You don’t need to try to guess what combination of stocks, bonds or futures would allow you successfully collect in the event of a recession anymore. You can make an event bet now without using the securities markets at all. I’ve been making some of my own on Kalshi.com. I’m not doing this with large dollar amounts but I am having a lot of fun forcing myself to think through the bets and the odds I’m getting. How strong or weak is my conviction?

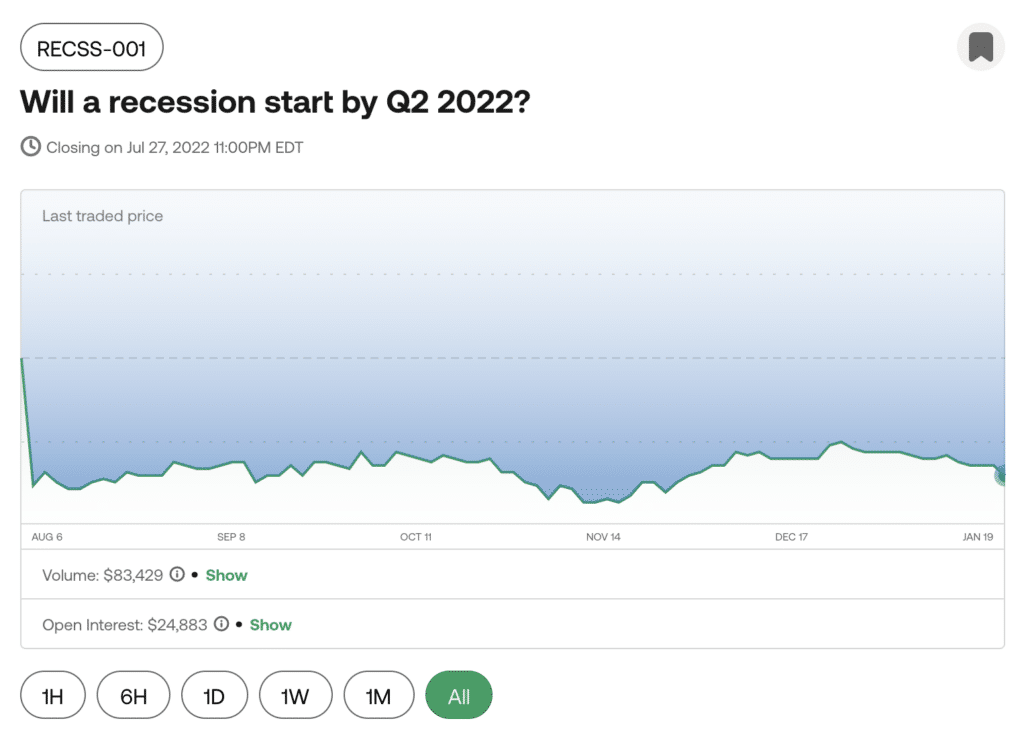

As of this writing, the price of a “No” contract to the question of “Will a recession start by Q2 2022?” is about 84 cents. Which means you have to put up a lot to win a little, because the “No” bet is consensus. The long shot bet on “Yes” there will be a recession by the end of June only costs 15 cents, if you’re feeling frisky. You’d have to think the Fed is really going to screw things up – or imagine a nasty new variant of the virus – to want to put a lot of dollars behind that “Yes” bet.

By August, the bet will have expired but players should be able to cash out at any time along the way if they like the prevailing price being offered by other bettors in the market.

We got so excited about the potential of the Kalshi platform, we became shareholders too. Obviously I am not endorsing any specific bet anyone would want to make, but if you have an opinion on this one, here’s how you can sign up and put your own bets on: