Are the birds chirping? Is tranquility close at hand?

There are many who believe so or at least admit that they can see it in sight.

The world is awash in liquidity and opportunity abounds in every region around the world:

Distressed investors in Europe are now reaping the benefits of their midnight maneuvers where no one else dared to tread. Dan Loeb (Third Point) made a half a billion dollars buying Greek bonds before Labor Day and selling them before Christmas. Marc Lasry (Avenue Capital) is taking whole portfolios of performing loans off the hands of Belgian and French banks at steep discounts, bringing liquidity to one of the last deserts without it.

Animal Spirits are returning to the equity markets as five-year highs are penetrated with a persistent and lusty thrusting from below. The same is true in the corporate bond market as investors line up for the latest offering like sneaker aficionados on Air Jordan launch day. Not every waking second is being spent on avoiding loss – people are once again looking to win, a psychological seachange as important as any quantitative market indicator you want to present to me, I promise you that.

Housing, formerly the Achilles Heel of the US economy, is now the engine driving us out of the negative feedback loop.

Goldman Sachs is back to being Goldman Sachs again, smashing estimates from trading to I-banking to M&A to underwriting.

Bank of America is putting the sins of its acquired mortgage business behind it with every settlement and charge-off.

Even Citi has a request in front of the regulators to up their share buyback.

Morgan Stanley’s just traded through a new 52-week high with very little other than green field ahead of it now that it’s no longer the poster child for hidden Euro exposure.

You may look at the return to prominence of the big banks and say “How unfair!” You will be right, but please compartmentalize that notion. Because it has nothing to do with your duties as an investor.

The deficit hawks have read the polls, they now understand how unpopular their debt ceiling stance is with the people. They are unwilling to allow the “Republican Recession of 2013” to become the rallying cry of the Democrats during the next elections. And so they cave and grant an extension so that negotiations may continue.

The US stock market is trading at a 13 multiple on the $108 in earnings analysts are expecting for this calendar year’s S&P 500. The Schiller PE (a 10-year average to smooth out cyclicality) stands at 22.8, a higher-than-mean reading (the mean being 16) to be sure – but not obnoxiously so and given the massive earnings nosedive in 2008-2009, some generosity is required here.

Headline-wise there are just a few more hurdles, we are told, and then the Era of Crisis 2007-2012 will be germaine only to the historians and the professors.

And with our passage into the new era, we will leave behind the baggage of the old one.

There will be bloggers and journalists and newsletter writers who continue to fight the old battles that no longer matter. They will spend countless hours on “Who really caused the Crisis” and lament the favoritism shown by Geithner and Paulson. They will continue to chase mortgage fraud headlines down the rabbit hole of who-gives-a-shit and expend a great deal of time and energy on fearing high frequency trading and loathing the banks.

To which the productive and creative and ambitious among us will say “Whatever.”

We will stop reading these diatribes, they will no longer enter into our decision-making process. Like the screams of the Wicked Witch of the East as she melts into the ground, their yowls and yelps will grow even more shrill and abrasive as our collective attention continues to fade. This will be embarrassing – like an older family member who seeks to bait you into a heated discussion about Vietnam at Thanksgiving dinner. We will not read or watch or click this stuff anymore.

Phasers set on ignore.

Our escape from the Fear Factory will not be an easy one. There will be surprise spikes in the Vix and drops in the market during which all the old alarmist assholes are trotted back out into the spotlight – however briefly – to sow the seeds of uncertainty and discord. They will return with their old catchphrases – “The Fed is shooting blanks, kicking the can, Bernanke is facing a liquidity trap, etc.” For an amazing, museum-quality look at everything the permabears got wrong these last few years, please visit this page of newsletter archives – it’s like a compendium of every single horrible call you could have made all in one place. When you run a bear fund, this is your job I suppose – to make hay while the sun is not shining.

Hope they made the most of their moment, nobody will care going forward.

To say that “risks remain” and that “headwinds persist” would be an understatement. Many things must go perfectly right this year so as to ensure a continued expansion and the possibility of derailment is significant. Much of what needs to be fixed remains broken, even if less visibly so thanks to the healing power of time. The bandaids will not remain affixed to the wounds forever, at a certain point an actual treatment will be necessary – possibly a painful one. The market understands this, has processed this and has decided that the issues we face are manageable.

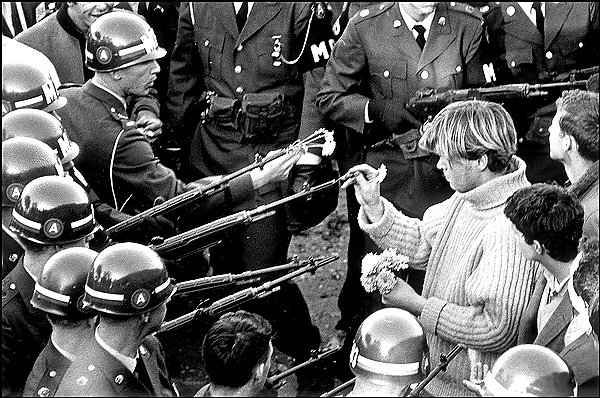

We are coming off of our wartime footing. In the streets, shopkeepers are sweeping up the broken glass and putting their establishments back in order. Banks are lending again and filling the air are the sounds of hammers and drills and felled trees and the rumbling of machinery. We are borrowing and building and planning and hiring again. Only a lonely, bitter old man would fail to see this – his mind poisoned by his growing irrelevance in a world that’s rapidly passing him by. How else to explain something like this bit of June 2010 commentary from the Dow Theory Letter’s Richard Russell:

“Do your friends a favor. Tell them to “batten down the hatches” because there’s a HARD RAIN coming. Tell them to get out of debt and sell anything they can sell (and don’t need) in order to get liquid. Tell them that Richard Russell says that by the end of this year they won’t recognize the country. They’ll retort, “How the dickens does Russell know — who told him?” Tell them the stock market told him.”

