I’m with the growing chorus of voices on Wall Street who would like to see the end of stimulus now – at least the beginning of the end of stimulus. There is absolutely no good reason for why the Federal reserve should continue to buy securities after the stock market has just staged its fastest double since 1950 and 20 million jobs have come back to the economy since the onset of the pandemic. While there are still 5 million fewer jobs than there were pre-pandemic, this can partly be explained by an explosion in entrepreneurship and new business formation. There’s also been a wave of retirements that would not otherwise have occurred this soon if not for the pandemic. The Fed can’t “respond” to early retirements with policy. It is what it is.

There are a record 10 million open job postings in this country, but no amount of quantitative easing or bond-buying by the Fed can turn an out of work waitress into an assembly line worker for Ford. We have disparities between where the employment opportunities are, what skills they require and who is available to take these jobs. The Federal Reserve cannot fix this, only time and ambition can. They can certainly make this issue worse, however, by indiscriminately flooding the zone and contributing further to the heating up of prices throughout the economy.

I know the Fed knows this. They’re hearing it from everyone – business leaders, money managers, bankers, CEOs, economists, etc.

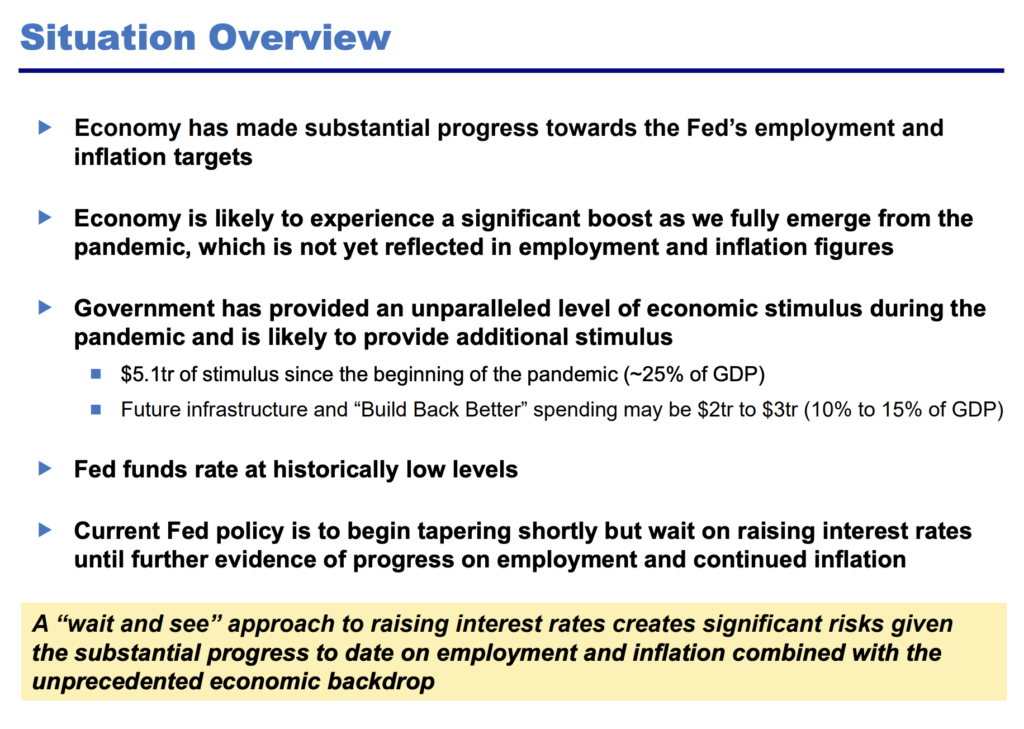

Bill Ackman gave a talk to the New York Fed imploring them to not only halt stimulus now, but also to immediately begin raising rates. I’m not sure I would advocate this quick of a transition from stimulus to equilibrium to tightening – and Bill knows that’s not going to happen either – but his larger point is the more important thing to focus on: There is nothing happening in the present economy that is being made better by increased stimulus, but a whole lot of things are being made more challenging (or even dangerous). Here’s the “situational overview” as he sees it, click the link for the whole deck.

Here’s a quick thought exercise: What would happen if the Federal Reserve actually decided to take this advice and raise rates immediately, coinciding with the instant cessation of all stimulus activity in the bond market?

A market crash? I woudn’t go so far as to call it that…but certainly it would cause a correction, perhaps a harsh one, say 20% or so for US stocks. Which would effectively wipe out this year’s gains but not chip away into the fantastic full year’s gains from 2020 (yes, we closed UP on the year during the worst global pandemic in a century, tuck that little factoid away for a rainy day).

