I’m going to tell you a quick story in the order in which it happened. You were there. You will be familiar with the sequence of these events. But you may not have reached the shocking conclusion that I have. At least not yet. Wait for it…

Our story begins in 2019…

It was the best of times, it was the best of times. The tail end of a decade of uninterrupted asset price appreciation for the top decile of American households who own 89% of the US stock market and 70% of all of the wealth. Not only did they ride this wave higher, they even figured out a way to have their cake and eat it too – a way to not even have to sell any of their assets to maintain the costs of a top ten-percenter lifestyle. Securities based lending. A silver bullet.

The banks were more than happy to arrange a loan against any stock, bond or building in their clients’ portfolios. And why not? This way, no one had to sell and pay taxes while the money under management remained sticky and eligible for fees forever. You could be rich, stay rich, borrow at will, never come out of pocket, never give up your piece of the pie and yet still be able to pay for whatever you wanted. Clients loved it, banks loved it, financial advisors and fund managers loved it.

It was a win-win engineered by the cleverest of the clever on Wall Street and a decade of ultra-low interest rates courtesy of the Federal Reserve and central banks around the world. Stock market volatility was minimal, taxes were low and borrowing costs were so slight they may as well have not even existed. Never before was it so easy to finance, accumulate and maintain a portfolio of real and financial assets – from private real estate to startup shares to public stocks to fixed income of every sort and stripe. The upper class was floating away on an endless river of cashflows and capital gains. Meanwhile, prices and costs in the real economy barely budged. Income and wealth inequality soared but it was hard to say the “winners” were directly hurting anyone or causing any harm to any other group. It’s just that they were noticeably pulling ahead of everyone else at faster rates. But everyone was advancing to some degree, so, whatever. Life went on.

So long as inflation remained in check, the Fed could more or less manage the stock market with occasional quarter-point rate hikes or rate cuts and a smattering of speeches here and there.

And it worked beautifully – here are the annual inflation rates (as measured by CPI) for the years leading up to this ecstatic moment in the history of American-style capitalism:

2015: .12%

2016: 1.26%

2017: 2.13%

2018: 2.44%

2019: 1.81%

The economists couldn’t believe the marvels of the disinflationary era. We had lived through decades of “the great moderation” following the peak of prices in the 1980’s but the last few years of it were truly extraordinary. It broke all of the models and core tenets of how we thought money was supposed to work. If people were willing to pay their governments interest to hold their money for them – and they were – then nothing made sense and all of our assumptions about “rational actors” in the capital markets were up for a reexamination. At one point during the summer of 2019, some $15 trillion worth of sovereign bonds, or one quarter of the overall global bond market, had negative interest rates. There was too much money sloshing around in these countries and the central banks were basically saying “go invest or spend it, we don’t need it but hopefully you do.” The bond yields in Japan, Germany, France, Sweden, the Netherlands and Switzerland were all deeply negative.

People in the know were utterly mystified by how all of this free money wasn’t causing enormous amounts of inflation in the real economy, let alone how it could actually be feeding into the disinflation being felt everywhere. They blamed tech (“Software is eating the world”), they blamed globalization, they blamed just-in-time inventory strategies, they blamed China (“They’re exporting deflation!”), they blamed millennials (“They’re not having sex! They’re not starting families and buying homes!”), they blamed indexing and ETFs (“It’s a gateway drug to communism!”) and, when all of that failed to explain the lack of inflation, they blamed the statistics themselves (“Obama! He’s hiding something. He’s in on it with the Jews and the lesbians! They’re taking over the pizza parlors in Washington D.C. for their satanic sex rituals and suppressing the inflation stats to keep Donald Trump Jr. from discovering the true location of the treasure chest Jesus Christ gave to George Washington for safekeeping in 1984!”). I wish I was kidding about that last thing, but I am not. We are surrounded by imbeciles. Social media has enabled the village idiots of every town and region to discover each other and band together in the millions. Society is actually regressing intellectually for the first time since the Dark Ages. We’ll get to that some other time.

Anyway…

Even after all these tortured economic theories were run through the financial media’s military-industrial spin cycle, deconstructed and recombined into takes on takes on takes, endlessly ricocheting off the walls of a thousand pdfs, we were no closer to having a real understanding of how a phenomenon such as this could even be possible in the first place, let alone how it could run on for as long as it did, year after year.

And then the pandemic came along a few months later and, without knowing it, we were about to run the greatest economic experiment since the Great Depression, in real-time, for all to see. Everyone got to participate in this experiment, whether they wanted to or not. Every existing person in our economy – from the CEO of the largest publicly traded company in America to the lowest paid employee of the smallest commercial farm – we would each be assigned a role to play. Every single one of us – that’s how big this experiment would be.

