I haven’t had the time to write much this month because of my schedule and some unforeseen things that have popped up in my life, but I wanted to break in with a moment of clarity here. We always get a lot of questions about the best way to save for a house or what people should be doing with their excess cash.

It’s hard to give general advice, but I will say what I myself would be doing now…

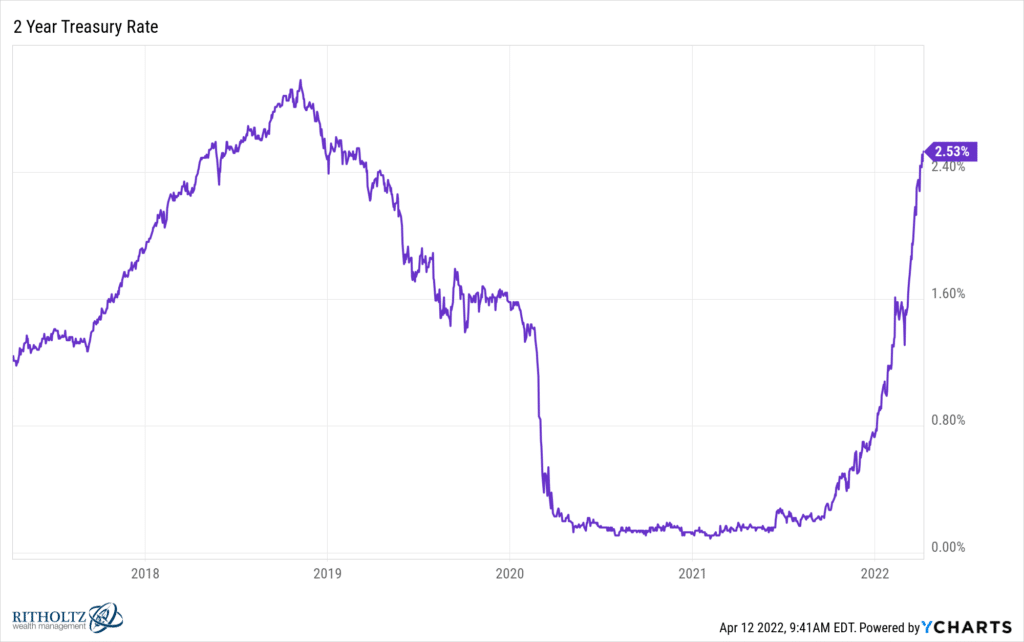

Last night, the two-year Treasury hit 2.5% – a new high for the current cycle. I would be buying anytime it gets anywhere near that level. It has since backed down into the 2.40’s. Whatever, same thing. I have a real estate transaction of my own pending, with cash due at various points over the next two and a half years. I’m using the SHY (1-3 year Treasury bond ETF) and the SHM (same thing but for municipal bonds, it’s called SPDR Nuveen Bloomberg Short Term Municipal Bond ETF) in a blend to save that cash and keep it liquid at the moment. My broker’s money funds (in this case, Fidelity) aren’t as good or as simple a solution. There’s no SMA worth bringing into the account given the time frame for when I’ll be liquidating. So I made my own fund with two ingredients.

Here’s that two-year Treasury yield by the way:

As the bonds in these funds mature, newly issued bonds at the new, higher market rates get added to their portfolios and the nominal interest rate of the whole fund increases. Think of them like extremely short-term ladders with a little bit of near-term protection built in. The protection takes the form of short duration, which means a further extreme move in the two-year Treasury yield would see that higher rate get incorporated into the fund sooner than you’d see it in an intermediate fund. And I turn on dividend reinvestment in the account I’m using in order to get the benefit of whatever fluctuation may happen as these funds pay out. I don’t need the income at the moment, I’ll take the increase in share base of the ETFs instead until I need the cash.

Is two and a half percent the best you could get for return of capital? Maybe not, but isn’t it good enough? Two years ago the going rate was about zero. On high six-figure or seven-figure money, this is a big difference.

The two-year Treasury is yielding about the same as the ten-year Treasury (what we call a flat yield curve, where you’re not being paid a higher interest rate to lend money at the longer duration). I would buy the hell out of the two-year at 2.5% but not the ten-year at the equivalent yield. Today’s inflation data makes it clear that the rate of change in things like home goods and appliances and used cars is now decelerating – probably as a prelude to rolling over as the comps get tougher in the second half of this year. Prices won’t come down, but they’re about to be done going up.

Services inflation will remain a problem. Peter Boockvar is talking about how everyone is undercounting the rise in rent and what this will mean for how much employers have to pay people. That too will run its course too and eventually calm down, but not yet. Consumer pushback on prices will eventually have an impact. The Strategic Petroleum Reserve’s release of oil and China’s not-as-bad-as-feared coronavirus re-lockdowns have already created a calming effect in the crude oil market – WTI prices had come down 25% from their peak into yesterday (interestingly, oil stock prices have not fallen at all).

The big picture is that demand is eventually met by supply and these things straighten themselves out. Which means the FOMC needing to do as many rate hikes as the market is now so certain about may become the next big consensus story to be unwound. They don’t have to start using the now infamous “transitory” language anymore, they can just decide to shut the f*** up for a few weeks and watch what happens in the data. Their jawboning has already done quite a bit of the heavy lifting in terms of moving the expectations. Could be they’ve done enough for awhile.

So what do you do with your cash, if you know you might need it in the next couple of years? I wouldn’t be afraid to grab a Treasury fund or a high grade Muni fund with a 2.5% yield and a maturity before 2025. Inflation might slightly edge us out over that time, but not definitely, and so what if it does? You paid for safety of principle, in that case. Money well spent.

***

Quick item of housekeeping – Michael and I are taking a two-week break from new episodes of What Are Your Thoughts due to our family vacation schedules this spring. We will return soon! Thanks to everyone who’s checked out the YouTube livestream we put up last night with Crowdstrike CEO George Kurtz. The audio is available too, listen here.

[…] Source link […]

[…] Source link […]

[…] Source link […]

[…] Take that two and a half percent and run – ” I would buy the hell out of the two-year at 2.5% but not the ten-year at the equivalent yield. “ […]