An announcement from the FOMC that stimulus activity is coming to an end by year-end, to be shortly followed by the first rate hike, would almost certainly bring about a “reset” in the stock market, in my opinion. It would be most acutely felt in the red-hot, high-multiple growth stock space at first, but then eventually in the cyclical stocks that have been running higher because of the new commodity up-cycle, the first we’ve seen since the mid-aught’s. Everything would eventually get hit, because even the largest, most liquid, most economically insensitive names would end up being a source of liquidity for investors forced to come up with cash. Resets like these do not spare anyone. By the end, there is nowhere left to hide, which you can eventually see in the advance-decline data, NYSE composite, percentage of stocks above the 200-day, etc.

***

In 1994, Fed Chair Alan Greenspan shocked the markets with an overnight rate hike that had not been telegraphed or expected, the way the Federal Open Market Committee currently does things. Back then, Greenspan would give an incomprehensible speech before Congress twice a year and basically just do whatever he felt was needed. There were no press conferences, dot plots, dueling speeches, Jackson Hole confab or any of that sort of thing. And in ’94, he felt things were heating up too quickly, so he jacked up overnight rates to a four-year high, causing what has since been known as the Great Bond Market Massacre. This so-called “Massacre”, in which the prices of older bonds fell in response to higher yields on newer bonds being more attractive, led to a panic in stocks. And the collapse of Orange County’s finances, but we can talk about that later.

Sometimes, in the midst of a secular growth market and economy, you get a reset. In the example above, 1994 was one of the best years for economic growth ever, but the stock market gave up all its gains and then finished the year down 1.5% (with dividends, slightly better). It didn’t end in catastrophe because the underlying economy was able to absorb this reset of expectations in the bond and stock markets, despite the initial shock. In fact, the Dow Jones, Russell 2000 and S&P 500 would all go on to triple over the next five years. The Nasdaq 100 would be up fivefold. A tighter Federal Reserve actually reset the bullishness, but did not extinguish it.

***

When the Fed throws $5 trillion at the US economy in 18 months, a lot of that money is going to find itself put to good, productive use. It will finance all sorts of capital expenditure, R&D, job creation, new business formation, mergers, financings, re-financings, construction, overdue maintenance, the underwriting of innovation and more. And that’s great.

But some of it will flood the bank and brokerage accounts of the sort of people who are collecting jpegs of crudely drawn rocks and apes and other useless bullshit. I know, I don’t get it, blah blah blah. I also didn’t get why, in 2003, all of a sudden, 50 million people were walking around wearing yellow, rubber LIVESTRONG bracelets on their wrists, literally out of the blue. I have wedding photos from that summer wherein multiple people are seen with them on in multiple shots. I know we loved Lance Armstrong and we were rooting for him in his battle with cancer, or whatever was going on, but – I mean – what? What was that all about?

Fortunately, the bracelets would come off by the following summer to make room for the Von Dutch trucker hat epidemic (there is still no vaccine), and that was that. But for a brief moment, the yellow rubber bracelets made perfect sense to the millions and millions of people who walked around with them. Sort of how exchanging one hundred thousand US dollars for a digital image of someone’s drawings might make all the sense in the world to someone who is surrounded by other people doing the very same thing. It’s easy to forget how quickly a large group of people engaged in a particular activity can just suddenly – and without warning – decide to stop. Remember Tae Bo? Frozen yogurt? Online poker? Zumba? There was a three month period in 1992 where people were wearing their clothes backward (thanks Kris Kross). I once had hoop earrings in both ears. In 2010 people were challenging each other to drink a Smirnoff Ice in the early days of social media video. It comes, it goes. I know, this is totally a different thing. Of course it is.

The media is fueling (and normalizing) this digital collectible mania by focusing their reporting on the biggest wins from this sort of activity and ignoring all of the purchases that have not led to instantaneous, obscene wealth. A typical article reporting on digital assets these days features a wallet held by an unknown holder who has just made ten figure gains in something that was likely purchased by accident. Or a bidding war over a digital asset that everybody knows has absolutely no purpose beyond re-selling it later to an even crazier and more unjustifiably wealthy lunatic. One of the best explanations for why this could keep going on for a long time came from a friend of mine who is deeply entrenched in this nexus between crypto and collectibles. He explained to me this past winter that money “won” is treated differently than money earned (just picture yourself, playing with the house’s money, anteing up at the blackjack table in Vegas) and that the majority of capital won in the crypto space will never leave it – and is more likely to be used to make purchases denominated in crypto than to do anything else. This is backed up by the fact that most digital assets you can buy are, by default, denominated in ETH or SOL, not USD.

The Hustle Pornographers on TikTok and Instagram (CRUSH IT! YOU CAN DO IT! I JUST READ THREE BOOKS, INTERVIEWED SHAQUILLE O’NEAL AND MADE SIX PROFITABLE TRADES IN CRYPTO, COMMODITIES, STOCKS AND REAL ESTATE ALL BEFORE LUNCHTIME TODAY, GET ON MY LEVEL) are supporting this hype by repeating the most superlative statistics emanating from all of this activity and amplifying them before the eyes of their millions of followers. It’s gaslighting, but it’s fun and I prefer it to the alternative (We’re all going to die, the Fed is out of bullets, 1929, gold, guns, etc). However, the longer this goes on for without a reset, the worse it will be for the people playing with the only money they have – money they cannot afford to have at risk. A reset would cool everyone off, wring some leverage out of the game and allow for the very best assets, stocks, coins, startups, funds, etc to show themselves and be distinguished from the rest of the Rising Tide Club.