Most experiments start with a question. A hypothesis is then proposed to answer that question. A test of the hypothesis is devised and then carried out. It is proven true or false.

Our experiment started out with the following question: “Can we shut the economy down for a health emergency and not cause a second Great Depression?”

The answer turns out to have been “Yes, we can.”

The hypothesis was that if we print enough money so that no one falls behind on their bills, we can effectively shut down all but essential commerce for an indeterminant period of time and most people will be okay. It took a lot of money, but it basically worked.

We carried out stimulus in several ways but the most notable thing we’d done was brand new: Direct payments to regular people whose employers had permanently or temporarily asked them not to show up for work. This happened in three rounds of payments. These numbers are taken directly from the government’s pandemic oversight agency:

Round 1, March 2020: $1,200 per income tax filer, $500 per child (CARES Act)

Round 2, December 2020: $600 per income tax filer, $600 per child (Consolidated Appropriations Act)

Round 3, March 2021: $1,400 per income tax filer, $1,400 per child (American Rescue Plan Act)

To prevent companies from conducting mass layoffs of their employees, the Paycheck Protection Program or PPP was created. Beginning in late March of 2020, and continuing over the course of two rounds, a total of $792.6 billion went out to 11.5 million small and midsized businesses. Over 10 million of those loans ended up being forgiven (not repaid) or $742 billion worth. My firm borrowed money under the Paycheck Protection Program during the unprecedented uncertainty of early April 2020 and then repaid the loan in its entirety two months later in June. Almost none of the program’s borrowers saw fit to do the same. It’s possible that the 90% or so of firms who kept the money genuinely needed to. I don’t sit in judgment of people and situations I have no knowledge of so I will leave that debate for others. But the money was almost entirely kept, so we’re talking about another three quarters of a trillion dollars of stimulus remaining in the economy and never coming out.

The Coronavirus Relief Fund was created to get money to states and cities. A total of $150 billion was sent to almost 1,000 entities, from the Governor of Texas to the Treasurer of California, the Commonwealth of Kentucky to the Executive Office of the State of Wyoming.

Then there was the State and Local Fiscal Recovery Fund (or SLFRF if that’s easier to pronounce, and it isn’t). $350 billion distributed to 1,756 states, territories, cities, and counties with populations over 250,000. Bergen, New Jersey. Albuquerque, New Mexico. Tampa, Florida. Green Bay, Wisconsin. The money went everywhere and to everyone for everything.

Throw in another $186 billion through the Provider Relief Fund to support hospitals and healthcare organizations of which $134 billion was actually sent out. Then there was another $16 billion in the form of the Shuttered Venue Operators Grants – cash handouts for movie theaters, Broadway, museums, etc. The Restaurant Revitalization Fund (or RRF) was another $28.5 billion with an average grant amount of $283,000 to over 100,000 recipient restaurants. This is above and beyond whatever they got in paycheck protection, tax and rent relief, etc. They needed money to convert their dining rooms for additional spacing and plexiglass enclosures for ordering counters and hand sanitizer and masks and all sorts of other stuff that didn’t end up working at all.

In total, the Federal government created $4.3 trillion in direct economic stimulus of which $3.95 trillion was dropped onto the economy, as if by helicopter, in a period of under 18 months. There were people comparing the dollars spent on the government’s pandemic response to the spending America did on World War II. This is a silly comparison, especially when calculated as a percentage of GDP, but the point is that there are few other things you could compare it to that would even be in the same ballpark.

And while the Treasury was disbursing all of this money into the bank accounts of business owners and workers, the Federal Reserve was doing its part on a parallel track, with the bank working “hand in glove” with the federal government. Interest rates were slashed to zero and the Federal Reserve began an asset purchase program designed to re-liquify financial institutions by buying Treasury bonds and mortgage bonds from them at prevailing prices, no questions asked, to the tune of $120 billion per month, every month, for an unspecified period of time (which turned out to have been almost two full years!). This led to unprecedented liquidity in the system and plunging borrowing rates for corporations, which would eventually lead to record profit margins for the S&P 500, record stock buybacks and one of the greatest bull market rallies in history.

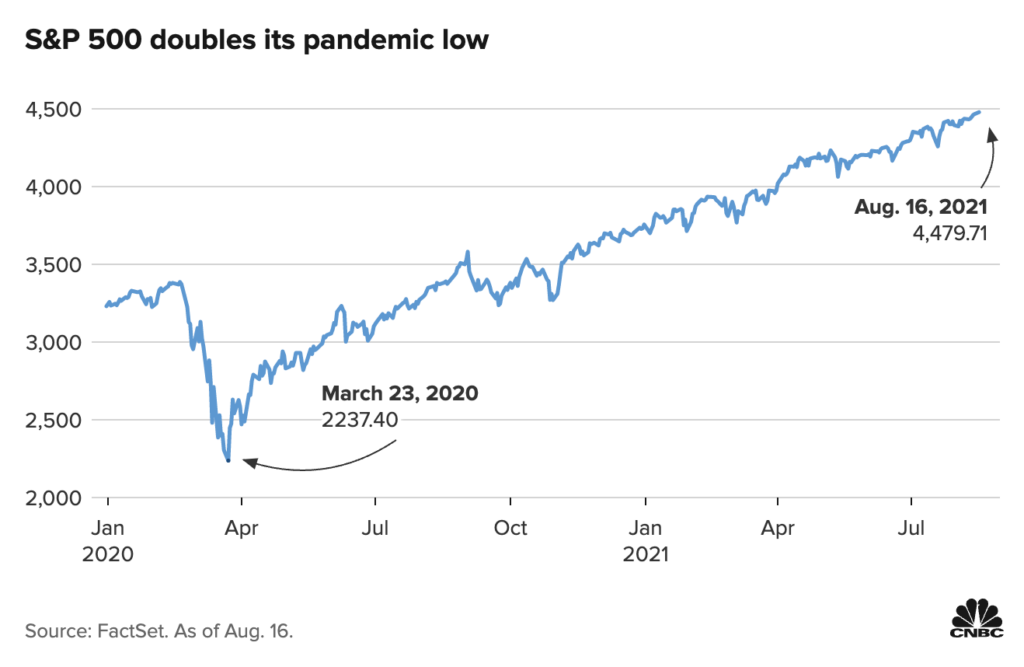

Between March 23rd, 2020 (the day stocks bottomed) and August 16th, 2021, the S&P 500 had doubled from 2237 to 4479. It took just 354 days, the fastest double in stock market history back to World War II. In the one year period from March 2020 through March of 2021, 0ver 95% of all S&P 500 component stocks had a positive return. In calendar 2021, over 1,000 companies came public, wiping out every initial public offering record on the books.

We used the term “unprecedented” so many times in this era, heedless of Pee-Wee Herman’s warning, that we effectively wore it out. But it was no exaggeration. Everything was unprecedented.

Trillions of dollars in cash hit people’s bank accounts while the balances in their brokerage and retirement accounts exploded higher and the value of their real estate soared. The cost of their household debt shrank and even the used cars parked in their driveway had appreciated in value. There wasn’t a lot to do so their monthly expenses declined and their savings rates rose. According to Federal Reserve data, by the end of 2021 the median American had never been in better shape. Household net worth rose to a new record in the fourth quarter of 2021, totaling $150.3 trillion which was up 3.7% or $5.7 trillion from the previous quarter, and 14.4% from the end of 2020.

Here’s the thing about the pandemic experiment: It worked too well.

Everyone had money. Everyone had options. There was a bull market in people forming their own LLCs and starting companies. A bull market in sitting on their asses and doing nothing too. A bull market in quitting their jobs. A bull market in whatever they felt like doing. Indulging their hobbies, accepting flexible hours, moving their residence, taking college classes while being employed, secretly having two full time employers, quitting without quitting, being paid for waking up in the morning, taking extended periods of time in between gigs, making a big career change. Whatever people wanted to do, they could do. Freedom on a previously unimaginable scale.

Young know-nothings from all walks of life were investing in digital art and SPACs, trading options on their phones, starting their own companies, selling their own weed and launching their own crypto projects. Older ordinary people found themselves accidentally wealthy overnight, their houses instantly worth 30 to 50% more almost regardless of condition or geography, the values of their 401(k)’s bursting at the seams, potential buyers for their small businesses and real estate holdings coming out of the woodwork with blank checks ready to be signed at the conclusion of a Zoom meeting. You could sell anything to anyone for any price at any time. We were minting millionaires by the minute.

Capitalism felt like it offered possibilities for everyone for the first time ever. Influencers fluent in the language of entrepreneurship and personal finance had a potential audience in the millions for their messaging. The world was ripe with possibility and people felt emboldened. They were liquid and ready to maximize their own opportunities. It was an exciting moment in time. No one was left out.

And that was the problem.

Widespread prosperity, it turns out, is incompatible with the American Dream. The only way our economy works is when there are winners and losers. If everyone’s a winner, the whole thing fails. That’s what we learned at the conclusion of our experiment. You weren’t supposed to see that. Now the genie is out of the bottle. For one brief shining moment, everyone had enough money to pay their bills and the financial freedom to choose their own way of life.

And it broke the fucking economy in half.

The authorities are panicking. Corporate chieftains are demanding that their employees return to the way things were, in-person, in-office, full time. The federal government is hiring 87,000 new IRS employees to see about all that money out there. The Federal Reserve is trying to put the toothpaste back into the tube – the fastest pace of interest rate hikes in four decades and the concurrent unwind of their massive balance sheet. Everyone is scrambling to undo the post-pandemic jubilee. It was too much wealth in too many hands. Too much flexibility for too many people. Too many options. Too much economic liberation. “Companies can’t find workers!” the media screams but what they really mean is that companies can’t find workers who will accept the pay they are currently offering. This is a problem, we are told. After decades of stagnating wages, the bottom half of American workers finally found themselves in a position of bargaining power – and the whole system is now imploding because of it. Only took a year or so.

The War on Inflation™ is the new War on Drugs. In the 1980’s they were willing to sacrifice entire cities and communities to the War on Drugs. A million brothers and sons behind bars, a million children in fatherless homes in service to some nebulous goal of a drug-free society that’s never actually existed at any time in human history. We figured out how to ferment barley to get intoxicated more than 13,000 years ago, which predates the invention of the wheel for god’s sake. The War on Drugs had less of a chance of working than Prohibition did. We went ahead and destroyed countless lives with it anyway.

Now we have a new war.

Today they’re willing to sacrifice the stock market, the bond market, housing values, anything – there’s nothing they’re not willing to do to get it all back under control. Over $10 trillion in wealth wiped out this year, a sacrifice on the part of wealthy Americans in order to ensure a return to normal. You’re hearing the term “normal” a lot these days or normalization. Normal is 2019, where the rich had unlimited options and the not-quite rich had the chance to join them someday by helping to maintain the status quo. The working poor had no options in this world but had lots of obligations. It’s just how things were. This kept the economy humming on an even keel. It was necessary. It was “normal.” It’s what the Federal Reserve is willing to crush the stock market and the real estate market in order to return to. Every time you hear a Federal Reserve official use the word “pain” they are really saying “recession” and when they say “recession”, which they are loathe to do, they are actually referring to people losing their jobs so that wage gains return to a “slower trajectory.” You are being fucked around with, assaulted with the English language and all its inherent trickery. The Greater Good requires a less good circumstance for millions of workers. Too many Chiefs, not enough Indians for the game to run smoothly.

They cannot say any of these things out loud in plain terms. But what they want, what they need, is a shittier situation for the bottom of the income distribution in order to preserve the advantages of the professional and managerial classes who ran the pre-pandemic establishment. It’s not pleasant to admit out loud. No politician or authority figure wants this included in the talking points. It’s not exactly an applause line.

We have to fight the War on Inflation, the story goes, because it is going to hurt the lower income people in our society most. Never mind that the lower income people are actually the biggest beneficiaries of the current labor shortage. Never mind the fact that, when it comes to inflation, the lowest income Americans are most affected by gas prices, which a) have already fallen and b) are completely outside of the control of the central bank anyway. So they’ll distract us with a never ending parade of bullshit lest we consider the truths unleashed in our economy last year. Look over there, Kanye West is doing something insane! And look at that! Marjorie Taylor Greene is using the N-word again! Joe Biden’s adult son just packed his own spleen into a crack pipe and smoked it! Look at Kim’s ass! Yes, you’ve seen it before, but still! And look over there, abortion rights in Alabama under siege! Trump stole the nuclear codes! New Lord of the Rings content on Amazon Prime. Game of Thrones is back. The NFL returns!

Look here, look there, look anywhere else. Just don’t look at the almost-liberated wage slaves being put back into their places. How dare you ask for more, how dare you expect more? Stock trading time is over, get back to loading these cardboard boxes.

I know we’re not supposed to admit these things about our system. We’re not supposed to say them aloud in polite company. But how can you say they aren’t true? How can you say that the reality is anything other than what you’ve just witnessed with your own eyes?

When some people have prosperity and the American Dream is still a brass ring for the masses to reach for, the system works. Everyone stays in line. When the American Dream is actually attained – by everyone all at once – the system buckles. That’s what you’re living through today. There isn’t a moment to lose. We have to hack off a couple of limbs to save the patient. Emergency surgery. Four hundred and fifty basis points of interest rate hikes in nine months. We went from trying to prevent layoffs to daring companies not to do them inside of a single calendar year. We’ll make it worse, just you wait and see. The beatings will continue until the desks are filled and the warehouses are staffed. Until everyone gets back in line. Then, and only then, when the world is normalized, can the pain come to an end.

And please, for the love of god, forget what you saw last year. You weren’t supposed to see that.