A bombshell new survey from the Infogroup/ORC concerning what Americans believe about financial advisors and stockbrokers has the potential to turn the entire industry on its head.

We’re not talking semantics here, we’re talking about a fundamental confusion that afflicts more than two thirds of the investors in this country. This is a landmark survey because understanding the difference between advisors and brokers should be a sine qua non for investors before entering into any financial relationship.

According to the poll, which came out on September 15th, an overwhelming majority of investors do not understand the fact that stockbrokers are in the business of selling them things while advisors are in the advice business.

Let me give you the data first:

* Two out of three U.S. investors (including 70 percent of 45-54 year olds and 62 percent of college graduates) are incorrect in thinking that stockbrokers are held to a fiduciary duty.

* 76 percent of investors are wrong in believing that “financial advisors” – a term used by brokerage firms to describe their salespeople — are held to a fiduciary duty.

* By contrast, 75 percent of investors think the fiduciary standard is in place for “financial planners” and 77 percent say the same about “investment advisers.”

* Over three out of five American investors mistakenly believe that stockbrokers are investment advisers.

The survey group included around 2000 or so people, half men and half women. How is it possible that there is such a major misunderstanding about the difference between advisors and brokers? I’ll explain:

Sometime around the dot com bust (and the accompanying research scandal in which customers were sold garbage stocks from their brokers’ investment banks), the wirehouse firms discovered that they actually possessed a shred of shame and some conscientiousness in their DNA. And this discovery led to some navel gazing followed by a decision that, in order to survive, their massive sales forces had to rebrand themselves as Financial Advisors. It was the beginning of the end of the Registered Rep as the Merrills and Morgans began upgrading themselves to “Wealth Managers”.

This was the right thing to do for both the firms and their customers, in theory. The reps got smarter and more well-rounded. Pushing products, while still fundamental to the firms, was no longer the only goal. Many reps at firms of all sizes became what we call Hybrids – a broker/advisor mix.

Unfortunately, the proliferation of the hybrid model led to a massive gray area because of the public’s lack of awareness and the typical “regulatory arbitrage” game that The Street plays so well. Within this gray area, reps were acting as brokers in some cases and advisors in others.

For some clients or even specific transactions, the rep had a Fiduciary Responsibility in that he was acting in an advisory capacity (selling his advice to the customer for a fee). For other clients or transactions the rep was only “wearing his broker hat”, meaning he was not held to any Fiduciary Standard, he merely had to comply with suitability rules. In brokerage transactions, he did not formally have to concern himself with whether or not the customer’s needs were before his own. The selling of in-house products and banking deals is exponentially more lucrative than the straight-up business of fee-based advice only, so many reps were maintaining both designations and deciding almost autonomously when they wanted to act as which.

And believe it or not, this lunacy continues to this day.

Stockbrokers, while engaging in nearly identical activities as financial advisors in the eyes of the client (“my financial guy” is how we’re referred to), have no fiduciary responsibility to their customers based on current rules. Brokers merely must be able to say that the stock, bond, or fund they sold a client is in keeping with the client’s risk tolerance and objectives. The fact that the broker may have picked one investment product to recommend over another because of a higher commission or concession does not even have to be disclosed.

Now imagine that you are a client paying both advisory fees and commissions to the same guy or gal depending on what he or she is suggesting that day – it’s so convoluted that a majority of people have tuned the entire thing out as this survey clearly shows.

There’s enough gender-bending going on here that Congress and the SEC will probably push through a massive overhaul of the issue when their 6 month study period ends at the beginning of 2011. That’s the good news. Virtually every single person polled agrees that anyone offering investment advice, even if it is a stockbroker giving only limited advice that is incidental to a transaction, should be governed by the Fiduciary Standard.

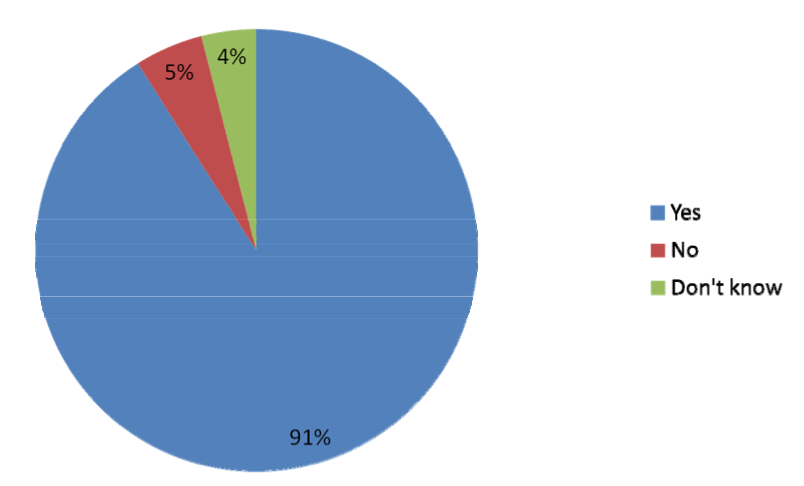

Here’s the only stat that truly matters in the end and the one that will likely overcome any roadblocks that the brokerage industry lobby throws in its way:

Virtually every investor agrees (91%) that if a stockbroker and an investment adviser provide the same kind of investment advisory services, they should both have to follow the same investor protection rules (based on 1319 responding investors):

Josh Brown’s Translation: America has spoken and it is telling you that it doesn’t care about your opinion of its suitability – it wants you to put its interests ahead of your own.

It used to be that you could make a living with a Series 7 and a good story to tell. Those days are and have already been numbered. One of the foremost authorities on the broker dealer world, my friend and fellow blogger Bill Singer, believes in the need for a unified profession – one title for those offering investment recommendations and advice. He was early in reaching this conclusion and I think that the industry will ultimately come around to his way of thinking.

Armed with this knowledge about their constituents’ expectations for the financial services industry, there isn’t a congressman in the world who could openly work against the universal Fiduciary Standard for all investment professionals.

In a year the brokerage industry will be unrecognizable – consider this your official Heads Up.

You can read the entire survey here:

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2010/09/19/what-is-a-stockbroker-america-has-no-clue/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2010/09/19/what-is-a-stockbroker-america-has-no-clue/ […]

… [Trackback]

[…] Here you can find 29498 more Information to that Topic: thereformedbroker.com/2010/09/19/what-is-a-stockbroker-america-has-no-clue/ […]

… [Trackback]

[…] There you can find 81618 more Information on that Topic: thereformedbroker.com/2010/09/19/what-is-a-stockbroker-america-has-no-clue/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2010/09/19/what-is-a-stockbroker-america-has-no-clue/ […]

… [Trackback]

[…] Here you will find 10479 additional Info on that Topic: thereformedbroker.com/2010/09/19/what-is-a-stockbroker-america-has-no-clue/ […]

… [Trackback]

[…] There you will find 52116 more Information on that Topic: thereformedbroker.com/2010/09/19/what-is-a-stockbroker-america-has-no-clue/ […]