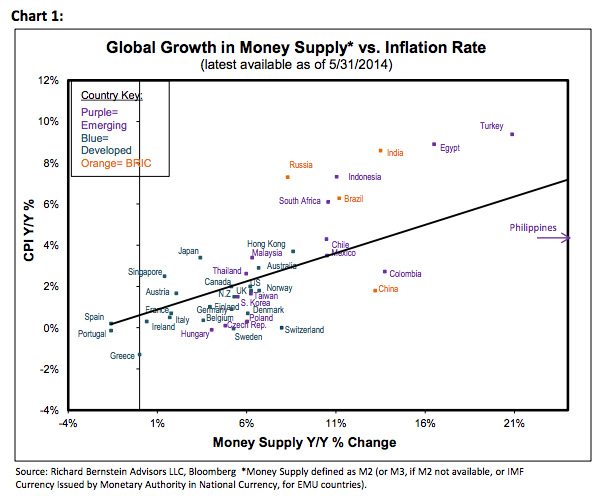

Killer chart from strategist Richard Bernstein of Richard Bernstein Advisors this week.

Bernstein has been bullish on US equities for the last few years both in absolute terms and, especially, versus the emerging markets. He sees the US small and midcap sector, which are heavily focused on the US economy, as being a better bet than the emerging markets, which are struggling with inflation and deteriorating fundamentals in many cases.

EM Inflation and money growth quite high.

The emerging markets have had for the last several years the highest rates of

money growth and the highest rates of inflation in the world. Chart 1 shows the

latest money supply growth rates and inflation rates for forty-one countries,

and emerging markets comprise all the countries with substantial money

growth and inflation. In fact, many of the major emerging markets now have

inflation rates between 5% and 10%.

Josh here – You can see the extreme growth in both prices and money supply in the upper right-hand quadrant of the chart – it’s almost all BRICs and EM nations up there.

Source:

EM Debt Seems Risky – June 2014

Richard Bernstein Advisors

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2014/06/15/rich-bernstein-heres-where-the-inflation-is/ […]

… [Trackback]

[…] Here you will find 52633 more Information to that Topic: thereformedbroker.com/2014/06/15/rich-bernstein-heres-where-the-inflation-is/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2014/06/15/rich-bernstein-heres-where-the-inflation-is/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2014/06/15/rich-bernstein-heres-where-the-inflation-is/ […]