The parabolic spike in 2-year Treasury bond rates this winter ended with a crescendo on Thursday, March 9th and Friday March 10th. That week, the collapse of Silicon Valley Bank had thoroughly spooked the markets and convinced traders that the Federal Reserve would be forced to start downshifting its hiking cycle and the accompanying hawkish rhetoric. By Sunday afternoon, March 12th, the FDIC had stepped in and resolved the bank. It was over. A couple of weeks later, First Citizens Bank had announced a deal to acquire what was left of its branches, customer deposits and employees.

The bond market reacted to these developments swiftly, with yields dropping precipitously just ahead of the rescue while several other banks were capsizing and a chill hit traders old enough to remember the run-up to the 2008 financial crisis. Treasury bond prices rose as capital fled to safety. Interest rates on Treasury bonds fell commensurately with the rally in price. All of a sudden, inflation didn’t seem like the biggest risk in the markets anymore.

That weekend I had declared the top in 2-year Treasury bonds was in. Not forever, but for awhile. You can read the piece here.

It wasn’t a terribly courageous call, given all the fear about what a systemic bank run could do to the economy. But regardless, it was right.

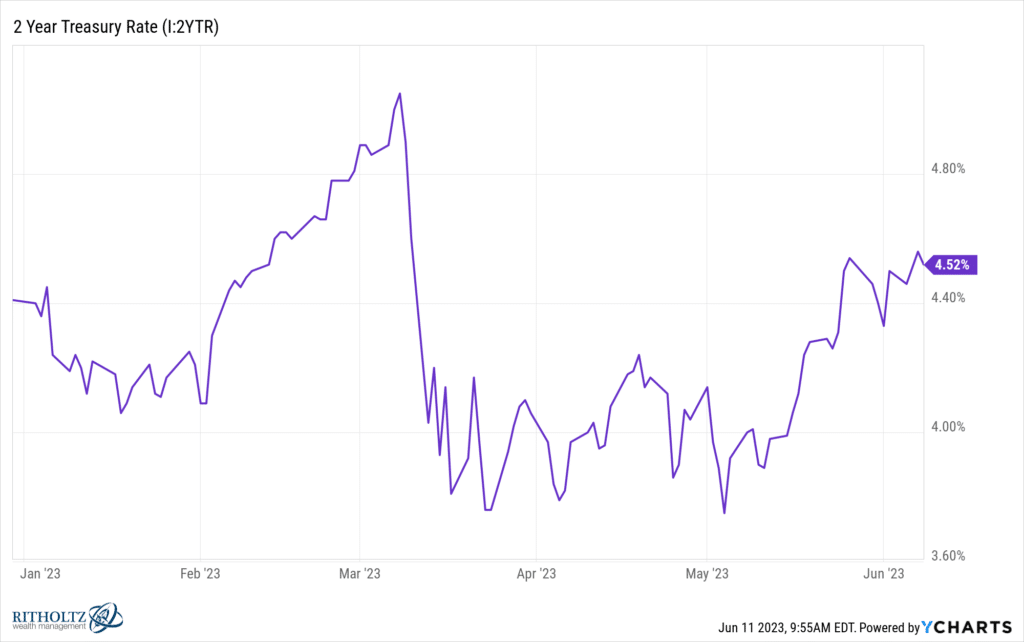

Here’s what the 2-year Treasury rate has done since:

We’ve been as low as 3.75 and haven’t seen 5% since. The overnight (or Federal Funds Rate) is now five and a quarter. The 2-year is no longer leading it to higher ground, despite recent strength in the labor market and a raft of upside economic surprises. The early March spike still looks like it was the blow-off top for the cycle.

More interestingly – and the thing I did not see coming – was happened in the stock market since that top for 2-year bonds.

The Nasdaq went bonkers.

