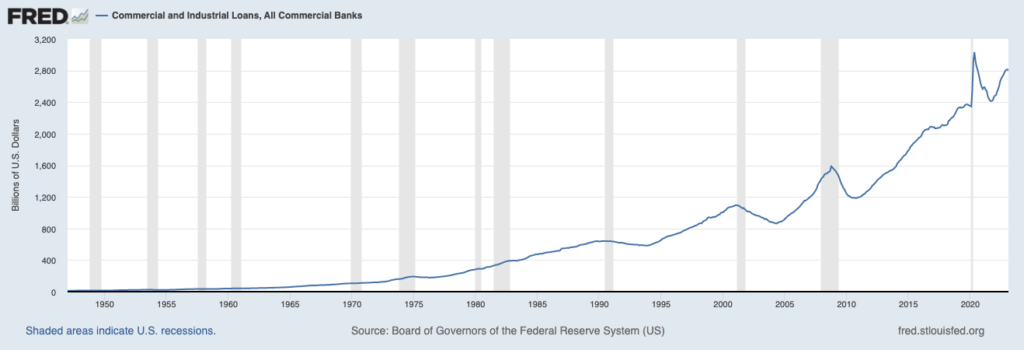

This is it. The only chart you need to concern yourself with now if you’re trying to figure out where the economy is heading. Construction and Industrial (C&I) loans are a $2.8 trillion business (approximately) for banks all over the country. If they roll over, we have a soft landing. If they roll over hard, we have a hard landing. It’s not complicated, the only thing that’s up in the air is the timing and severity.

C&I loans take the form of either lump sum or revolving credit. They are usually a year or two years in length and are made to businesses so that they can expand, hire, invest in new equipment or facilities, improve owner-occupied real estate or just have working capital on hand. This is what small and mid-sized banks really do outside of mortgages and checking accounts. It’s their real business. It’s their whole purpose for existing. Small companies cannot tap Wall Street for capital. They cannot issue bonds or sell stock. They need banks to grow and improve and fund new projects.

The economy needs this activity as well. Over the two decades between 2000 and 2019, the SBA estimates that 64.9% of all new jobs were created by businesses with fewer than 500 employees. That’s two thirds of the total employment growth in the United States for twenty years, mostly funded by C&I loans and credit arrangements between banks and business owners.

When banks start diverting capital away from this line of business or saying no to making new loans, stresses begin to appear economy-wide. Small business owner confidence takes a hit. Employment hits the wall. This is how recessions materialize from being a thing the stock market is worked up over to being an actual, tangible reality on Main Street.

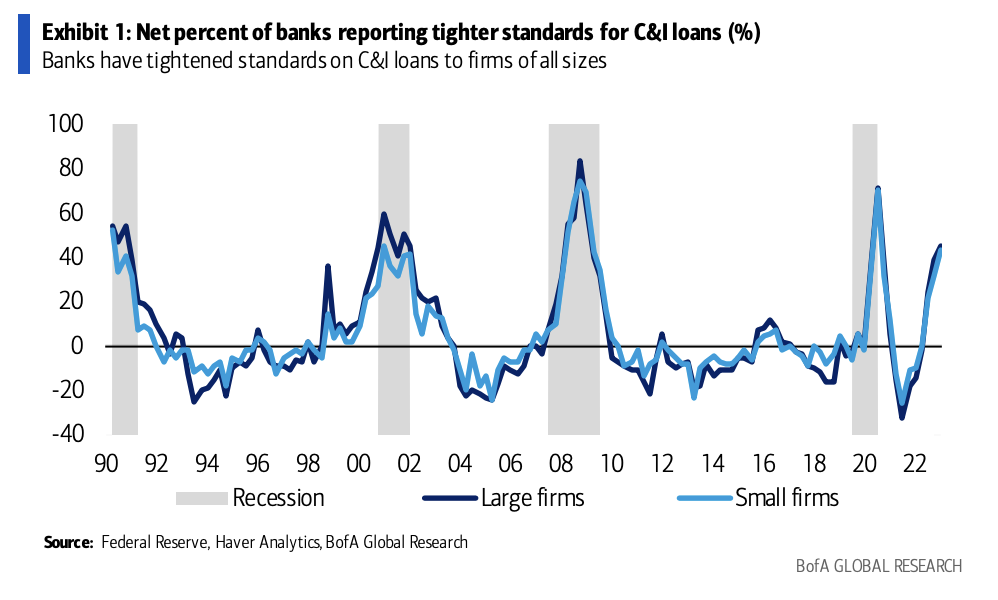

So here’s a look at the net percent of banks cutting back on C&I loans by tightening their lending standards, via Bank of America this morning:

You can see that historically lending standards at large banks rise and fall with those at small banks, so if we see the contraction in loans continuing at the small banks, the impact will be meaningful for everyone. We know that the large banks are current beneficiaries of the regional bank panic in terms of the shifting of deposits, but that doesn’t mean they’re going to play offense on loan growth. Everyone’s on defense right now. This is the very definition of a financial shock.

The FOMC’s decision to hike interest rates last week will look considerably more ridiculous as the weeks and months go on from here. The economists at BofA note what typically follows a shock like the one our banks are currently enduring:

We estimate the effects on economic activity from changes in standards and terms for bank lending using a vector autoregression (VAR) on quarterly data from 1991 through 2022 (see the report Estimating downside risk from a sharp tightening in bank lending standards, 21 March 2023). We find that a one standard deviation shock to lending standards on C&I loans and banks’ willingness to lend to consumers causes a 1-2% cumulative decline in personal consumption over six quarters, a cumulative 2-4% decline in employment over six quarters, a cumulative 10-15% decline in structures and equipment investment over six to ten quarters, and a 15% decline in real growth in C&I loans over ten quarters.

Tighter standards on consumer lending reduce consumer loans by a cumulative 10% over about ten quarters. We also find fairly short lags between any tightening in lending standards and economic outcomes; effects tend to appear within about two to three quarters. In addition, shocks to lending standards for C&I and consumer loans are very persistent and, generally speaking, do not wear off. This is similar to findings in previous research, where we found that shocks to financial conditions can cause prolonged drops in activity data…

SVB, Signature, Credit Suisse are not small banks. Their collective demise this month, regardless of what happens with depositors, will be something we’ll look back upon as the beginning of the hard landing. I’m unsure of whether or not the Federal Reserve cutting rates in the back half of the year would even matter at this point. Might be too late.

Source:

Central banks continue to follow the playbook and so do we

Bank of America – March 24th, 2023