Apparently it’s news to the whole world this morning that Credit Suisse is some sort of undead Swiss zombie bank worth more dissected and sold off in chunks than alive. Who knew? Oh wait – everyone knew, for a long time now. Open secret. Single digit stock price. Come on. I meet financial advisors at industry events and cocktail parties – I wince when they say they work at Credit Suisse. The other guy winces too, nervous giggle, “Madison Square Park neighborhood doesn’t suck…” I’ll say to ease the moment. “You got the outdoor Shake Shack…”

Anyway, none of this is surprising.

The entity itself was a Frankenstein to begin with. Let me tell you a story. I might not have every detail right because this is off the dome, so bear with me, I’m pretty sure these are the broad strokes:

First Boston, a 1920’s-era majorly respected investment banking house hit some tough times in the late 1970’s and Credit Suisse, the European bank, managed to buy a large stake in the company in exchange for, I don’t know, stability? Chocolate? It was the 70’s, who could remember.

You see what had happened was Larry Fink (yes, that Larry Fink) was trading mortgages for First Boston and trying to compete with the maniacs at Salomon Brothers. It didn’t go well. Fink’s bets failed because of interest rate surprises and also prepayment risk (we’ll discuss this some other time) and the fifty year old institution lost a hundred million dollars, once considered to be a lot of money. Fink went on to join Blackstone – the private equity firm, then in its infancy – and later incubates the BlackRock asset management division which gets spun off, sold and then becomes the largest asset manager on the planet. You can Google all of this, it’s not that important to the story today.

Anyway, the Europeans take a stake in First Boston and then, a decade later in the late 80’s, they buy the rest of the company, creating Credit Suisse First Boston. Then the combined entity swallows up Donaldson Lufkin Jenrette (DLJ, if you were there), an even more vaunted and famous name on The Street. There’s a Swissman named Oscar or Oliver in charge of the whole thing. It’s a fail from day one. The dot com crash happens followed a few years later by the financial crisis. CS is embroiled in scandals and losses for an entire decade from the twin crises and never really has a chance to succeed as a combined entity. It has always been a disaster but with a few great pieces (asset management, certain fixed income trading desks, some wealth management, a little bit of underwriting, etc).

Okay, so everyone is renewing their fears about its ability to survive in the wake of the Saudis saying they’re done writing checks to support this monster. This has rattled the markets. I understand. It’s a big global bank and serves as counterparty to everyone and everything. Let’s just remember that this company was always a mess. It’s not a shock. They will sell off some of their good businesses and the Swiss government can figure out who they want to leave in charge of whatever’s left. Life will go on. But this is the thing everyone is worried about right now.

Here’s the good news: This past week, investors finally got one of their most important arrows back in the quiver. Bonds are working again. Treasurys are risk-off. This is critical.

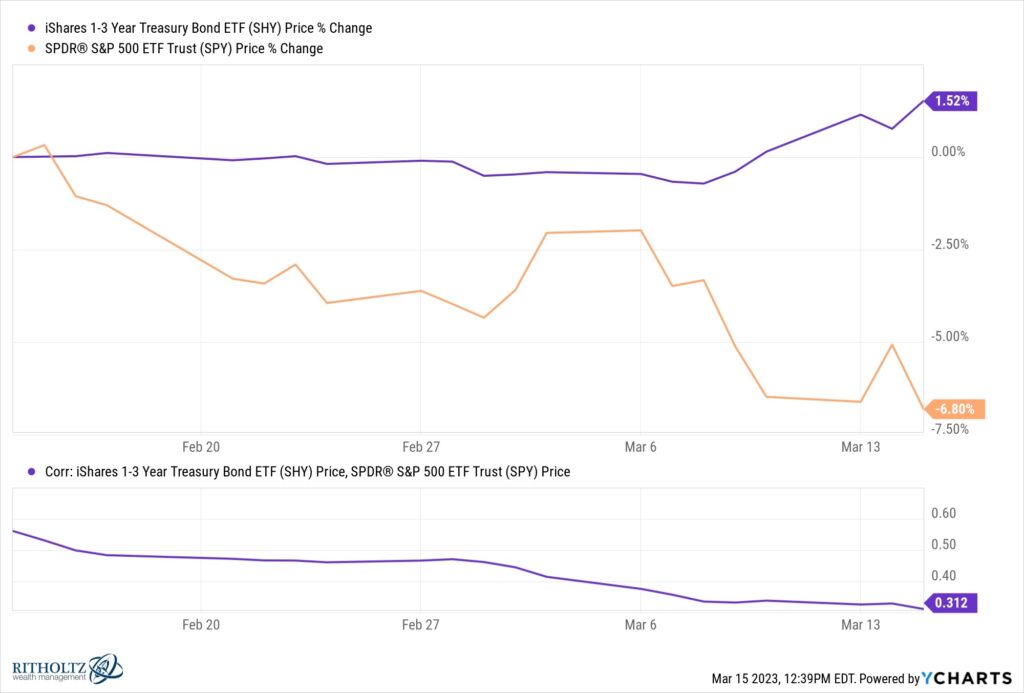

One month ago, the 1-3 year Treasury bond ETF from State Street (SHY) was .78 correlated with the SPY ETF, making stocks and short-term treasury bonds basically an identical directional bet. That’s f***ed up. Shouldn’t be that way. Short-term Treasury bonds should not move with the stock market. And, of course, they can’t for long, because sooner or later asset allocators gotta allocate to one or the other.

Finally, this correlation broke. It went from almost 80% down to 30% and falling. The last few days they’ve been inversely correlated, which is exactly what you need to see happen in a correcting, panicky market. We didn’t have that inverse correlation last year and it messed with people’s heads big time (not to mention everyone’s returns). Bonds and stocks moved up and down together based on how panicked or relieved we were about the inflation situation from one week to the next. Not anymore. Now we’re more worried about the financial system than inflation, and this synchronized skating routine between stocks and bonds has ended.

Which is good. Risk-off positions have to act risk-off or the whole concept is sabotaged. So we have that going for us again.