The more you study history, the more you realize that we are endlessly repeating the same cycle dynamics again and again – with only the characters and scenery changing.

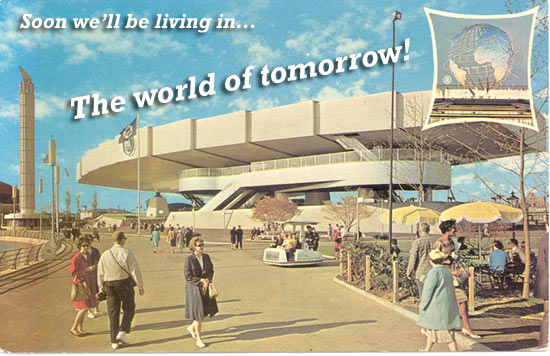

Since the end of World War II, America has been obsessed with the future – look no further than Disney’s Tomorrowland theme park or the explosion in sci-fi literature and film from that era. In the investment markets we are similarly obsessed now, our affinity for all things venture capital, cloud computing and social media-related being just the latest examples.

Dr. Jeremy Siegel’s 2005 book The Future for Investors contains a chapter explaining this obsession as “The Growth Trap.” He makes the case that investors routinely pay up for the companies that are delivering these innovations to the market, despite the fact that over time, it is never the high-growth companies that reward their shareholders the most.

Here’s Siegel describing the year 1950, a year in which the populace was similarly enamored of the future-is-now zeitgeist:

Not unlike today, the world in 1950 stood at the edge of tremendous change. U.S. manufacturers had shifted from munitions to consumer products, with technology leading the way,. In 1948 there were 148,000 television sets in american homes. By 1950 that number had risen to 4.4 million; two years later, the figure was 50 million. The speed of penetration of this new medium was phenomenal and far exceeded that of the personal computer in the 1980’s or the Internet in the 1990’s.

Innovation waas transforming our society, and 1950 was a hallmark year of invention. Papermate developed the first mass-produced, leak-proof ballpoint pen, and Haloid (later named Xerox) developed the first copy machine. The financial industry, already a heavy user of technology, was about to take a great leap forward as Diner’s Club introduced the first credit card in 1950. And Bell Telephone Laboratories a branch of the largest corporation on earth, American Telephone & Telegraph, had just perfected the transistor, a critical milestone that led to the computer revolution.

The future looked so bright that the term “new economy,” so often bandied about during the 1990’s technology boom, was also used to describe then economy fifty years earlier. Fortune magazine celebrated its twenty-fifth anniversary in 1955 with a special series devoted to “The New Economy” and the remarkable growth of productivity and income that America had achieved since the Great Depression.

Siegel’s point is well-taken – there are periods of time in which we are remarkably impressed with our own abilities to innovate and create – and the resultant investor stampede that accompanies these periods begins as a boon and ends up as a parade of wannabes paying valuations so high that future returns are almost impossible to come by.

When clients have asked me in recent years about “hot” IPOs like Facebook, Zynga, ServiceNow, Workday, Groupon, Tableau Software, Palo Alto Networks, LinkedIn, Fusion IO, Marketo, Splunk, etc, this is a point I try to get across. Yes, we can “play” them, but they are mostly already priced as though their future success is assured due to the investor obsession with growth and tech. I could give you scores of examples in which breakthrough technologies have done more to benefit society and the rest of the economy than they have for the shareholders of the tech company itself.

Samsung is a perfect example – for all the talk about how they’re out-innovating Apple and kicking ass in smartphones, you wouldn’t know it from their share price, which is down 12% year-to-date. Or how about Tesla – there is a serious chance that the Model S changes the entire infrastructure and automobile industry in America as other players enter the electric car and infrastructure game – but does that assure gains from here for investors in TSLA? Not necessarily. It is entirely possible that Tesla shareholders watch as the company they love creates a bigger opportunity for everyone else now that the floodgates are open.

Investors paying up in valuation to be a part of “the future” need to consider that innovative products do not ensure higher stock prices.

Source:

… [Trackback]

[…] Here you will find 52156 additional Information to that Topic: thereformedbroker.com/2013/07/01/jeremy-siegel-on-the-new-economy-of-1950/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/07/01/jeremy-siegel-on-the-new-economy-of-1950/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2013/07/01/jeremy-siegel-on-the-new-economy-of-1950/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/07/01/jeremy-siegel-on-the-new-economy-of-1950/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2013/07/01/jeremy-siegel-on-the-new-economy-of-1950/ […]

… [Trackback]

[…] Here you can find 6896 more Info to that Topic: thereformedbroker.com/2013/07/01/jeremy-siegel-on-the-new-economy-of-1950/ […]