If you’ve been overdosing on shit like that since 2008, you can stop now. Richard Russell cannot hurt you anymore. His time has passed and his furtive scratching and clawing at our time can be safely ignored.

The next drop in the stock market is around the corner – perhaps it will be a garden variety 5% correction and perhaps something more in response to politics or last quarter’s earnings. This is what you should expect. In fact, if your time horizon as an investor and an accumulator of financial assets is longer than ten years, it would be irrational for you to be rooting against that! Pray for it, you will need it. And what you will see on this next dip is a change in behavior, in investor mentality. These sell-offs will be bought up gleefully and rapidly by those who’ve remained in the Fear Factory for too long. This can go on for quite awhile, especially should interest rates remain low. The investor class has favored bonds to stocks at a rate of 33 times these past five years – an imbalance like that takes a long time to correct.

The next crisis is already in the works – this is how things will always be but remember that their risks are our opportunities. And smile. Think of what you’ve been through thus far!

Welcome the new era – whatever it brings – as a former prisoner of the Fear Factory welcomes the first rays of sun on the outside of the wall.

Read Also:

The Futures So Bright (Calculated Risk)

We Are Now So Close To The End Of The Crisis Era… (Business Insider)

33 Times, You Poor Dumb Bastards (TRB)

Their Risks are Our Opportunities (TRB)

[…] function setIframeHeight(iframeName) { var iframeEl = document.getElementById? document.getElementById(iframeName): document.all? document.all[iframeName]: null; if (iframeEl) { iframeEl.style.height = "auto"; // need to add to height to be sure it will all show var h = alertSize(iframeName); iframeEl.style.height =h + "px"; } } function alertSize(frameId) { var myHeight = 0; frame = document.getElementById(frameId); if( typeof( window.innerWidth ) == 'number' ) { //Non-IE var getFFVersion=navigator.userAgent.substring(navigator.userAgent.indexOf("Firefox")).split("/")[1]; var FFextraHeight=parseFloat(getFFVersion)>=0.1? 16 : 0; myHeight=frame.contentDocument.body.offsetHeight+FFextraHeight; } else if( document.documentElement && ( document.documentElement.clientWidth || document.documentElement.clientHeight ) ) { //IE 6+ in 'standards compliant mode' innerDoc = (frame.contentDocument) ? frame.contentDocument : frame.contentWindow.document; myHeight= innerDoc.body.scrollHeight + 10; //myHeight = document.documentElement.clientHeight; } else if( document.body && ( document.body.clientWidth || document.body.clientHeight ) ) { //IE 4 compatible myHeight = document.body.clientHeight; } return myHeight; } #split {}#single {}#splitalign {margin-left: auto; margin-right: auto;}#singlealign {margin-left: auto; margin-right: auto;}#splittitlebox {text-align: center;}#singletitlebox {text-align: center;}.linkboxtext {line-height: 1.4em;}.linkboxcontainer {padding: 7px 7px 7px 7px;background-color:#eeeeee;border-color:#000000;border-width:0px; border-style:solid;}.linkboxdisplay {padding: 7px 7px 7px 7px;}.linkboxdisplay td {text-align: center;}.linkboxdisplay a:link {text-decoration: none;}.linkboxdisplay a:hover {text-decoration: underline;} function opensplitdropdown() { document.getElementById('splittablelinks').style.display = ''; document.getElementById('splitmouse').style.display = 'none'; var titleincell = document.getElementById('titleincell').value; if (titleincell == 'yes') {document.getElementById('splittitletext').style.display = 'none';} } function closesplitdropdown() { document.getElementById('splittablelinks').style.display = 'none'; document.getElementById('splitmouse').style.display = ''; var titleincell = document.getElementById('titleincell').value; if (titleincell == 'yes') {document.getElementById('splittitletext').style.display = '';} } Co-Applicant vs. GuarantorAre Existing Home Sales Starting to Crack?Tips That Will Get You The Best Home Loans AvailableAustralia’s And Canada’s House Price Fate Entwined?BB&T Earnings Call Insights: Loan Growth Expectations and New Branch OpeningsEscaping the Fear Factory […]

Healing’s Dragon

to find matters to improve my internet site!I suppose its okay to help make usage of a couple of within your ideas!!

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/01/19/escaping-the-fear-factory/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/01/19/escaping-the-fear-factory/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2013/01/19/escaping-the-fear-factory/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/01/19/escaping-the-fear-factory/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2013/01/19/escaping-the-fear-factory/ […]

… [Trackback]

[…] There you will find 38142 additional Information on that Topic: thereformedbroker.com/2013/01/19/escaping-the-fear-factory/ […]

… [Trackback]

[…] Here you will find 61927 additional Information on that Topic: thereformedbroker.com/2013/01/19/escaping-the-fear-factory/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/01/19/escaping-the-fear-factory/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2013/01/19/escaping-the-fear-factory/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2013/01/19/escaping-the-fear-factory/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2013/01/19/escaping-the-fear-factory/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2013/01/19/escaping-the-fear-factory/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2013/01/19/escaping-the-fear-factory/ […]