A few years back the asset management industry began to get really interested in broadening out their emerging markets (or BRIC) exposure on the equity side with emerging markets debt. They did so primarily with emerging markets sovereign debt – bonds from the countries themselves. And it was good.

Obviously because of currency issues in 2011, the locally-denominated stuff (like $ELD, also from WisdomTree) did not do as well as the dollar-denominated stuff but there are a bunch of different funds to play the EM sovereign space with now and the category has been accepted by the industry. EM debt as an asset class sports higher yields than developed debt (Europe, Japan) but with much better underlying fundamentals (lower debt-to-GDP, mineral wealth in-country, younger populations, lower consumer debt, higher savings rates etc) in many cases.

And now that the acceptance is mainstream, there is a brand new asset class nudging its way into professionally managed portfolios that I’m just now starting to consider myself. We’re talking Emerging Markets Corporate Debt – bonds from highly-rated issuing companies in the EM regions as opposed to the countries themselves.

The logic makes sense – if we own both corporate bonds and Treasury bonds in our fixed income allocations here, so why would we not do the same abroad? Also, there is an index for this asset class kept by JPMorgan for these bonds already, complete with historical data.

There’s one investment vehicle pure-play I know of that’s pretty much inventing the category on its own right now, it owns the space in terms of ETFs. It’s called the WisdomTree Emerging Markets Corporate Bond Fund ($EMCB) and it launched in early March of this year. Unlike the rest of WisdomTree’s ETFs, this one has an active manager (Western Asset Management) because the index approach doesn’t make sense for this space (yet).

My rule with new ETFs is I don’t touch them for at least 90 days so that real volume can come into them and I can get some sense of tracking issues and things of that nature. So without getting too much into the ETF itself, I’ll throw up some of WAM’s charts to give you an idea of what this asset class looks like empirically:

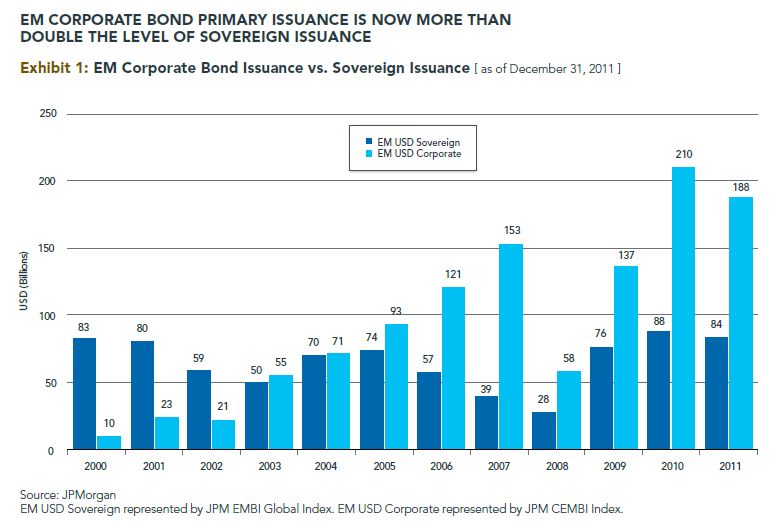

In the first chart, we see that issuance of EM corporates is healthy and that the market is becoming wider and deeper than the EM sovereign debt marketplace:

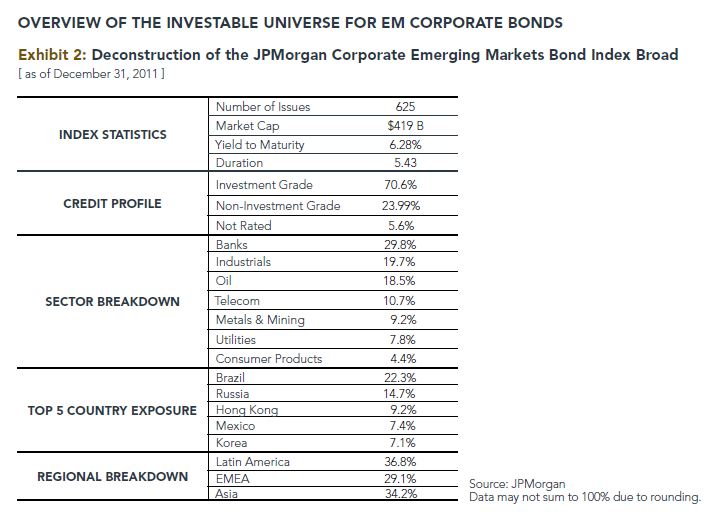

Here you can get a sense of the sector weightings within the index itself:

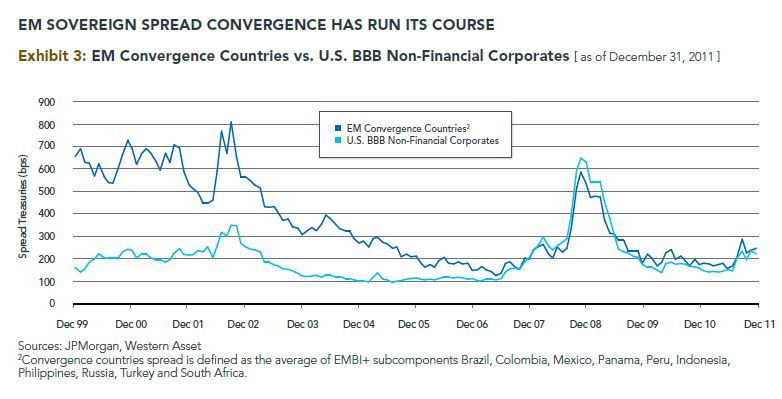

Spreads are extremely now versus US bonds of similar credit quality. EM Corporates are no longer being treated as second class citizens.

I recommend doing a lot of research on your own before wading into any new-ish kind of investment area. Below is a link to Western Asset Management’s entire white paper.

Source:

Emerging Market Corporate Bonds: Seizing Opportunities in the 21st Century (WisdomTree)

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2012/04/05/emerging-markets-corporate-debt-the-new-new-thing/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2012/04/05/emerging-markets-corporate-debt-the-new-new-thing/ […]