businesses far beyond this circle of half a million.

A very smart reader of mine pointed out the following about Texas banks to illustrate the far-reaching consequences of an oil bust on the state’s overall economy (emphasis mine):

What seems to me to be of importance is the exposure that our regional banks have to oil overall. The bulk of a standard portfolio of a regional bank here is petrochemical, manufacturing, transportation,and real estate. But the rub is this: the manufacturing is pipe-threading, frac tank construction, or various oil patch related business. The transportation component is trucking – trucks that haul pipe, yellow iron, or various path related components- or companies that move oil and gas product from the port of Houston. The real estate component is largely commercial, whose tenants are petrochemical companies of varying sizes.

And worst of all are the oilfield services part of the portfolio, which are largely what credit analysts from my time in finance would refer to as “financing air”; a personal guaranty on a loan or lease is only worth so much when the collateral is worth ten cents on the dollar. And even though some of the smaller borrowers are strong credits – 1mm to 5mm per loan – that did not prevent similar borrowers from defaulting in 2009. Borrowers who had never missed or been late on a payment simply dropped their equipment off at Ritchie Brothers auction lot and told banks where to find it. In spite of all the sanguine claims to the contrary, when oil goes bad, companies blow up in a hurry.

The weak hands are going first, like always, but if the truth were known outside of TX, a lot of these start-ups are weak hands. It has been a boom down here, the #1 economy in the US for several years, while the rest of the country struggled along through the QE-induced recovery. We have been chopping tall cotton down here, my friend.

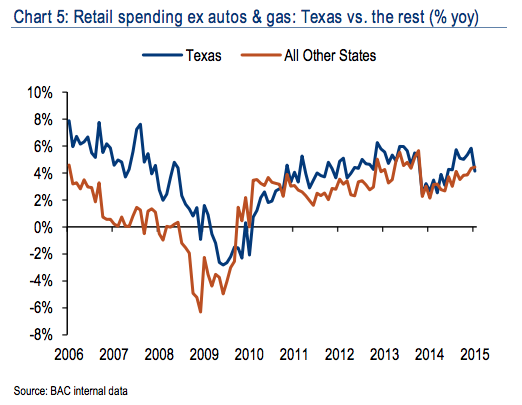

What my reader is getting at, with the “chopping tall cotton part”, is that the economy in Texas has far outperformed most of the country thanks to strong energy prices and the fracking revolution. But according to a new note from the economists at Bank of America Merrill Lynch, this has abruptly changed and now Texas retail sales could be about to nosedive.

BofA tracks consumer spending trends looking at the aggregate activity on their own banking clients’ credit and debit cards each month:

In an attempt to capture the potential stress on the regional economy in Texas from a drop in oil and gas production, we are isolating consumer spending trends in Texas.

In recent years, spending in Texas has outpaced the rest of the country, reflecting the relatively healthier economy. However, sales weakened notably in January, slowing the yoy growth rate.

Michelle Meyer & co believe that this trend bears watching. I would agree. While the total number of oil workers and related support workers is not huge, the impact will most assuredly be felt beyond just that immediate circle. The longer the slump goes on the more of a negative effect it could have, erasing some of the benefit that should be showing up elsewhere.

Source:

The consumer conundrum

Bank of America Merrill Lynch – February 10th 2015

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2015/02/10/mess-with-texas/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2015/02/10/mess-with-texas/ […]

… [Trackback]

[…] Here you will find 62164 additional Info on that Topic: thereformedbroker.com/2015/02/10/mess-with-texas/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2015/02/10/mess-with-texas/ […]

… [Trackback]

[…] Here you will find 69437 more Info on that Topic: thereformedbroker.com/2015/02/10/mess-with-texas/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2015/02/10/mess-with-texas/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2015/02/10/mess-with-texas/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2015/02/10/mess-with-texas/ […]