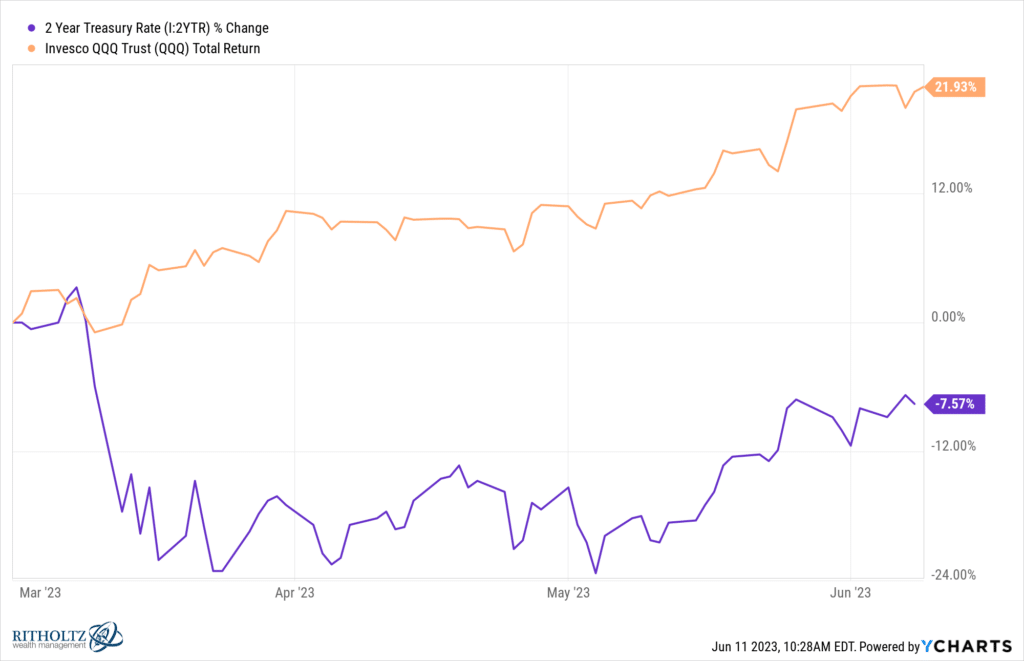

In orange, the Triple Q’s ETF exploding 22%, taking off like a rocket ship as the bond blow-off began (purple).

I wouldn’t give the bond market all of the credit for the return of large cap growth stocks since March. Several other things happened. First, as the earnings came in for the first quarter this April, we re-learned the difference between economic data and the resilience of Corporate America’s profit machine.

It turns out, US executives have lots of levers to pull, despite demand slowdowns, cost pressures and the like. Six months of layoffs contributed to both bottom-line stability and sentiment-driven multiple expansion. The index-weighting giants somehow delivered on the earnings numbers, despite being challenged on top-line revenue growth. It was crucial. Analysts had been expecting a drop of 7% for year-over-year corporate profits in the S&P 500 and by the time we got the last of the reports, that was looking more like minus 2.

Additionally, it’s important to remember where we had started from. Meta was in an almost 80% drawdown from its high. Amazon and Alphabet had been cut in half. Even Apple was down 30%. The Nasdaq as a whole had experienced a peak-to-trough sell-off of 35% from November 2021 through October 2022 and they still hadn’t recovered much by early 2023. There was lots of room to the upside and very little enthusiasm for these stocks, so when they started to beat expectations, the effect was like a powder keg popping off. Oh wait a minute, Microsoft is still pretty awesome. Yeah, no shit.

We also had a once in a lifetime moment of technological awakening as the ChatGPT phenomenon began to capture the public’s imagination. All of a sudden Chief Executives began talking up the enormous potential of AI and this fed into a chase for all of the companies who had substantial AI efforts underway – large cap tech being the epicenter of it all. Nvidia’s explosive earnings report, during which it doubled its forward guidance, served as affirmation that the hype had a solid basis in reality. The company added $200 billion to its market cap in a single day, an unheard of milestone in the history of the stock market. AI wasn’t just a theme, it was a clear and present business opportunity here and now. The stock prices of the hyperscalers – Alphabet, Amazon, Microsoft, Meta – went absolutely crazy. You had to own them.

By late May, Wall Street’s strategists had begun to raise (yes, raise) their earnings outlooks and S&P 500 year-end targets. By early June, Wall Street’s economists were following suit, with GDP outlook upgrades and tamped-down recession probabilities to match the stock guys’ optimism.

We now find ourselves in a situation where the resilience of corporations’ ability to grow earnings is on full display. Concurrently, falling inflation is becoming apparent everywhere (inflation topped at 9% last June and is rapidly headed toward a 3-handle according to consensus expectations.) April inflation, which was reported last month, fell for the tenth straight month. This Tuesday, we’re expected to get a month over month CPI reading of .3%, which would equate to a 3.7% annualized inflation rate. Core inflation, which strips out food and energy, is expected to be in the 5’s, which is still high, but not high enough to have Fedheads continue to make speeches implying hikes without end. An upside shock could probably undo some of the recent rally in stocks, but not most of it.

Michael and I will be going live on Tuesday night to cover that day’s CPI as well as all of the most recent and important developments in the market. 122,000 people have subscribed to our YouTube channel. We hope you are among them. These are remarkable times and we are doing our best to cover it all for you, having a little bit of fun along the way.

Thanks for reading and watching. We love our fans and I hope that is apparent with every show we broadcast.