Merrill Lynch Wealth Management is out with their new monthly CIO Report in which they make a some recommendations on how we should be thinking about the bond market.

The bottom line seems to be that Merrill analysts think there will be plenty of time to pick up on a rise in rates given the Fed’s extraordinary new precedent of explicit targeting guidance. There are no signs in any near-term maturities that anyone believes this is about to happen out of the blue.

In addition, the strategists note that the Fed’s exit will not be a singular event – rather, it will actually occur in four steps:

We think the broad outline of the Fed’s plan to reduce its influence in the capital markets has the following elements, in order:

1. Slow down of asset purchases

2. Slow down and then stop reinvestments

3. Raise short-term rates

4. Begin sell down of asset portfolios

Merrill doesn’t see this process even beginning for at least the next 12-18 months, let alone cycling through all four steps.

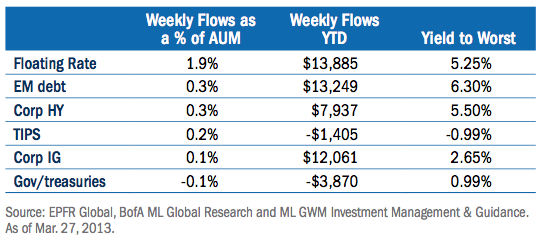

They caution that some of the more speculative areas within fixed income (EM, HY) are now showing signs of apparent froth (see chart below) – but given the “anchoring” taking place, this need not lead to calamity.

Lastly, some advice about where and how to be taking risk in the bond market given these realities:

Where are the opportunities in the fourth quarter of this great Fed policy game? In our view, it is still worth taking some bond market risk in U.S. high yield, including senior (unrated) floating rate bonds, Emerging markets local debt, and recently added to our list, convertible bonds. The combination of negative real yields in high quality bonds, yet on average reasonably healthy corporate fundamentals, support taking credit risk over interest rate risk. We do not see credit metrics flashing red yet and as long as corporations are maximizing their profit margins, we are comfortable that the extra risk in higher yielding bonds has the potential to be rewarded. We remain on the lookout for any signs of weakness in corporate balance sheets and while the rate of improvements has slowed, overall non- financial balance sheets remain healthy.

With defaults low, balance sheets healthy and rates going nowhere anytime soon, this playbook grows ever more popular.

Source:

Merrill Lynch Wealth Management

[…] Merrill Wealth Management: Here’s what to do with your bond portfolio. (The Reformed Broker) […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/04/08/merrill-how-to-play-the-bond-market/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/04/08/merrill-how-to-play-the-bond-market/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/04/08/merrill-how-to-play-the-bond-market/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/04/08/merrill-how-to-play-the-bond-market/ […]

… [Trackback]

[…] Here you will find 47887 additional Info to that Topic: thereformedbroker.com/2013/04/08/merrill-how-to-play-the-bond-market/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2013/04/08/merrill-how-to-play-the-bond-market/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/04/08/merrill-how-to-play-the-bond-market/ […]