***

The problem with bubbles is that they lead to myopia, according to Rich Bernstein’s latest note. He talks about how we’re currently funding infrastructure in space while the percent of slower supply deliveries to terrestrial manufacturing companies is hitting an all-time high of over 60%. But space is f***ing sexy and trucking is not. It’s a great example, and a good corollary, of what we saw in the late 90’s as energy development hit a low point while investors deluged the Nasdaq. Here’s Rich:

Bubbles misallocate capital within the economy. Investors often extrapolate shorter-term price momentum for longer-term potential returns, but bubble sectors attract too much capital which actually lowers future returns. Too much capital chases too few ideas. However, the overcapitalization of bubble sectors means non-bubble sectors become relatively starved for capital and ultimately provide better long-term returns. The romantic futuristic stories that often fuel bubbles may indeed come true within the economy, but that doesn’t mean bubble assets outperform. Bubble assets’ valuations often discount potential returns very far into the future.

…if one had bought the NASDAQ 100 Index in December 1999 (i.e., months before the bubble burst), it would have taken 14 years for investors to simply break even. The energy sector at the time was probably the sector most starved for capital. As the Tech Bubble deflated, capital naturally flowed to assets with higher rates of return, and the S&P 500® Energy sector tripled over the same 14-year period during which tech investors broke even. The flow of capital to outer space-related stocks is perhaps today’s most stark misallocation of capital within the equity market. There are significant and potentially long-lasting logistical problems here on earth that reflect significant under-investment similar to 1980/90s’ underinvestment in the energy sector…today’s delivery delays haven’t been seen since the 1970s.

I’m a fan of web3. I want to build the multiverse too. Space is cool. I get it. I’m in. As the owner of an investment management firm, I will be directing capital to companies engaged in these activities for years (decades?) to come. I think there is a ton of opportunity ahead. I am an optimist, an opportunist and somewhat starry-eyed when someone tells me a great story about the future. And even still, I would rather have the reset now versus later. Even if it came about violently, I still think it would be preferable to the Runaway Train Mode we’re currently experiencing.

***

It’s not higher rates that the market doesn’t like, it’s the uncertainty. The market doesn’t like the unexpected arrival of something no one had been thinking about before. Unfortunately, this uncertainty is with us always, it just doesn’t make its presence felt each day, despite the fact that we go to sleep each night with it under our beds, biding its time. I don’t think Jerome Powell is at all interested in the Reset idea. He’s going to be as deliberate as possible in telegraphing the Federal Reserve’s next moves. He has to keep himself in the good graces of Biden. Not only Biden, but the far left and progressive wing of Biden’s party who literally think we need to bring about even hotter inflation in order to cure racial inequality. I wish I was joking, but this is a real argument being made.

The standard liberal critique of monetary policy is that, by being too quick to raise interest rates at the first sign of inflation, the Fed prevents low-skilled workers from securing wage increases from employers desperate to retain and attract workers. A mandate to reduce racial disparities, say proponents, would require the central bank to allow the economy to run “hotter” for longer.

Racial income and wealth disparities are a real problem. If you want to know why one community gets policed much more aggressively than another, look no further than the lack of political clout that comes along with having less disposable income with which to buy a Governor or a Representative in Congress. But I don’t think this is something the Fed can change with interest rates. The Third Mandate, after full employment and stable prices, should not be Avoiding the misguided, performative wrath of AOC on Twitter. If you want to tackle racial wealth gaps, gender income gaps, etc – and we must – the discussion needs to start with how we empower more people to become investors and owners at a younger age.

Lower for longer rates increase wealth disparities between the haves and the have-nots. As I type this, establishment white investment bankers, fund managers, property owners and tech bros are laughing their asses off at the prices for which they have recently sold stocks, SPACs, houses, buildings, etc – a veritable explosion in wealth inequality taking place even as incomes at the lower end of the distribution finally pick themselves up off the mat. In either case, Powell would have to be pretty brazen to abruptly raise rates in a political climate in which people actually believe lower rates lead to a solution for one of society’s most pernicious ongoing problems. Unless he doesn’t care about keeping his job anymore.

So I think the Fed Chair is going to try to save us from the sort of unexpectedness that could bring about a reset in the markets. I think he’s going to white-glove the unwinding of stimulus, even if it goes on longer than it should (and it has). But it’s worth considering what might happen if I have him wrong. A reset would be painful from today’s asset prices and altitudes of sentiment. Almost no one would be ready for it.