We get asked about the fiscal cliff’s potential impact on the dividend-centric model portfolios we run almost every day. As a refresher – If nothing is done and the Bush tax cuts sunset, dividend income will begin to be taxed at ordinary income again as opposed to the 15% rate we currently enjoy. The fear is, if dividend stocks lose this advantage, they will be sold off come January. I highly doubt it, but this is the argument we’re hearing.

Now of course, we’re concerned, but we still don’t know what will happen with policy so we’re making no adjustments at the moment.

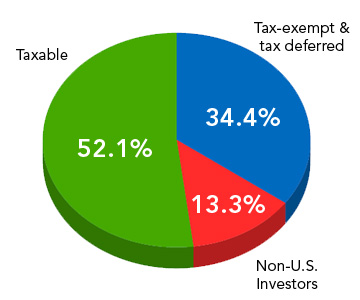

Fidelity Investments has a great explainer as to why the whole thing could be a non-event for dividend stocks (although the wrangling itself could have an impact on the markets in general if it’s acrimonious like last summer). The experts at Fido have gone back and looked at the impact of previous tax policy changes and have not detected much influence on share prices. They also note that the majority of dividend income goes to high earners anyway (56% to those in the top tax bracket) and that even among these high earners the percentage of dividend income of their total tax bill is something miniscule like 3%. And also, a lot of dividend paying stocks are held in tax free or tax advantaged accounts anyway, which nullifies the issue anyway.

I’ve got their charts below to illustrate that these fears are probably overblown:

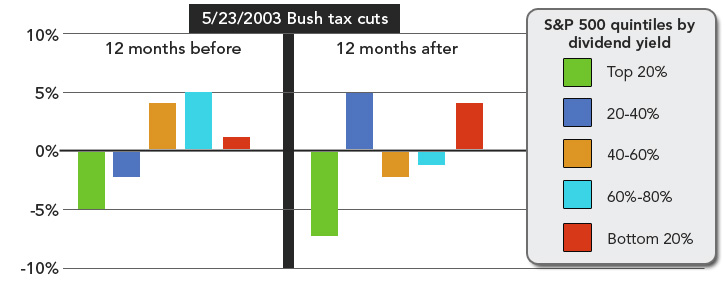

Tax cuts didn’t impact performance

If tax cuts drove performance, you might expect to see top dividend producers outperforming stocks that offered less yield when tax rates fell in 2003. As you can see, actual performance didn’t follow that pattern.

Past performance is not a guarantee of future results. Congress passed the Bush tax cuts on 5/23/2003. Chart divides the S&P 500 stocks into quintiles by dividend yield on 5/23/2003 and shows the relative total return to the overall index. Relative total return is calculated by taking the absolute total return and subtracting the equal-weighted-average absolute total return for the period

2010 Tax Status of U.S equity holdings

Source: Credit Suisse HOLT.

Investors have continued to investing in income-oriented fundsIncome vs. Domestic Equity Fund Organic Growth, Trailing 12 months

Source: Strategic Insight, Feb. 1194-July 2012

Read More:

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2012/09/19/fidelity-fiscal-cliff-should-be-a-non-event-for-dividend-stocks/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/09/19/fidelity-fiscal-cliff-should-be-a-non-event-for-dividend-stocks/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2012/09/19/fidelity-fiscal-cliff-should-be-a-non-event-for-dividend-stocks/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/09/19/fidelity-fiscal-cliff-should-be-a-non-event-for-dividend-stocks/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2012/09/19/fidelity-fiscal-cliff-should-be-a-non-event-for-dividend-stocks/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2012/09/19/fidelity-fiscal-cliff-should-be-a-non-event-for-dividend-stocks/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2012/09/19/fidelity-fiscal-cliff-should-be-a-non-event-for-dividend-stocks/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/09/19/fidelity-fiscal-cliff-should-be-a-non-event-for-dividend-stocks/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2012/09/19/fidelity-fiscal-cliff-should-be-a-non-event-for-dividend-stocks/ […]