“We don’t take our signals from the market.”

– formerly celebrated ‘value’ hedge fund manager

If you’ve lost money being long shares of Groupon ($GRPN) this year, it’s probably for one of the following three reasons:

1. You jumped in because the excitement for Facebook’s IPO was just too much, you couldn’t hold back.

2. The media just would not shut the f*ck up about this company, since even before the IPO.

3. You listened to a sell-side analyst’s buy recommendation and thought you were reading something useful.

Because quite frankly, other than one of those three reasons, there is absolutely nothing about this stock technically or fundamentally that ever would have “allowed” you to own it. That is, if you have any sort of process whatsoever.

I had lunch with Joe Fahmy a few months back and he and I hit upon a grand realization – it was one of those aha! moments, at least for me. We got to talking about the primary reason why investors lose money in the markets. Turns out it’s an Original Sin thing – the very first thing investors do is the wrong thing: They step up to the counter and select the wrong stocks. And then it doesn’t matter what kind of research you do or trading strategies you employ. Start with the wrong stock and you’re screwed before the opening whistle even sounds, just rip up the tickets.

And why, you may ask, do so many investors make this mistake (over and over again)? Because they watch TV or read articles in magazines and on the web. They hear a tidbit about this stock, a smidgeon of infotainment on that stock and when they fire up their online brokerage account, it is this random collection of stocks they happened to have heard something on that they begin to trade. And quite often, they are the very worst companies to get involved with for inexperienced investors; these stocks tend to be either overly loved or hated, controversial, “exciting”, newsy, noisy and wild.

And they get smacked up.

Groupon is a perfect example. The media was obsessed with the company from the moment two years ago that they turned down a $6 billion buyout from Google. Tech journalists (they’re mostly not really journalists, but we’ll be charitable here) praised Andrew Mason’s move as “brash” and “the right thing to do.” People from the Bay Area are hilariously optimistic, btw, it’s my favorite trait of theirs. New York financial reporters raged about the valuations they were hearing about – how can they possibly contain their enmity at $12 billion pre-IPO figures when the New York Times is worth less than $2 billion. To a reporter, it felt like the world was spinning off its f*cking axis.

And so the controversy raged on about what the company was and wasn’t worth. The sheer spectacle of it all kept Groupon on TV and in the paper at least four days a week for months on end. “Would you buy Groupon here, would you buy it there?” I would not buy it anywhere!

And the analysts whose firms did banking for the company should seriously consider joining that religion from the Da Vinci Code movie where they whip the sh*t out of their own backs in penitence. At least for a little while, switch back right before their kid’s communion or Bat Mitzvah. And this is actually the worst part – because a lot of the analysts who had you riding the stock down 80% were actually pretty good. These are not fools, so it’s hard to imagine them being this wrong for this long. And yet they were. Stupendously wrong.

But the Street Smart guys didn’t lose money here. They weren’t involved and if they were, it was likely only for a spec or a swing. Because a Street Smart guy never had a reason to buy it to begin with and even if by some accident they did, every single signal surrounding Groupon offered a fresh reason to sell it.

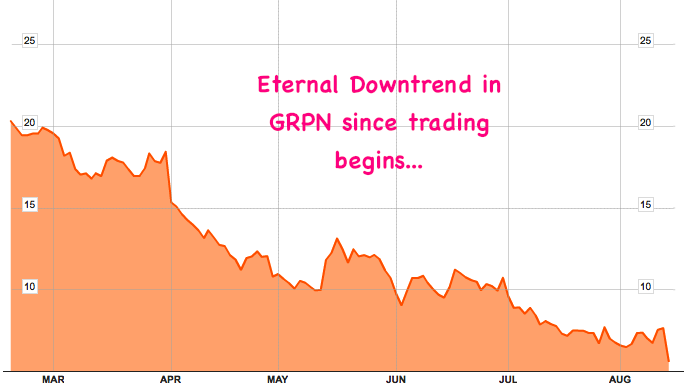

Technically, at no point from the beginning of trade did the buyers ever have control (see below).

We’re not talking about evening star dojis or humping dragon patterns here. Nobody’s throwing up a fibonacci fan so relax. This is basic supply and demand stuff. I don’t care how many beautifully tailored double breasted suits your warehouse holds, if everyone is buying two-button single-breasted suits instead, they are worth exactly nothing. Same thing with stocks, it’s a shame they don’t force fundamental analysts to at least have the basics of this concept interwoven with their old school discounted cash flow analysis stuff. Dummies.

Fundamentally, everyone covering this stock should have known better and most of them probably did. But sell-side analysts serve multiple masters and non-institutional clients who happen to read and heed their calls aren’t one of them. I promise, they don’t give a sh*t about you or your retail brokerage account, it’s a grain of sand in the Sahara of revenue streams. Banking clients get taken care of first, still, which means “constructive” reports on even the worst stocks like GRPN. Institutional accounts are taken care of second, which means the wink and the nod – “Yeah, our analyst is saying this in public, but…”

Once again, not even one time was the valuation ever compelling, nor was there any fundamental news flow, empirical or anecdotal, that ever had you long this stock. In fact, every single fundamental facet of this stock had you out of it or even short.

Analysts were recommending Groupon based on a combination of potential, an innovative business model and the novelty factor (there were only a few social media stocks). None of these are real reasons to invest in anything. You learn this the hard way – by getting beaten up a few times on The Street. Analysts don’t ever learn this because they only feel the pain of blowing the call indirectly, abstractly.

So here’s the bottom line:

If you bought it because of Facebook-proximity, you learned the lesson of not settling for the third-best in a group.

If you bought it because the media wouldn’t shut up about it, you learned the lesson about approaching the market with the wrong type of stocks.

And if you bought it because the analyst sounded intelligent, then you learned one of the biggest lessons you’ll ever learn: Intelligent is not the same as Street Smart.

Read Also:

You Are Now About to Witness the Strength of Street Knowledge – GMCR Edition (TRB)

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2012/08/15/you-are-now-about-to-witness-the-strength-of-street-knowledge-2/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/08/15/you-are-now-about-to-witness-the-strength-of-street-knowledge-2/ […]

… [Trackback]

[…] Here you can find 4036 more Information on that Topic: thereformedbroker.com/2012/08/15/you-are-now-about-to-witness-the-strength-of-street-knowledge-2/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2012/08/15/you-are-now-about-to-witness-the-strength-of-street-knowledge-2/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2012/08/15/you-are-now-about-to-witness-the-strength-of-street-knowledge-2/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2012/08/15/you-are-now-about-to-witness-the-strength-of-street-knowledge-2/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/08/15/you-are-now-about-to-witness-the-strength-of-street-knowledge-2/ […]