Where did this sudden spate of volatility come from? Journalists are pointing to Argentina and traders are citing various negative divergences, but I don’t believe that either of those explanations are legitimate, at least not in terms of the origin.

Today I’ll explain the machinations of how the markets are moving now in terms of asset allocation, which quite frankly, is this era’s definitive driving force (as explained by the Relentless Bid Theory).

US investors currently hold $70 trillion in financial assets, most of it in portfolios held at brokerage firms, directly with mutual fund families or in 401(k) accounts. A great deal of this money is overseen by intermediaries who have arranged their customers’ asset allocation based on what has been working – high dividend-paying stocks in the defensive areas of the market (consumer staples, utilities, integrated oils, large pharma) along with corporate bonds, investment grade or junk. Many portfolios look similar, tilted toward a slow-growth economy with low volatility and low interest rates.

The trouble is, just as everyone has gotten comfortable traveling in the same lane on the same highway, giant billboards have begun to appear along the road that advertise a coming change in conditions. The last few jobs reports along with a higher employment cost index are a few examples of these billboards. Last week’s 4 percent GDP print for the second quarter was an enormous one – the equivalent of the Cabazon, California T-Rex that towers over the I-10.

Investors are noticing these signs and beginning to think about the environment to come.

Plain and simple, they are shifting their allocations toward a world of faster economic growth and higher volatility. Not all at once, and not severely, but definitely. It’s happening.

This explains the bludgeoning of the consumer staples sector last week – its worst sell-off since the late-May Taper Tantrum of 2013. Consumer staples are the perfect stocks for slow growth and low yields – as they offer consistency of earnings regardless of cyclicality and higher than average dividends. In a higher-rate, more pro-cyclical environment, they are not so perfect – especially given their current high valuation. And so they are under distribution so long as economic news – like last week’s record post-crisis ISM report – continue to roll out.

Which brings me to the junk bond sell-off, another symptom of our awaking to the possibility of faster growth. It’s been a pretty orderly sell-off for the $1.6 trillion high yield market, but quite steady and relentless all the same. Why? In a higher rates environment – if ever such a thing should come about – investors are going to demand more return for the risks they’re taking in the asset class. Defaults have been almost non-existent, so the popularity of high yield bonds in investor asset allocations is perfectly understandable. But higher rates have a tendency of disturbing this placidity like a skipped stone across the surface of a pond. And so $5 billion has come out of high yield funds in July, including the highest one-week redemptions in more than a year. Once again, this is the Big Money preparing for something new.

Now, you may be asking, why, if large groups of investors are preparing for higher rates, are rates actually declining – as evidenced by the near record-low yields we saw in the 10-year Treasury last week?

This is a great question, I’m glad you asked.

My theory is that the activity and jostling for position inherent in a market regime shift like the one we’re now seeing is guaranteed to cause volatility. Elephants cannot play musical chairs, even slowly, without some degree of breakage and collateral damage. Nor can large pools of invested capital switch themselves around in complete silence.

And it is the volatility caused by this higher rate expectation that, ironically, creates the conditions whereby rates temporarily drop. As investors scramble for protection – they are pushed toward Treasury bonds, which in turn pushes yields lower.

For a time, anyway.

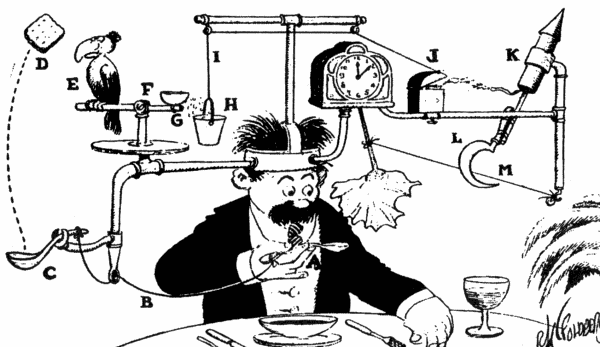

The market is a gigantic Rube Goldberg machine, where Thing 1 impacts Thing 2, which in turn activates Thing 3. Some use the bowling-related term “pin action” to describe these kinetic underpinnings while others use the even more ambiguous “crosscurrents.” regardless of how you describe it, what is clear to me is that, for the first time in awhile, the economic data is forcing people to rethink their allocations and driving them towards an adjustment. Risks are being rethought while tilts and leans are being reconfigured.

No one should be surprised, then, that the benevolence of yesterday’s tranquil tape has been interrupted by a change in attitudes about the near future.

.

tnx for info!

.

ñýíêñ çà èíôó!!

.

tnx!

The Ships’s Voyages

I feel know-how just can make it worse. Now there’s a channel to hardly ever treatment, now there wouldn’t be considered a probability for them to discover.

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2014/08/04/the-rube-goldberg-machine/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/08/04/the-rube-goldberg-machine/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/08/04/the-rube-goldberg-machine/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/08/04/the-rube-goldberg-machine/ […]

… [Trackback]

[…] There you can find 7966 additional Information to that Topic: thereformedbroker.com/2014/08/04/the-rube-goldberg-machine/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/08/04/the-rube-goldberg-machine/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2014/08/04/the-rube-goldberg-machine/ […]

… [Trackback]

[…] There you can find 45915 more Info on that Topic: thereformedbroker.com/2014/08/04/the-rube-goldberg-machine/ […]

… [Trackback]

[…] Here you will find 58177 more Info on that Topic: thereformedbroker.com/2014/08/04/the-rube-goldberg-machine/ […]