The fun part about stock market rallies is that all of your purchases reward you immediately. Which produces a positive feedback loop that makes you want to do even more purchases. You begin to feel like your timing is great, and so is your taste in tickers, and you are actually a very good investor. I’ll buy some of this, this, that, this… You used to log in with a basket in your hand but now it’s a shopping cart.

But then the longer this goes on for, you begin to feel as though others are doing much better. You are being left behind. You are missing out on the very best stocks, holding onto merely good stocks or okay stocks. And it all continues trending higher. Trending, trending, trending. The best names are not letting you in. You can’t think straight. You begin throwing money at things “just in case the train leaves the station.”

If that sounds familiar, it’s because you’ve recently lived through an environment just like it. One year ago, that was the entire stock market, including SPACs, recent IPOs and crypto currencies. It didn’t matter what you bought, so long as you bought. That began to fall apart last spring and by summer the stock market rally had grown increasingly…shall we say selective. Then a rotation from growth into cyclical produced yet another rally, which led to that same trending phenomenon I’ve discussed above. Just different names. Metals, oil companies, banks, shippers, manufacturers, equipment firms, natural gas producers, construction suppliers. Up day after day – let me in! No, we will not.

That environment is now fading away too, with every red open in the major averages and every overnight slide in the futures. You can think straight again. You can take your time. The trains are leaving the station and then breaking down on the tracks. They’re hauling them back into the station for repairs. Charts are substantially damaged. The few areas of outperformance have the smallest number of players in them. Most everything is not performing. Gains are being retraced. Lows are being tested and, often, violated. Market cap is being ripped away. Confidence is disintegrating.

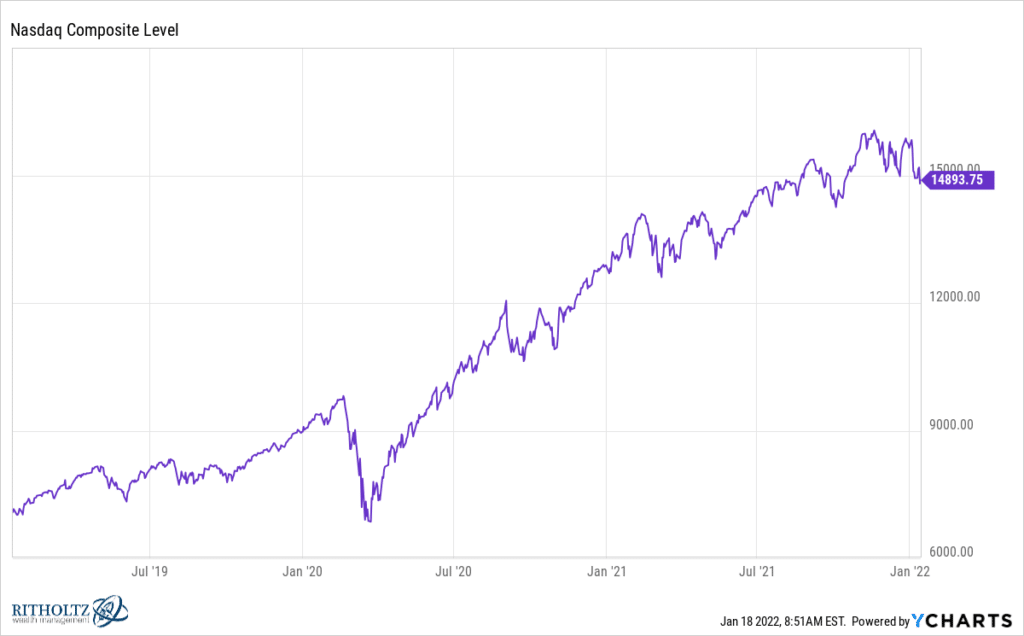

Here’s the Nasdaq Composite. It’s currently in a 7.5% drawdown from its record high and, as you can see, has recently printed a lower high before falling again. That’s not good. The index is still up over 110% over the last three years, which means there are lots of people with lots of gains to protect. They will strongly consider selling rallies for the foreseeable future, which makes forward progress difficult. This psychology takes hold after a series of lower highs – we’re not there yet but keep that in the back of your mind.

The bad news is that those instant unrealized capital gains after each purchase – the ones that made you feel so smart – are no longer a feature of the landscape. You’re going to log in to your Fidelity account less this week than you had been a few weeks back. You’ll have to get your dopamine hit from some other activity.

The good news is that now you can think straight. There’s no rush. If there’s a stock you’ve wanted to invest in, the pricing is becoming more favorable and there’s no longer any punishment associated with waiting. Taking your time. You can buy a third, a third and a third of a full position and plan things out based on the potential for falling prices. The technicians are going to get mad at this idea, but it works. Buying in tranches and saying firepower for lower prices later requires some humility. I think this is a good price to buy but I can’t be sure it’s going to end up being the best price – I better plan for lower prices and be willing to own less if it gets away.

Can you do that? Pick a ticker symbol and practice.

When the chase has come to an end, you are able to catch your breath and reassess. Formulate opinions rather than react with envy about the gains of others. Let the market come to you.

You can buy a two-year government bond this morning for about 1% and a 10-year bond for 1.8%. That’s not zero return. It’s not great inflation-adjusted but it’s also not nothing – especially as equity prices fall. That current yield allows you sit still for a little while. You can start thinking of prices as pitches. Wait for the pitches you actually want to hit. And if they’re not superior to collecting a percent and a half risk-free, don’t swing.