“The industry and these companies are shrouded in mystery. In that situation, history tells us that there will be all sorts of risky behavior, fraud, and deceit,” says John Reed Stark, a former chief of the Securities and Exchange Commission’s Office of Internet Enforcement. “It’s not the Wild West. It’s a Walking Dead-like anarchy with no law and order.”

Bitcoin is down 70% from its high and has taken about $900 billion in market capitalization down with it. And that’s just Bitcoin. The other tokens and coins are, for the most part, down even more. The related market for NFTs is also crashing.

Back to Bitcoin – it’s an epic fall for an asset that many believed would offer diversification from the stock market and a hedge against inflation. It has failed to do either, in spectacular fashion. Directionally, it has traded almost perfectly in sync with the crashing growth stock sector and Nasdaq Composite – but the drawdown has been significantly worse. And as for the inflation hedge conceit – well, let’s just say the US dollar is at a 20-year high versus the basket of international currencies while BTCUSD has been the absolute worst trade on the board this year, and it’s not even a close race.

Bitcoin believers will tell you about all of the crashes of the last ten years and explain this one away as just the latest example of something that is endemic to the crypto asset class. That’s true, the prior crashes had all ended up looking like excellent buying opportunities in hindsight. But almost none of them will point out that this time the price of a Bitcoin has undercut the previous bull market’s peak. There are people who bought their first bitcoin in late 2017 at $20,000. They are still down on their investment five years later. That’s new.

I have a few observations to make here. I won’t spend too much time elaborating on them here because I feel as though they could each be the subject of a subsequent post. I may or may not have the time to actually write them this summer. We’ll see.

Anyway, here goes:

1. Everyone hates rules and regulations until it’s too late. The fantastyland idea of software protocols and algorithms and communities policing themselves flies in the face of 500 years of financial market history. Digital money is still money and people are insane. That doesn’t change, no matter what kind of investment we’re talking about. Financial markets were born in a time where you could not safely drink water so everyone drank alcohol all day long, out of cups made of lead. This is Europe in the 1500’s. We were crazy then and we are crazy now.

2. The only thing more disgusting than the accompanying crime wave that seems to flourish in the shadow of digital assets everywhere they sprout up would be the avarice. The sheer amount of leverage being employed in crypto trading is downright unholy. I have asked many people about why Bitcoin isn’t volatile enough for its traders and fans. Why so many players in this market feel compelled to then build on that volatility with an enormous margin balance. There is no reasonable explanation other than to observe that people are pigs. If you think you can make a hundred grand on a trade, why not make ten million instead? I guess it worked until it didn’t. This Three Arrows Capital fund is a shandeh for the ages.

3. Drawing a distinction between defi (decentralized finance) and cefi (centralized finance) is a little too cute right now. Industry proponents are bending themselves into pretzels to make the case that, actually (always actually), everything decentralized is working as it should and it is only the centralized lending and trading outfits that are blowing up because of bad business decisions by their leaders. I don’t see this distinction as being particularly meaningful at the moment. It’s all one trade – name a token, it’s been more than cut in half, regardless of how concentrated or “democratized” the holdership is. In a crash, nuance doesn’t get you anywhere.

4. I am starting to think that the best thing congress could do would be to empower the SEC and banking regulators to impose their existing regulatory frameworks to these assets now and worry about the finer details later, in a case-by-case iterative process that evolves over time. If the assets act like securities, let’s regulate them as such. If the players are acting in the capacity of banks, let’s regulate them like lending institutions have always been regulated. We don’t have another twelve months for this free for all to run its course while dithering about creating brand new regulations (and a brand new regulatory authority). Enough damage has been done. It’s time to take the machine gun away from the baby.

5. The entire subprime mortgage market was $600 billion by 2006, which proved to have been more than enough to take down the entire global financial system and put 9 million Americans out of work. Do we really need to run that experiment back? I don’t think crypto has gotten big enough or entrenched enough to cause systemic risk to the banking system or the real economy, given how few and minor the use cases are. That’s the good news. Digital playthings are not as important to everyday life as the housing market is. I reserve the right to change my mind about this but my current thinking is that today’s turmoil is not going to be very damaging outside of crypto. It might hit some of the high-end real estate developers and lambo dealerships in Miami. We’ll live. My bigger concern is what happens during the next crypto boom and bust. Will that one be big enough to do some real damage?

6. Younger market participants are learning that there is no such thing as a one-way trade. They’ve just seen the absolute best and worst that stocks and crypto have to offer in back to back years. It’s going to have been a positive experience for them in the fullness of time. Nobody learns anything from winning, especially when the winning comes so easily. You learn from losing. And when you lose a lot, you should be learning a lot. Every generation gets its education sooner or later. My generation had the dot com crash and the Great Financial Crisis occur inside of a single decade.

7. Twitter is a toxic environment for impressionable investors. The people taking the biggest losses today are among the most extremely online people in our society. Stay out of rabbit holes. Most of them do not contain a treasure chest at the bottom. The more time you spend exposed to the firehose of opinion, misinformation, promotion and grift on Twitter, the more susceptible you become. Stick around long enough and you can become convinced of anything. The algorithm is designed that way. I know people whose brains have become scrambled or rewired by it. Can’t even have a conversation with them anymore. When you ask “How could an otherwise normal middle aged man who works a 40 hour week and raises a family end up on the steps of the Capitol building swinging a hockey stick at police officers?” the answer is The Internet.

8. Anytime an asset class or investment market falls 70%, there is an opportunity for someone. I am a firm believer that kings will be made during this time. Perhaps Sam Bankman-Fried at FTX is the leading candidate. He seems to be the man with one eye right now in the land of the blind. He has the two most important attributes for the current moment – capital and credibility. Meanwhile, a thousand crypto startups are flailing about in search of both. Sam is white-knighting in a way we haven’t seen since Warren Buffett in the aftermath of 2008 or even J. Pierpont Morgan a hundred years before. It’s cool to watch. Chaos is a ladder. Sam’s going up the rungs. He’s running around the Monopoly board with a pair of loaded dice. What else will he end up owning or controlling by the time the dust settles? The irony of this increased centralization should not be lost on anyone.

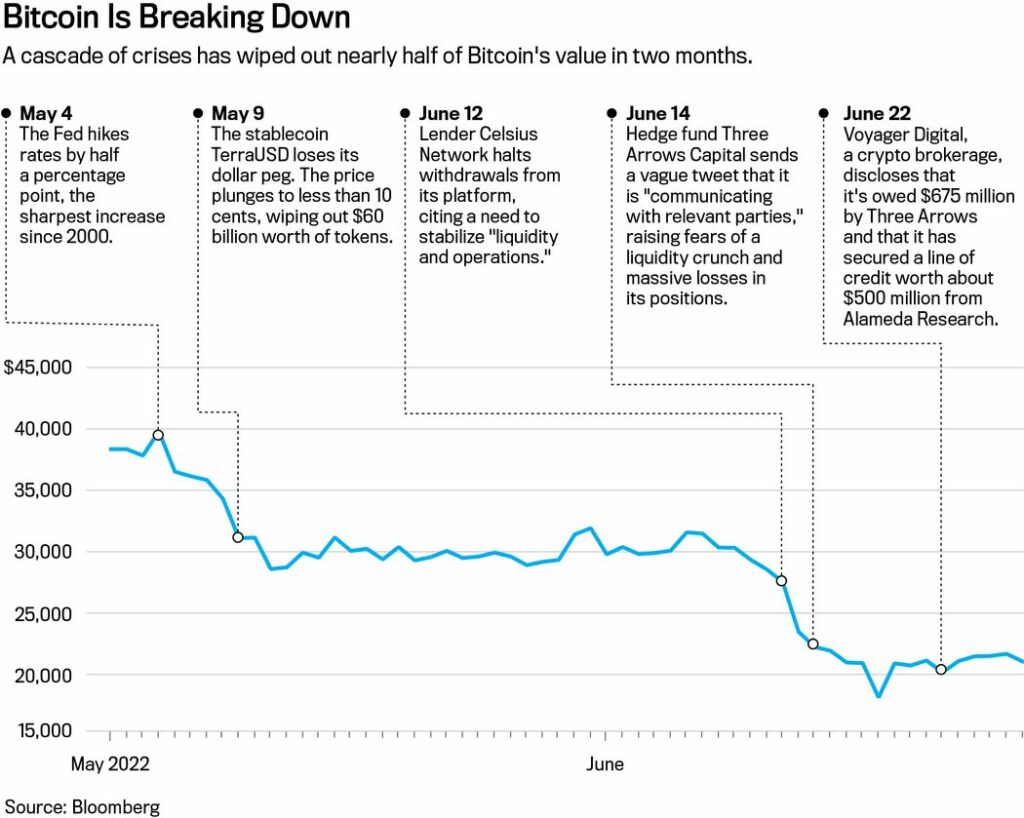

A recent history of the calamities affecting the crypto market seen above, via a new Barron’s story this weekend. If you’re not following the day to day developments that have led us to this moment, I highly recommend reading Joe Light’s new piece for a panoramic look at where things stand. At some point the carnage will slow down, then stop. You’ll want to be ready for it.

Crypto Took Wall Street on a Wild Ride. Now It’s Ending in Tears. (Barron’s)