Compared to quantitative easing, the two COVID stimulus plans done on the fiscal side were absolute home runs in terms of having an immediate effect in the real economy. As we’ve discussed before, when the Fed does stimulus, it leads to rich people allocating some capital to VC and PE funds while the majority of it ends up in Treasury bond ETFs. There’s very little velocity.

When you put money into the accounts of people who actually need to spend it today, however, they actually spend it today. Locally. It’s not more complicated than that.

Here’s Michelle Meyer with the latest report on credit card and debit card spending among Bank of America’s customers, a fairly representative sample of American consumers, generally:

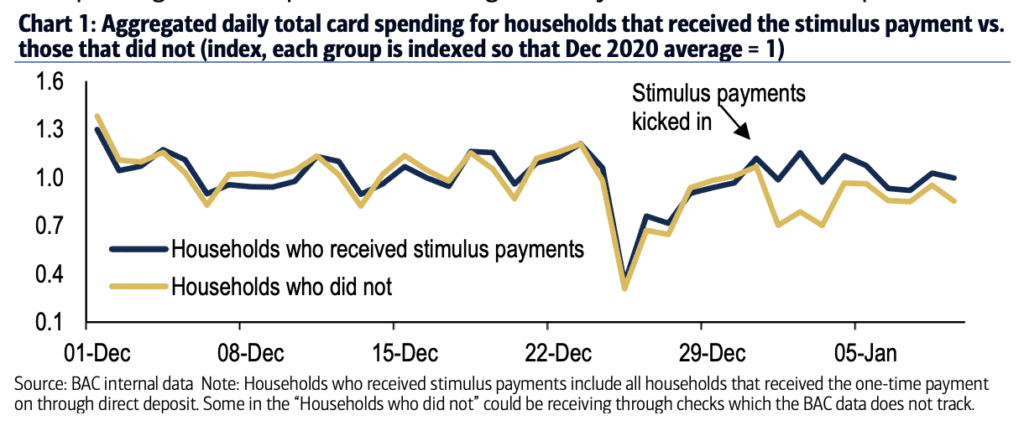

Total card spending for the stimulus recipients accelerated meaningfully at the start of the year with a jolt on Jan 1st which lasted about 5 days. Total card spending for stimulus recipients is up nearly 20% yoy average since Jan 1, which is almost 4X the Dec average growth rate. This compares to those without stimulus payments where spending was flat on a YOY basis since Jan 1. We can also show the differential using indexed values – over the five days starting Jan 1st, total card spending for stimulus recipients was 30% above the rest of the population.

And here’s her chart:

Amazing how that happens.

Source:

COVID-19 and the consumer: data through January 9th

Bank of America – January 14th, 2021