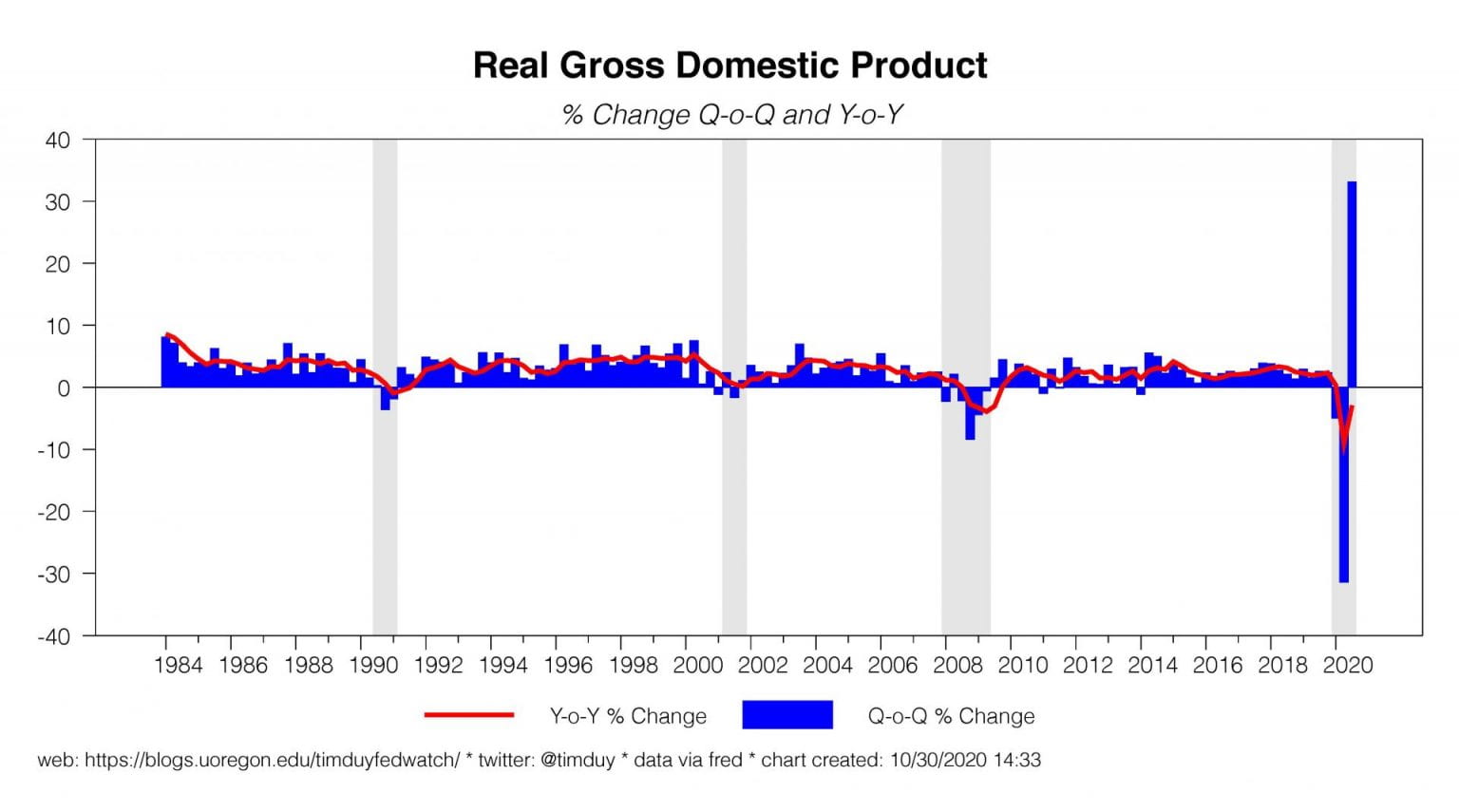

Let’s go ahead and say out loud, without reservation, that the thirty-someodd percentage point quarterly GDP swing we’ve just experienced is unlikely to ever be repeated again…

That’s from Tim Duy’s blog today, btw.

And since we’re not going to be repeating it, it’ll make future swings of the more garden variety one-tenth-of-one-percent look so inconsequential that maybe – if we’re lucky – the markets will forget all about GDP as an input entirely and focus more on corporate cash flows, prevailing interest rates and the future expectations of each therein.

Imagine you’ve just spent the last ten years formulating stock market opinions based on the growth rate of GDP, then this year came along and dropped a comically enormous cartoon foot on your head a la Monty Python. Now what? LOL.

GDP fell and then recovered at an annualized rate of 33% inside of a 90-day window. The idea that there is any actionable information contained within GDP growth rates as they fluctuate by a quarter or even half a point in future readings is eminently laughable and forever will be so long as 2020’s aberration remains standing.